There Will Be Bundling

A unified theory of B2B software and why all systems of record fall into the same traps

We've detailed Epic's meteoric rise, dissected the culture as told through litigation, and explored how the Midwestern monolith became healthcare's operating system. I keep circling back to a fundamental question that gnaws at the logical arc of the entire narrative: if Epic's dominance is truly as problematic as critics claim, why does this pattern feel so... familiar?

The more I research Epic's trajectory (the consolidation, developers’ integration challenges, the customer complaints paired with customer retention), the more I realize we've been looking at this wrong. Epic isn't an anomaly. Epic is following the playbook.

What if every industry's "Epic moment" is the end state of a predictable pattern? What if the same forces that pulled healthcare toward a single dominant platform are similarly operating across every vertical that has digitized? What if the complaints we hear about the closed APIs, the integration fees, the bundling lock-in, are just all-too-common consequences of how software evolves when left to its own economic incentives and the underlying physics of data gravity and switching costs take hold?

This isn't a story about Epic. This isn’t even just a story about EHRs. This is a story about the universal lifecycle of B2B software systems across industries much broader than even just providers - health insurers, banking, car dealerships, and more. And with that story in mind, where we might head next in healthcare becomes clearer.

Healthcare's Integration Reality

To understand how this plays out in practice, consider the daily reality facing developers trying to integrate with healthcare's dominant systems of record:

EHR: (throws an error at developer’s head) Why do you suppose your FHIR call just returned a 500, Developer?

Developer: (sweating profusely) I... I don't know.

EHR: Sure you do.

Developer: The... the patient ID format?

EHR: Were you expecting JSON or XML?

Developer: I don't know...

EHR: (EHR quickly walks to Developer) Start counting IDs.

Developer: Internal ID, GUID, MRN, patient reference.

EHR: With incorrect documentation, damn it! Look at me!

Developer: Internal ID, GUID, MRN, patient reference (EHR slaps developer). Internal ID, GUID, MRN, patient reference (slap). Internal ID, GUID, MRN, patie-

EHR: Now, were you expecting JSON or XML?

Developer: (petrified) I don't know.

Healthcare has been heavily digitized at the system of record level (at least in the United States) for around two decades, primarily thanks to the forcing function of Meaningful Use. We therefore see an abundance of point solutions orbiting the system of record trying to solve big problems and do interesting things. As an industry, healthcare is therefore very mature technologically - we’ve gone through the full arc of the “Business Owners Software Journey” defined by Luke Sophinos, a former vertical software founder and now operating partner at Atomic:

So why do our systems of record suck so much compared to other industries? Stop me if you’ve heard this one before, but time and time again, we hear from experts and end users about the pain of Epic, Oracle, and other leading EHRs:

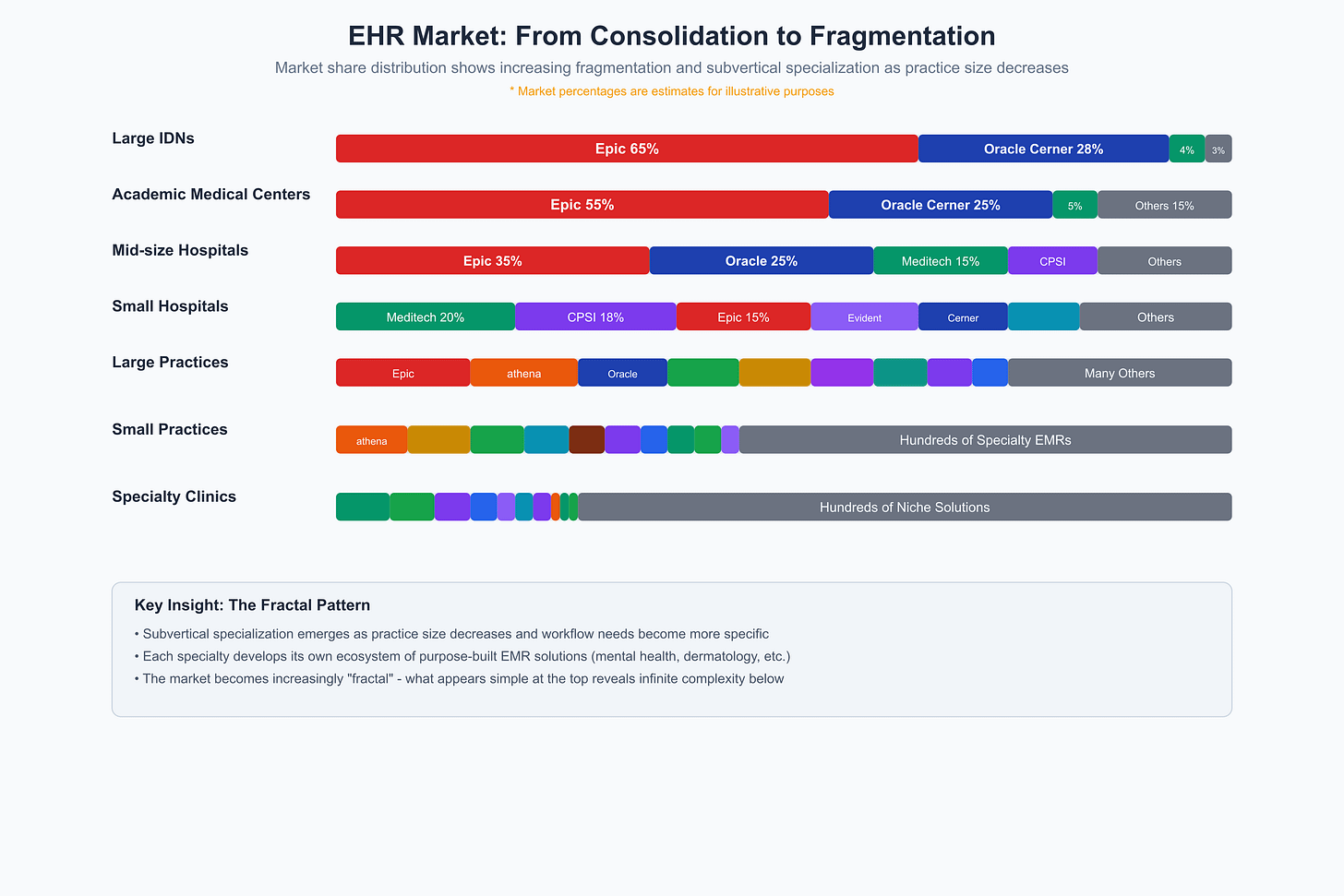

Epic skews enterprise with a majority market share among large integrated delivery networks. Epic is generally seen as the most advanced electronic health record on matters of financials and reporting, and—in comparison to its peers—has built many of its modules in-house rather than adding them through acquisitions. That said, Epic’s patient-facing products generally receive poor reviews and are the frequent target of digital health point solutions.

Beyond that, why do EHR vendors resist the API-first trend that is so popular in other verticals?

“In other industries, most people don’t stress out about 3rd party integrations,” said Okoruwa. “Software incumbents are API-first. They have robust APIs that work really well with teams supporting those API programs.”

In comparison to industry standard software platforms—a Salesforce, Hubspot, or Twilio, for example—EHR platforms tend to differ in a few major ways:

API technology. While modern technology platforms use REST or GraphQL APIs, most PMS systems use SOAP, an API protocol developed in the 1990s. SOAP is far more rigid than REST, and many software engineers are unfamiliar with SOAP.

Up-front fees. While it’s not uncommon for platforms to charge developers a fee—usually a percentage of revenue or usage-based—many EHR companies have implemented steep up-front charges ($10,000 or more) to any developers looking to integrate.

Paywalled documentation. While many software platforms put their API documentation on the web for all to access, electronic health records generally only allow developers to access documentation once they’ve paid an entry fee (see above) and been approved. “You don’t know what you’re getting into until you’ve already paid,” notes Okoruwa.

Furthermore, EHR APIs have the reputation of being fragile, buggy, poorly documented, and prone to breaking when seemingly-innocuous software updates are rolled out. An integration with Salesforce can be built by a junior software engineer over a weekend; an integration with Epic can take a talented and experienced team months.

All this in mind, it’s obviously common to hear people state this sentiment vocally and loudly in digital health communities, on social media, and on stage at all the major conferences.

Personally, I’m glad when people do, because it’s an immediate red flag. As familiar as all of these complaints may be to those in healthcare, none of the quotes above are actually about EHRs - they’re find-and-replace adapted from articles about property management systems:

The conventional wisdom is wrong. The reality of EHRs versus other industries’ systems of record isn’t that we’re behind or different - it’s (somewhat stunningly) that we’re exactly the same.

Core Organizational Characteristics

To understand why this pattern emerges so consistently, we need to step back and examine the fundamental forces that shape how organizations adopt and use software. At a basic level, an organization can be defined by three key characteristics for the purposes of this analysis:

Vertical: The sector in which the organization operates (healthcare, finance, manufacturing, retail, education, government, etc.) - each with unique regulatory environments, operational models, and legacy technology constraints. This is both blurry in that organizations cross boundaries. It’s also inherently fractal - any industry of a certain size has subdivisions forming entirely new verticals (healthcare has acute and outpatient care, but also numerous more specific outpatient specialties).

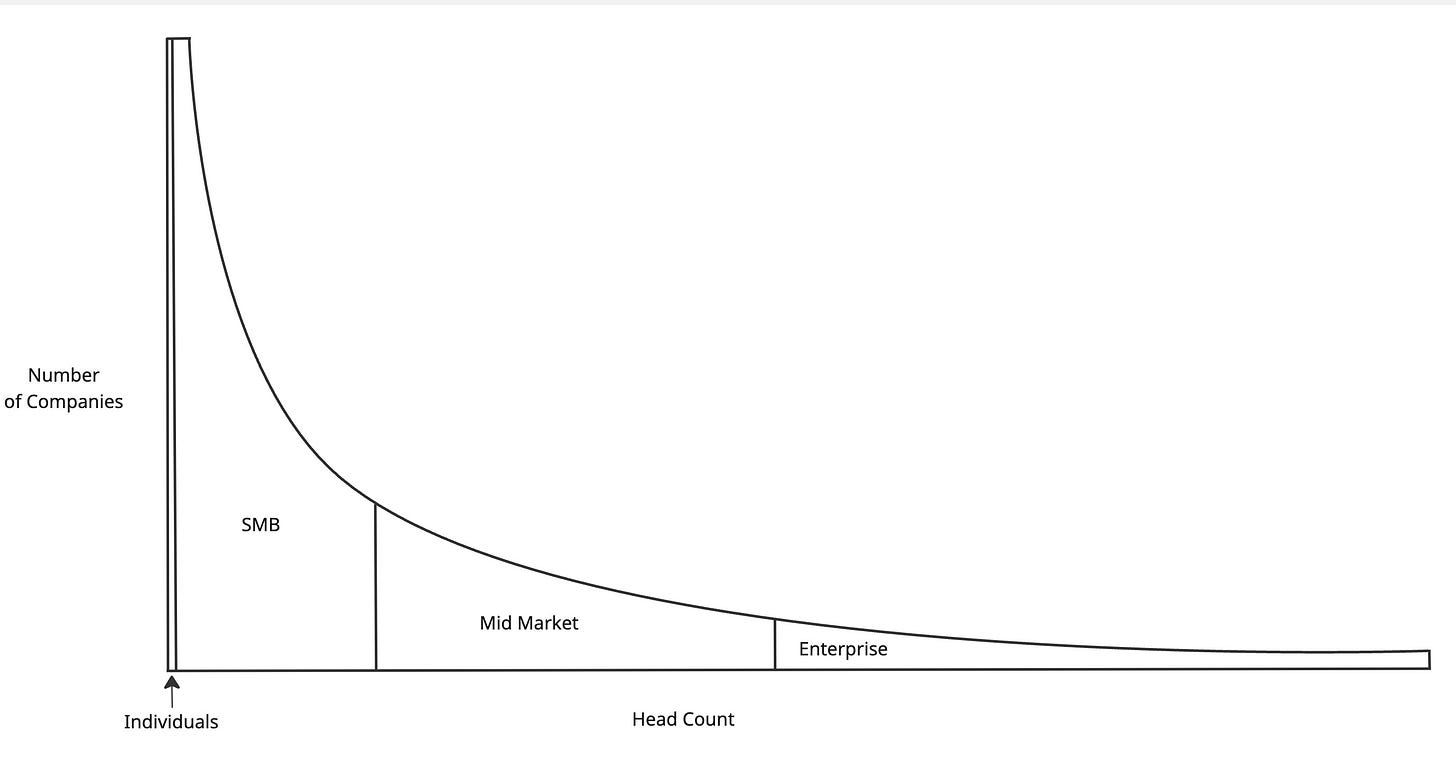

Size: Both employee count and revenue/budget - typically categorized as SMB (small-medium business), mid-market, and enterprise. Size influences purchasing power, decision-making complexity, and implementation resources. As a reminder, enterprise sales are an entirely different muscle than consumer or SMB sales.

Tech operations: The degree to which an organization prioritizes, invests in, and leverages technology internally as a strategic advantage. Some organizations are on paper, some use simple off-the-shelf software, and others are builders (typically held up as a “tech-enabled” variant). What percentage of spend is directed towards operational self-improvement (the level of investment in administrative tooling, “operations” roles, analytics, and software built for internal users) is the best proxy for this. Funnily enough, by this measure, we quickly see that even tech companies and startups aren’t all that tech-oriented - the fruits of their highly skilled development labor are projected to the outside world while they organize their own work via rudimentary, siloed, off-the-shelf tools.

Understanding these three characteristics in isolation is useful, but it’s more important to understand how they interact. Size and technology orientation, in particular, create distinct market dynamics that fundamentally shape how B2B software gets built, sold, and implemented.

Let's examine how these latter two attributes play out across the business landscape, generally following power law distributions:

Market Segmentation by Size

These distribution, while simplified, helps illustrate why market dynamics vary so dramatically across different segments of the business landscape:

Individuals: Self-employed professionals or micro-businesses with minimal organizational structure. The beauty of this market is that the user and the buyer are the same, avoiding the Principal-Agent problem that affects all the other categories of organizations in a market. Product-led growth (PLG) is possible, as purchasing decisions are quick, based on immediate value perception, and highly price-sensitive.

SMB: Small and Medium-sized Businesses, typically organizations with fewer than 500 employees, representing the vast majority of companies by count but a smaller portion of total market purchasing power. SMBs face unique challenges of resource constraints - limited budgets, small procurement teams, and minimal dedicated IT staff. Decision-making typically involves 2-5 stakeholders with relatively short sales cycles (1-3 months). Implementation resources are constrained, requiring solutions that can be deployed without extensive professional services.

Mid Market: Companies that fall between SMBs and enterprise-level organizations, typically with employee counts ranging from 500 to 2,000, representing a valuable but competitive segment. These organizations often experience the "awkward teenage years" of business software — outgrowing simple solutions but lacking the resources to implement enterprise platforms fully. They require scalability and more sophisticated features, yet still need implementation timelines measured in weeks rather than months. The ROI calculation becomes increasingly formalized at this level.

Enterprise: Large organizations with 2,000+ employees, forming a small percentage of total companies but commanding significant buying power and often requiring the most complex, customized solutions. Enterprise sales cycles are notoriously lengthy (6-18 months) and involve multiple stakeholders with competing priorities. These organizations have substantial implementation resources - dedicated IT teams, project managers, and budget for professional services. The complexity of their operations means even "standardized" software requires extensive configuration, integration work, and change management, resulting in implementation costs that often exceed licensing fees by 3-5x.

Technology Operations Spectrum

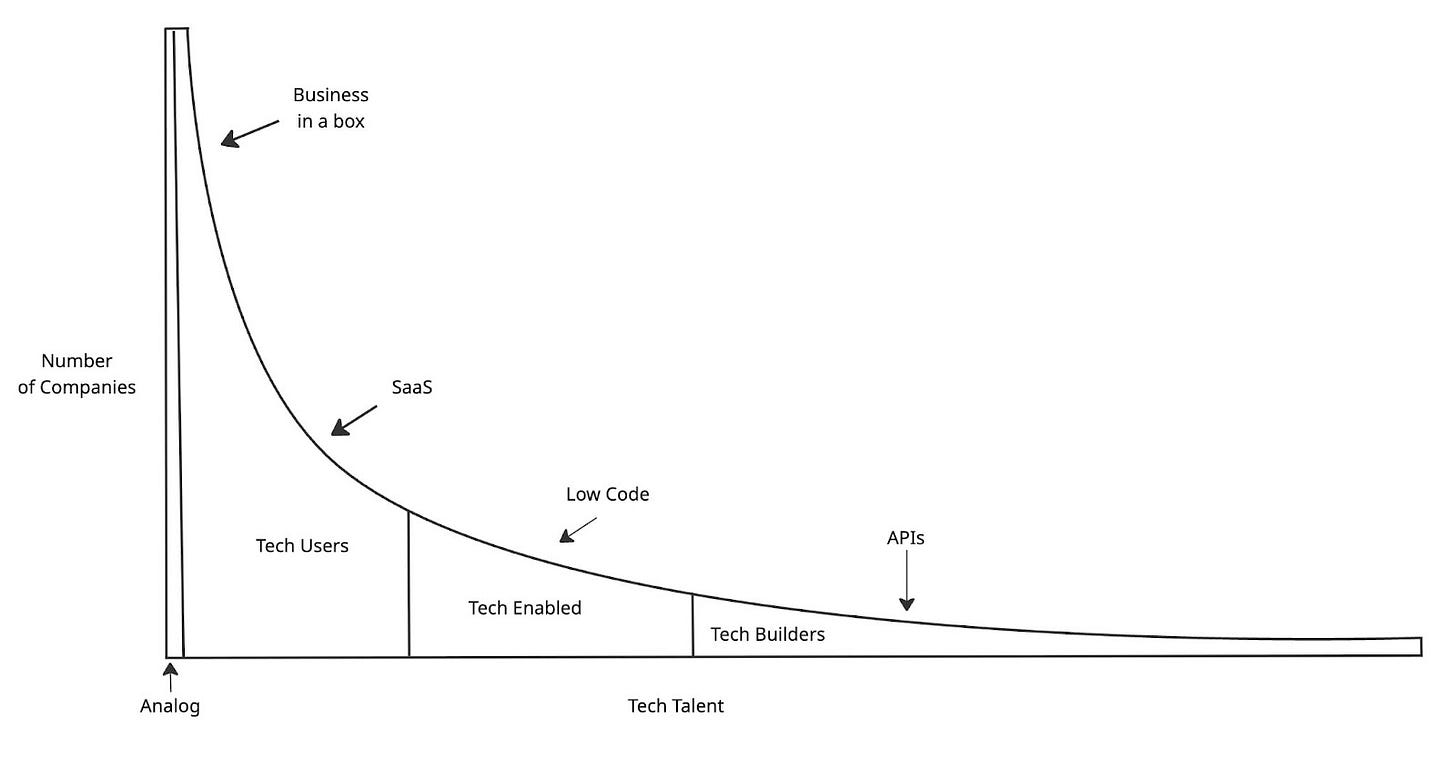

While size creates obvious market segments, there's a second dimension that's equally important but often misunderstood: how organizations actually use technology internally. This orientation toward technology adoption creates fascinating cross-currents that cut across size boundaries and explain why a 10-person startup might have more sophisticated internal tooling than a 10,000-person enterprise.

It is a choice to use technology solutions in pursuit of operational efficiency. It may come as a surprise to people, but that choice (an organization’s use of technology) is actually separate and distinct from its production of technology. I have worked at and with software businesses that ship unbelievable products, but invest next to nothing into how they use software internally.

Analog: Organizations with minimal technology adoption, often relying on manual processes or basic digital tools like Excel. These businesses view technology as a necessary evil rather than a strategic asset. Decision-makers typically resist change until competitive pressures force modernization. The sales process for these organizations emphasizes tangible ROI, simplicity, and extensive handholding during implementation.

Think of the old-world vineyard not even listed on Google Maps.

Tech Users: Organizations that utilize technology primarily as consumers, implementing standard software solutions with little customization. These businesses typically follow industry trends rather than lead them, adopting established solutions only after they've become standardized. Their purchasing decisions prioritize reliability, vendor stability, and compatibility with existing systems over cutting-edge features. Software-as-a-Service is popular for this segment.

This is the Italian place down the street that uses Facebook Pages. They recognize technology's value but lack the internal expertise to extend beyond vendor-provided capabilities.

Tech Enabled: Organizations that actively adopt and integrate digital tools into their operations but lack the internal capabilities to build or deeply customize technology themselves. Technology is a strategic enabler, not a core competency. These organizations go beyond passive tech use and seek competitive advantage through better systems, smarter workflows, and automation, but still rely on external vendors and standardized software to get there.

Think of a modern restaurant group that uses integrated POS systems, inventory management, online ordering platforms, kitchen display systems, and automated social media posting - all connected through platforms like Toast or Resy, with data flowing between systems via built-in integrations.

Tech Builders: Organizations with internal technical capabilities that can customize, integrate, and sometimes build their own solutions. These companies view technology as a competitive differentiator worth significant investment. They employ technical staff who can evaluate solutions based on architectural fit and extensibility rather than just features. Tech builders often seek platforms rather than point solutions, valuing robust APIs, customization options, and the ability to tailor the technology to their unique processes—even if it requires additional development effort. So much useful technology, particularly infrastructural in nature, comes from these organizations - LinkedIn was the original builder of the Kafka event processing framework, which they then open-sourced.

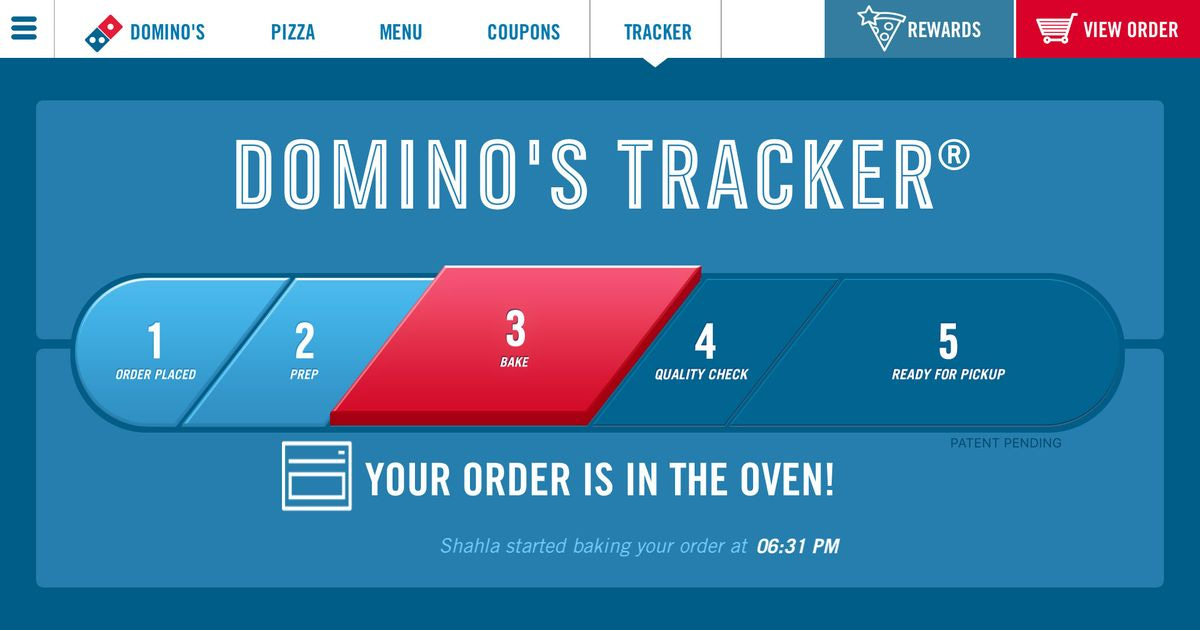

This is Domino’s in the early 2010s with their patented “Method and system for centralized order status tracking in a decentralized ordering system” (aka the Pizza Tracker, aka the only good thing to come out of Ann Arbor).

It is very common to conflate the tech operations and company size dynamics and assume they are the same. Unfortunately, there’s a widespread belief that small organizations buy SaaS, while big organizations build things. A passing review of most markets shows this to be false - each market segment, broken down by size, has sub-segments of tech orientation. Big organizations are not necessarily builders! Many enterprises deliberately remain only tech users despite their size, preferring standardized solutions that minimize risk and complexity. Conversely, some startups begin as tech builders from day one, viewing custom technology as their core competitive advantage.

Perhaps most interesting (to the point that we could spend a whole article on it) are organizations in transition between orientations. An analog company attempting to become a tech user faces enormous cultural and operational hurdles beyond the technology itself. The organization must overcome deep-seated resistance to change from employees who have mastered manual processes. The transition exposes process inconsistencies previously hidden by workarounds, revealing a web of exceptions and tribal knowledge that defy standardization. Analog organizations view technology as discrete projects with endpoints, while modern software demands perpetual investment that many traditional organizations struggle to sustain.

Similarly, a tech builder is shifting from venture funding to profitability often experiences painful contractions in their technology ambitions. The transition from growth-at-all-costs to sustainable economics forces a harsh reevaluation of which custom systems truly deliver competitive advantage versus where standardized solutions would suffice. In this phase, the technical talent that drove innovation during the building phase may become restless or disengaged when maintenance and optimization take precedence over greenfield development. This creates retention challenges precisely when institutional knowledge is most valuable.

Now that we've mapped the landscape of organizational characteristics, you are probably thinking: “Brendan, why does any of this matter? Can you perhaps get to the point?” In this hypothetical riposte, this is where I jump on the couch like Tom Cruise on Oprah and cajole you a bit. Let me cook a bit - this is a framework article.

These three traits of vertical, size, and tech orientation aren’t just interesting metadata. They shape how and why organizations buy and use software, which in turn determines what kind of software wins. When you stack these dynamics across industries, a pattern emerges: dominant systems of record rise when they match the messy coordination needs of large, complex, tech-moderate organizations. Understanding these dynamics explains why the bundling playbook works so reliably across industries.

The Raison D’etre for B2B

Regardless of size, technology orientation, or vertical, a fundamental fact remains: businesses exist to solve problems. If successful, they exist to grow to solve those problems at scale (they literally have a fiduciary duty to shareholders to maximize value). As they grow, the groups of people brought together must collaborate and coordinate all their activities to move in the same direction and create that value at scale. This coordination challenge skyrockets exponentially with organizational size - more people, more processes, more data, more decisions that need to be made in concert.

Management consulting has built entire practices around organizational coordination - Six Sigma, Lean, Agile, OKRs, and countless frameworks that promise to untangle the complexity of human collaboration. Each offers genuine value, but they all require sustained human discipline to maintain, and human discipline doesn't scale linearly with organizational growth.

We over-index on technology as "the" solution, assuming progress inevitably shifts organizations up the adoption curve. But we've all experienced the contradiction: the cash-only garage with no online presence that fixes your car faster than any Google-listed alternative, or the HVAC specialist who can't work an iPhone but eyeballs your furnace and quotes half the price of the tablet-wielding team with laser measurements. If adopting technology makes your employees less efficient, you've chosen the wrong operational investment. Tech is expensive, and sometimes simplicity trumps complexity.

That said, when technology does genuinely address coordination challenges rather than creating new ones, software becomes a powerful solution. When you have multiple people trying to work together toward shared goals, you immediately face challenges that don't exist for individuals:

Information synchronization: Everyone needs access to the same data, but keeping information consistent across many people is hard. Who has the latest version? What changed? Who made the decision?

Process standardization: Without systems, every employee might handle the same task differently. B2B software creates repeatable, predictable workflows so outcomes don't depend on who happens to be doing the work.

Resource allocation: Businesses need to track and optimize how they use their time, money, people, and materials across many competing priorities and projects simultaneously.

Communication overhead: As team size grows, the number of potential communication paths grows exponentially. Software provides structured ways to share information without drowning everyone in meetings and emails.

Accountability and visibility: Managers need to understand what's happening across their organization without micromanaging every person. Software creates transparency into who's doing what, when, and with what results.

Essentially, B2B software exists because human coordination becomes exponentially harder as groups get larger. It's the digital scaffolding that allows organizations to function as coherent entities rather than collections of individuals working at cross-purposes. Individual consumer software optimizes personal productivity (or entertainment). B2B software optimizes collective productivity - which is a fundamentally different and much more complex problem.

The ultimate, sometimes unachievable end state of B2B software for any given business is one that allows for perfect collaboration and peak efficiency across all parties (internal and external) to maximize margin and mission. It is good to solve one problem for a business, but to solve all of a business's problems is to both help them grow maximally and capture all spend they have towards operational efficiency.

From the customer's perspective, this creates a perpetual tension: integrated solutions that match the exact nuances of the business' operations while eliminating complexity are ideal in the hypothetical, but the reality is that no software can be both perfectly tailored and universally simple. This fundamental tension shapes how different categories of business software evolve and compete.

B2B Software Taxonomy

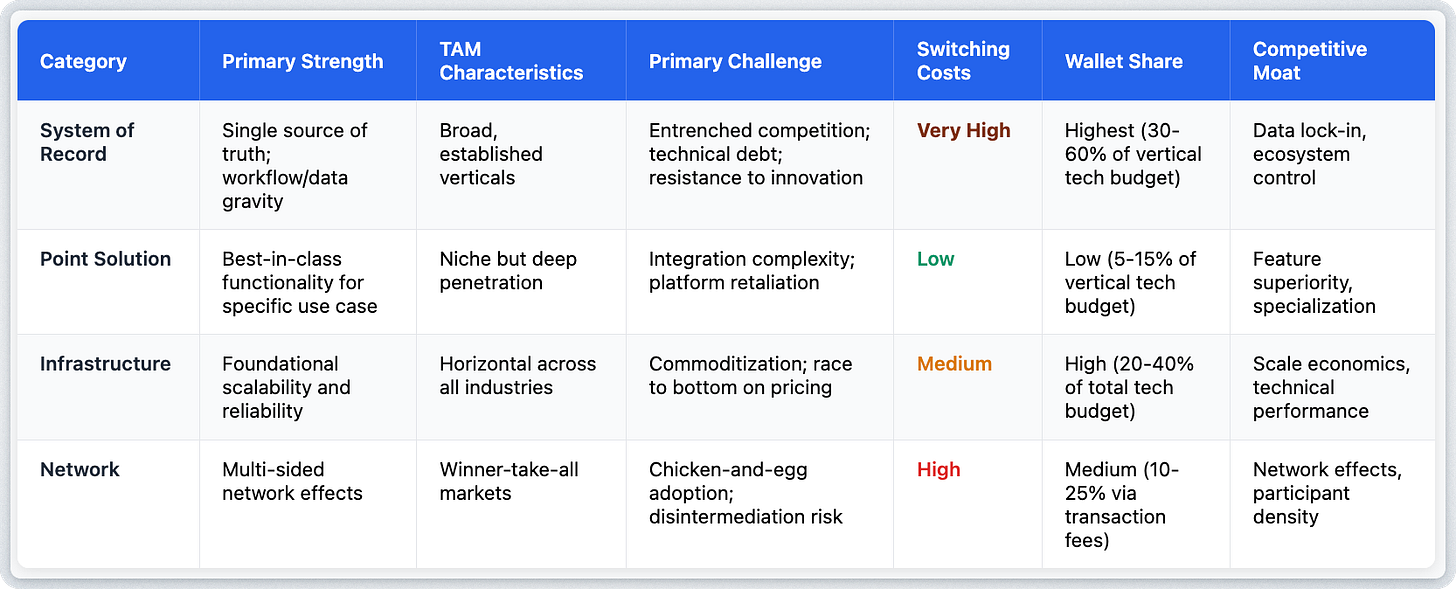

A very rudimentary and simplistic taxonomy for all business-to-business software would bucket vendors into these categories:

Infrastructure: Foundational technology platforms and services that provide the essential computing resources, storage, security, and technical environments on which business applications are built and operated. These form the underlying technical architecture that supports all other software systems

Systems of Record: Core enterprise software platforms that serve as the authoritative data source for critical business information. These systems manage and maintain the primary business data that an organization needs to operate. If you’re hearing the words “single source of truth", you’re likely talking about the system of record for a specific domain.

Point Solutions: Specialized software tools designed to address specific business needs or pain points rather than providing broad functionality. These targeted applications excel at solving particular problems with depth rather than breadth. These orbit around the systems of record and must necessarily integrate with those cores to work seamlessly and reduce double documentation.

Networks: Platforms that connect multiple businesses, facilitating exchanges and interactions between different organizations. These solutions derive their value from the number of participants and enable various forms of collaboration, commerce, or data sharing between separate entities.The Previously Undiscovered Bible of API Companies explores this particular genre quite comprehensively.

Your mission (should you choose to accept it) is to evolve from a point solution into either a system of record, a network, or infrastructure. Those solutions provide the most value, claim the highest wallet share, and have the strongest competitive moats. The challenge, of course, is how to get there given the obstacle often in your way: the incumbent system of record.

A View Across Industries

This evolutionary struggle isn’t limited to one industry. It’s a recurring pattern seen again and again, regardless of vertical. Let’s take a closer look.

Real Estate

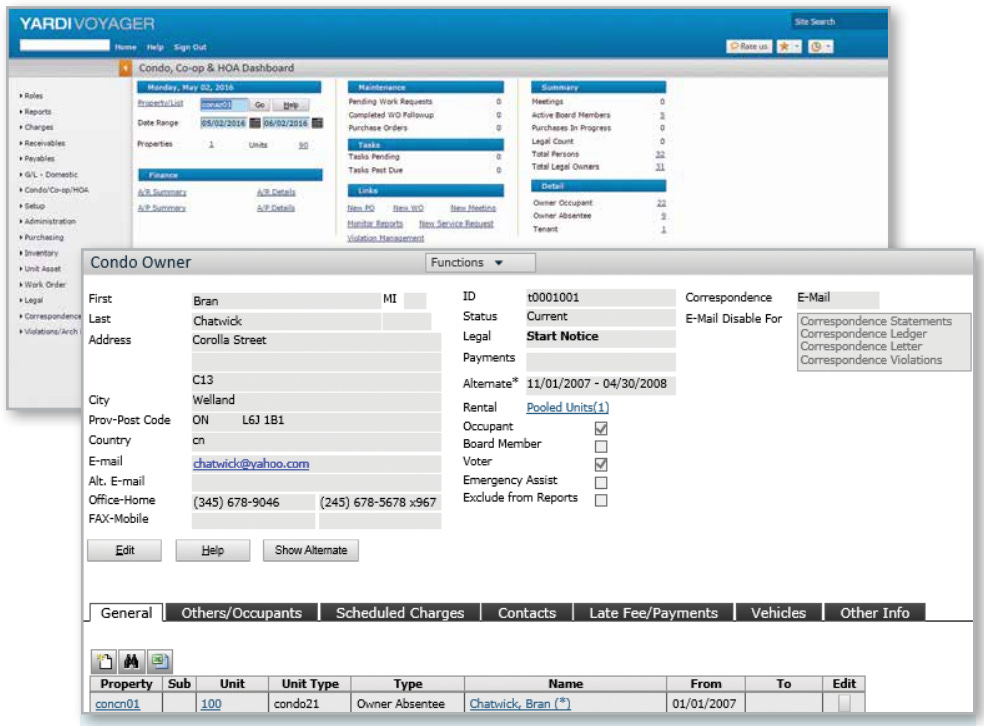

As the quotes above (and in other parallel articles) show, the state of affairs in Property Management Systems (PMS), the systems of record for rental properties and real estate portfolios, is shockingly similar to what we see in healthcare.

The PMS landscape mirrors healthcare's consolidation around a few dominant players:

Yardi, founded in 1984 by Anant Yardi and still entirely owned by him, commands the institutional market with over 13 million units under management—essentially the Epic of real estate. Like Epic, Yardi built most modules in-house rather than through acquisition, creating a comprehensive but monolithic platform that institutional owners find difficult to escape.

RealPage (6 million units) took the opposite approach much like Cerner, growing through the aggressive acquisition of point solutions, such as revenue management tools and tenant screening platforms.

MRI Software, dating back to 1971, remains a significant player in the institutional space with 4.3 million units, paralleling MEDITECH.

Newer entrants like Entrata (2.6 million units) and AppFolio (7.7 million units) represent the "emerging incumbents"—old enough to have substantial market share but young enough to embrace more modern approaches.

The newest PMS vendors, like Ender, are trying a radically open approach akin to Healthie or Canvas Medical, designing for extensibility and third-party integration from the ground up, but facing the heavy headwinds of penetrating established markets.

These platforms offer the same integrative pain we see in healthcare: SOAP APIs instead of modern REST, $10,000+ upfront integration fees, paywalled documentation, and fragile systems that break with updates. The PMSes shamelessly exclude and self-preference, as exemplified by Yardi’s blocking of third-party payment processors. An integration with Yardi (after meeting requirements of acquiring 3+ mutual customers, existing for 2 years, and paying $25,0000) takes months of specialized engineering work, so the surrounding ecosystem has responded predictably. Verticalized integration platforms-as-a-service (iPaaS) and generalized API companies, such as Propexo, emerged (much like Redox, Rhapsody, or Vim in healthcare) specifically to translate between modern APIs and legacy PMS systems. Proptech companies spend an estimated 20% of their engineering time on integration maintenance.

The market dynamics mirror healthcare exactly. Point solutions like Vero (tenant screening) and Funnel (marketing) win on features but struggle with integration complexity and platform retaliation. When these companies become too successful, incumbents respond through acquisition (RealPage buying KnockCRM) or punitive fees (Yardi targeting marketing integrations). Meanwhile, "emerging incumbents" like AppFolio and Entrata try to thread the needle between openness and control, with AppFolio embracing modern APIs while Entrata remains cautious about platform risk.

The frustrations of the market have boiled over into litigation, with intellectual property disputes from Yardi against RealPage, Entrata, and RealPage, and antitrust allegations against both RealPage and Yardi.

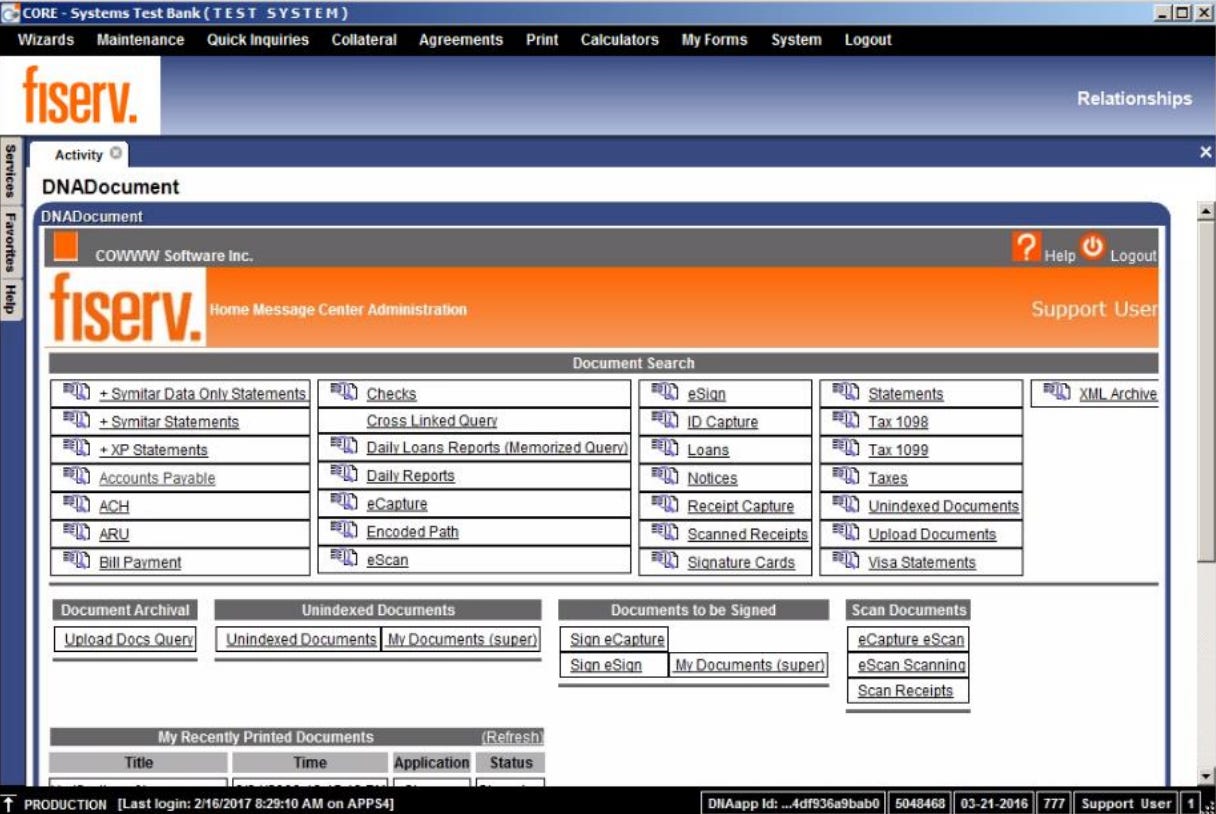

Banking

Tell me if you’ve heard this story before. A market is concentrated to three main systems of record (FIS, Fiserv, Jack Henry) in the enterprise (although more options exist for SMBs):

The core services market is highly concentrated, as the “Big Three” core providers—FIS, Fiserv, and Jack Henry and Associates (Jack Henry)—have sizable market shares. Chart 1 shows the shares of banks and credit unions the Big Three serve according to recent surveys (ABA 2023; Chilingerian and Schafer 2020). Collectively, the Big Three served more than 70 percent of banks surveyed in 2022 and nearly half of credit unions surveyed in 2020. Individually, Fiserv serves the largest share of DIs: 42 percent of banks and 31 percent of credit unions use a Fiserv core platform such as Premier, Precision, DNA, or Cleartouch. Jack Henry serves 21 percent of banks and 12 percent of credit unions across core platforms such as SilverLake, CIF 20/20, Core Director, or Symitar. And FIS serves 9 percent of banks and 3 percent of credit unions using a FIS core platform such as Horizon or IBS.

I had my friend Alex Johnson of Fintech Takes at Workweek provide some additional color commentary, which we will include throughout:

Alex’s Fintech Take

Banking is a really weird market because it's gigantic (4,500 banks and 4,500 credit unions in the U.S.), but also very concentrated (the top 15 banks control like 80% of the deposits). What this means is that the core providers technically serve everybody, but they make most of their money from their big whale customers. As such, those customers get all the newest upgrades and new features and the small banks have to wait years or decades for the innovation to trickle down to them. I can't emphasize this enough: community bank CEOs fucking hate their core providers.

These products are not the pinnacle of user interface design, despite their dominance. They are brutally outdated, with color schemes that haven't been refreshed since the early 2000s, navigation patterns that require multiple clicks to accomplish basic tasks, and interfaces that look like they were designed for Windows 95.

Those entities are unhappy with their core system of record due to implementation fees, upgrade fees, inability to modify core/ancillary services, convoluted contracts (some to the point of suing their system of record), and bundling of services to the core software:

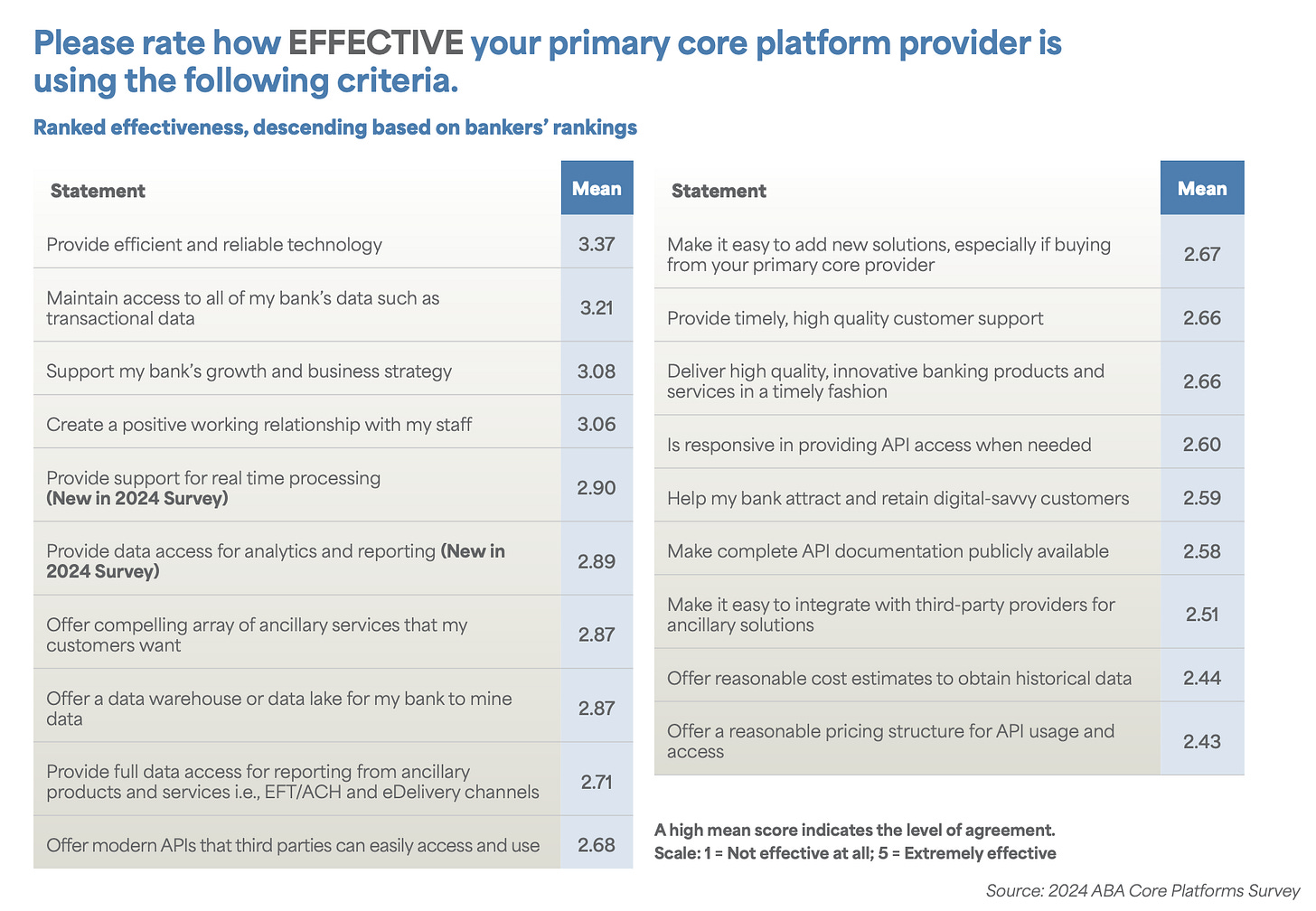

Whether core providers leverage their market power is difficult to assess; however, DIs’ lower satisfaction with the Big Three firms may be an indication of their market power when considered alongside other factors. According to the 2022 ABA survey, nearly half of banks (46 percent) that used the Big Three were either extremely or somewhat dissatisfied with their core provider, compared with about a quarter of banks (27 percent) that used a smaller core provider (ABA 2023). Notably, nearly 80 percent of large banks (with assets greater than $5 billion) were dissatisfied or neutral, compared with about 40 percent of small banks (with assets less than $500 million). The surveyed banks noted that their core providers were ineffective in delivering quality, timely customer support, integration with third parties, and data maintenance. In contrast, core providers assessed the effectiveness of their own performance much higher. The ABA concludes that this gap in effectiveness assessment between the banks and core providers “is the root cause of bank leaders’ dissatisfaction with core providers” (ABA 2023).

And yet, according to the most recent ABA survey, these organizations overwhelmingly do not change vendors due to massive switching costs, with 83% having been with their vendor for over 5 years and 68% for over 10 years. Only 19% stated that they were very likely to convert at their next renewal date, while 69% are likely to remain with their current provider.

Time and time again, the customers of these platforms do not punish them, despite their dissatisfaction:

Despite the rising discontent with existing solutions, as Ben Robinson pointed out, modern core banking infra vendors have struggled to increase penetration in recent years. Only ~1-2% of US / EU banks switch their core providers each year, vs ~20% that come up for contract renewal. The primary reason for this is the cost and length of the migration - the switching and implementation process can last multiple years.

Modern solutions exist, but over and over again, the status quo is chosen:

Alex’s Fintech Take

There's a real "nobody gets fired for picking IBM" vibe in core banking. There's this obscure law on the books called the Bank Service Company Act (BSCA baby!) which allows regulators to directly supervise the largest tech service providers to banks, which obviously includes the big three cores. This creates a regulatory comfort with those three providers that is risky to walk away from. A new core provider, even if it's great, can't receive that same unofficial stamp of regulatory approval until enough banks start using it and most banks won't take the risk of using it until it gets that stamp! Chicken and egg.

And when banks or credit unions do stick their necks out and try to do something different, it often doesn't go well! Take a look at Vystar CU, which tried to switch to Nymbus (which it was an investor in) and screwed up and got sued by the CFPB. Or look at TSB over in the UK. Bottom line - you don't get in trouble for operating on a bad core system and delivering terrible products and experiences to your customers. You do get in trouble if you try to fix those problems by migrating off your legacy core and messing something up.

What's crazy is that the respondents to this survey are the executives and C-suite, by and large. When 35% of respondents are Presidents/CEOs, 17% are COOs, and 14% are CIOs, these are the people making strategic decisions and viewing the platforms from a high level. If executives who primarily interact with vendor account managers and see quarterly business reviews are rating customer support at 2.66/5 and system effectiveness at 2.78/5, imagine what the front-line employees dealing with slow interfaces, system downtime, and clunky workflows would say. The disconnect between what executives experience in vendor presentations versus what their staff endures daily suggests the true user experience is far worse than even these dismal ratings indicate.

These platforms are not built to integrate. The effectiveness ratings for integration capabilities are systematically the worst across all measured attributes. They lack APIs and, when they are available, they are ancient, overpriced, and difficult to use. Integration with point solutions is hard, and data access for migrations or external reporting is lacking.

Alex’s Fintech Take

When actual good tech comes along that genuinely threatens the big three, they just buy it. And then they are never heard from again. The cores are where good tech in banking goes to die. There are two many examples to recount, but the more important point is that FIS isn't one system. It's a holding company for a whole bunch of different core systems that FIS has bought and loosely integrated over the years. Various systems are constantly being sunset by the cores as they try to keep their product messes from getting too big.

Automotive Dealerships

If property management systems and core banking systems seem egregious in their ways, the dealer management systems may be the boss mode of systems of record. DMSes are the single source of truth for car dealers nationwide:

The market is highly concentrated, with a landscape that can only be characterized as an oligopoly, as the Big Two, CDK Global and Reynolds & Reynolds, together control roughly 75% of franchise automotive dealers’ DMS business:

There’s a distinct Windows XP vibe to their design:

In some ways, this vertical is the endgame of the standard system of record arc. The market is mature and saturated, with reports estimating 99+% of franchised auto dealers using one and 90+% of related markets (used car, commercial truck, powersport, etc). The dominant players have existed for decades and have amassed integrated platforms that provide for every need of the business. Growth is predicated on maintaining market share while expanding along the value chain of adjacent participants , such as Original Equipment Manufacturers (OEMs) and Digital Service Providers (DSPs).

CDK and Reynolds & Reynolds realized this in the mid-2010s: any technical spend by a dealer that wasn't directed towards their platforms represented a failure of their bundling strategy. Rather than compete on features, they decided to force bundling by blocking third-party access entirely, ensuring dealers had to purchase data integration services as part of their platform bundle. Despite controlling 70% of the auto dealer software market together, they decided they were no longer going to let firms like Authenticom access dealer data from their respective systems.

The coordination was explicit:

Both shut down third-party integrator access to dealer data simultaneously

CDK stopped doing data integration for Reynolds customers, and vice versa

Classic market allocation: they divided the integration market between themselves

At a 2016 industry convention, CDK executive Dan McCray delivered a mob-style ultimatum to competitor Authenticom: "For god's sake, you have built a great little business, get something for it before it is destroyed otherwise I will f***ing destroy it."

The economic impact was immediate and devastating. Data integration services that cost $30-35 from Authenticom jumped to $893 after the exclusion strategy kicked in, a 25x price increase enabled purely by eliminating competition. The few that fought back initially won injunctions, but appeals courts used Scalia's Trinko decision to reverse them, ruling that forcing monopolists to share data would hurt "innovation incentives."

A decade later, CDK finally paid a price, shelling out $630 million to software vendors plus $100 million to dealers. But the payouts came with no structural remedies, no behavioral restrictions, and no admission of wrongdoing. It's essentially a massive fine for the right to continue monopolistic practices. A 2024 ransomware attack that paralyzed 15,000 dealerships shows the real consequence of this strategy: when customers can't switch, there's no incentive to invest in security or quality.

The industry has necessarily not rolled over - states like Arizona have passed innovative laws mandating data portability that mirror healthcare’s information blocking regulations (at a smaller scale). Innovative competitors like Tekion are also sounding the antitrust horn again as they are blocked from migrating customers’ data. But thus far, this narrative in some ways represents the Platonic ideal of modern B2B system of record behavior for mature markets - explicit coordination, literal threats, immediate price gouging, legal protection from Trinko, and finally massive settlements that change nothing structurally.

Claims & Administration Platforms

While Epic's dominance on the provider side gets most of the attention, the payer side follows an eerily similar playbook. Claims & Administration Platforms (CAPS) serve as the systems of record for health insurers, handling claims, enrollment, and billing for the $4+ trillion healthcare economy.

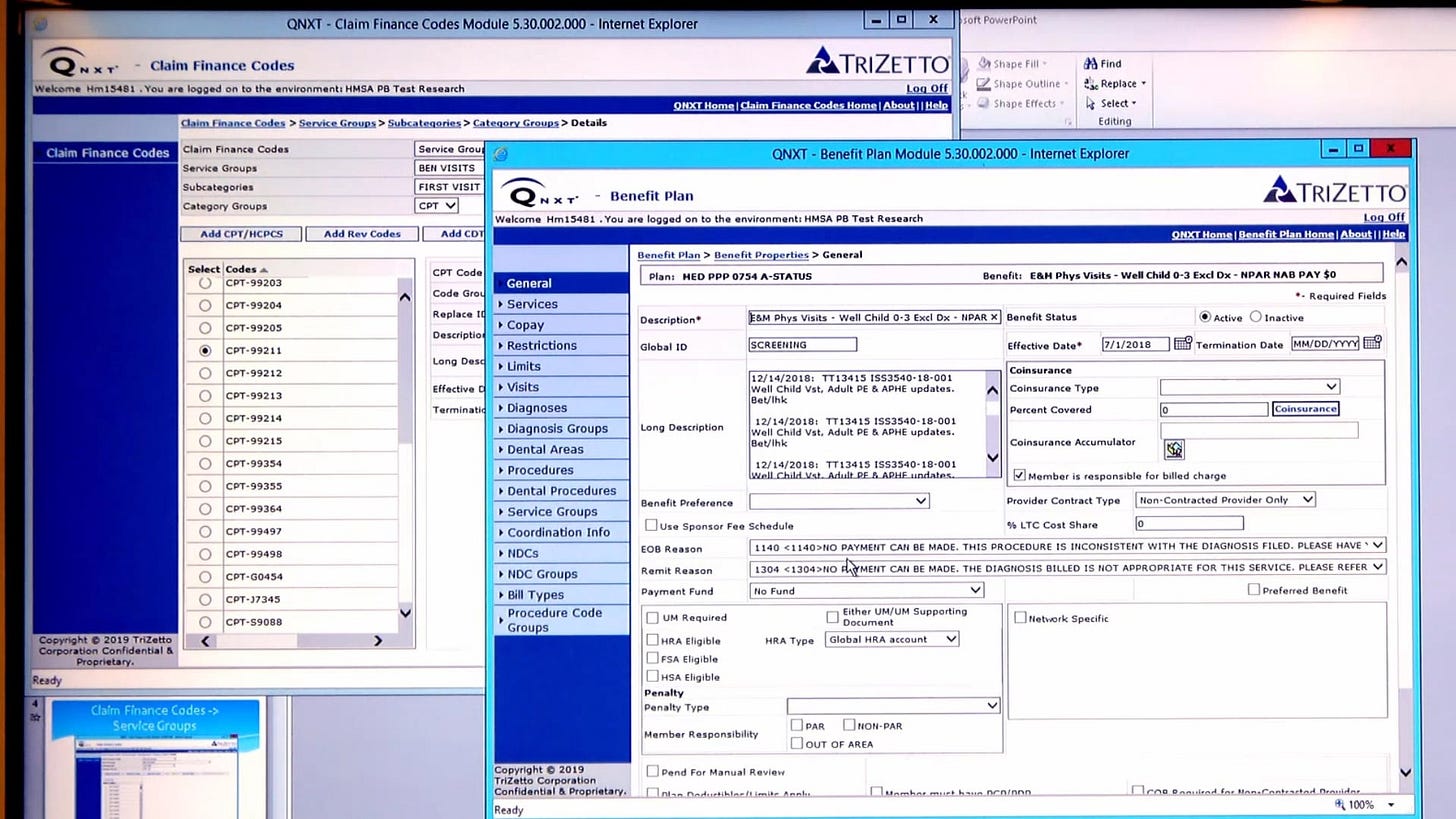

Cognizant's TriZetto suite (Facets, QNXT and QicLink) processes over 50% of all insured lives in America (roughly 150-180 million people). TriZetto achieved similar dominance among Blue Cross Blue Shield plans and national insurers like Anthem and Cigna. HealthEdge has emerged as the "modern alternative" with their cloud-native platform, winning new deals while incumbent customers remain locked to TriZetto due to switching costs.

We see the same fractal pattern of vertical specialization that appears across all mature B2B markets - once the dominant platforms emerge, smaller players survive by finding niche segments that the giants either can't serve effectively or choose to ignore, creating a long tail of specialized solutions that collectively fragment the remaining market share. Thus, a handful of other systems carve out sub-verticals to dominate - Epic Tapestry for provider-run plans, UST HealthProof (formerly Advantasure) for regional Medicare Advantage, NASCO for Blue Cross affiliates, and Gainwell (formerly DXC) for state Medicaid plans.

The technical complaints are virtually identical: outdated technology stacks, expensive customizations, and integration challenges. Health plans report the same frustrations with vendor relationships and systems frozen in time despite processing trillions in healthcare transactions.and systems frozen in time despite processing trillions in healthcare transactions.

Most tellingly, this market has reached the same anticompetitive endgame. In January 2025, Infosys, a tech services firm with Helix (a nascent upstart CAPS), filed an antitrust counterclaim in the trade secrets lawsuit brought against them by Cognizant, alleging they "weaponized" their TriZetto acquisition to foreclose IT services competition. The complaint reveals Cognizant paid a "monopoly premium" of $2.7 billion for TriZetto—nearly four times its revenue—specifically to gain market control, then imposed contract terms preventing health plans from awarding services work to competitors. While the court case is still in progress, the parallels to the CDK/Reynolds & Reynolds situation are striking.

The Pattern Repeats Everywhere

The examples above aren't isolated incidents - they represent a seemingly universal pattern that emerges as B2B systems of record mature. The same dynamics play out across virtually every industry vertical that has digitized:

Veterinarians: The market is absolutely and completely consolidated, with Covetrus and IDEXX (which strangely are just down the street from one another). Software is somewhat of an afterthought intended to lock in these organizations, as they’ve vertically integrated the industry to offer comprehensive diagnostics and a full supply chain to clinics. The API programs exist but are cloaked opaquely by partnership programs, with friction if not using their preferred options.

Warehouse Management: The WMS market is dominated by Manhattan Associates, Blue Yonder, and Oracle, with enterprises reporting the same integration pain points, expensive customization requirements, and lengthy implementation cycles that characterize systems of record across industries. Each vendor has built comprehensive suites that span robotics orchestration, AI analytics, and multi-tenant cloud architectures, making switching exponentially more complex.

Construction: Oracle's construction empire, built through strategic acquisitions of Primavera (2008), Textura ($660M, 2016), and Aconex ($1.2B, 2017), demonstrates the classic playbook of consolidation through M&A. Even newer entrants like Procore, which took 20 years to incorporate financial services and built their platform around communication rather than financial transactions, still follow the same expansion trajectory toward comprehensive industry solutions. Trimble and Autodesk round out the oligopoly in this market, with the same complaints we see elsewhere:

Property & Casualty Insurance: These platforms handle mission-critical policy administration, claims processing, and billing with implementations often taking multiple years and costing millions. Three vendors dominate core systems for large North American insurers: Guidewire, Duck Creek Technologies, and Majesco, but no one seems happy.

K-12 Schools: School districts face similar vendor concentration with platforms like PowerSchool, Infinite Campus, FACTS, and Skyward dominating public schools. These systems handle enrollment, grading, state reporting, parent portals, and integration with dozens of educational technology tools. State compliance requirements and the complexity of data migration create switching costs that keep districts locked into systems they openly complain about, with implementation timelines often spanning multiple school years.

Telecom: Telecom is a fascinating vertical in that it feels uniquely opaque compared with almost every other industry. Even with some Matrix-level Google kung fu and very targeted partnership with my good friend Deep Research, I felt thwarted getting a detailed pulse on market share and dynamics. What is clear, however, is that telecom runs on a distinctive architectural duality and system-of-record mullet: Business Support Systems (BSS) in the front (billing, CRM, product catalogs), and Operations Support Systems (OSS) in the back (network inventory, service orchestration, fault management). Industry reports cite that around 80% of their IT budgets go to integration and customization around this mullet. Amdocs, cited as the largest player here, faces regular complaints about anticompetitive bundling of solutions to exclude competitors and their lack of interoperability.

To address fragmentation, TM Forum launched the Open API initiative - standardized RESTful interfaces aimed at creating modular, interoperable telecom software. While many operators and vendors have pledged support, adoption has been uneven. Newer players have certified dozens of APIs, but legacy vendors like Amdocs lag behind. Even where APIs exist, interoperability is hampered by inconsistent data models and entrenched platform incentives.

This universality isn't coincidental - it's the natural outcome of how B2B software markets evolve when they achieve the critical mass necessary to become systems of record. The pattern transcends industry specifics because it's driven by fundamental economic forces rather than technical constraints.

The Anatomy of Platform Dominance

The market structure follows a predictable pattern of extreme concentration around 2-4 dominant players controlling most market share, with customer retention rates above 80% despite widespread dissatisfaction. These high retention rates aren't driven by satisfaction but by switching costs, creating long vendor relationships that span 5-10+ years based on lock-in rather than loyalty.

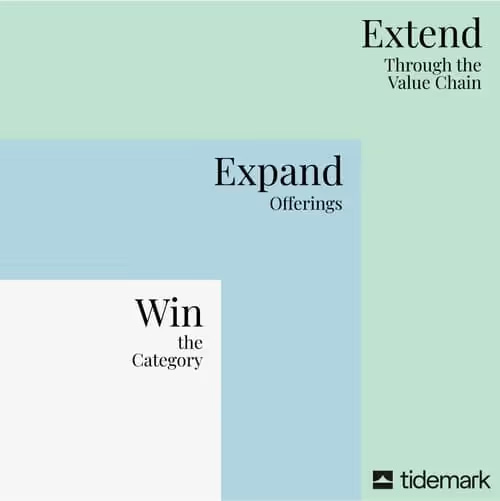

To that extent, systems of record sit at a fundamental point of strength. Their nigh impregnable moat comes in two compounding forces (well articulated by David Yuan at Tidemark):

Workflow gravity – the system that all other systems integrate to – it’s where the most users spend the most time. Not all workflows deliver the same value; in my experience the system of record workflow tends to deliver the most value.

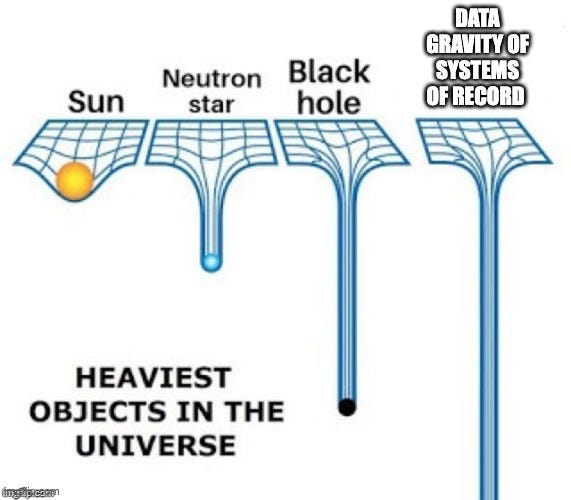

Data gravity – the system that creates and holds the most critical information and is the hardest to migrate. That data can be critical to a client for a wide range of applications, from understanding their customers (e.g. CRM) to managing risk (e.g. compliance). Bundling accelerates data gravity by forcing customers to store more types of information in a single platform - financial data, operational data, customer data, and analytics all become entangled in one system.

Account gravity – the user/sponsor of the system is the highest-ranking individual in the customer organization; it’s the system that requires the biggest financial outlay, etc.

Switching thus grows exponentially heavier as organizations expand. Switching costs are not linear in nature - the single source of truth becomes a black hole of complex data structures and accrued years of history, the web of integrated point solutions turns into a Gordian knot, and users adapt their behaviors to the eccentricities and oddities of the software’s quirks.

As mentioned earlier, the easiest way for a software business to grow is to expand within existing customers rather than acquire new ones. This leads to aggressive bundling strategies that squeeze out point solutions. It's hard not to view the tech spend of a single business as a zero sum game - if it's going to another tech company, it's not going to you. The system of record's response is predictable: bundle that functionality into their platform either by building it in-house or acquiring the point solution provider.

Having an ecosystem of partners that handle small, obscure, or niche functions is good as they mature. But if those small, obscure, and niche things become important enough to be valuable to the mutual customer, the incentives flip. Any level of success means a system of record will resent your take of their potential upside and growth. The system of record’s self-preservation instinct is to take that wallet share by:

Building competing features in-house

Acquiring the point solution provider

Making third-party integration so expensive that customers choose the bundled alternative.

This bundling imperative explains why successful point solutions either get acquired or get squeezed out.

Ecosystem control strategies often become increasingly aggressive as markets saturate. The competition of that last paragraph can accelerate to anticompetitive behaviors - data access restrictions that prevent third-party innovation, acquisition of successful point solutions that threaten platform dominance, and punitive measures against integration partners who become too successful. The platforms systematically self-preference their own modules over superior third-party alternatives.

Finally, these systems have benefited from regulatory and legal protection that reinforces their market position. Industry-specific regulations often increase switching costs, while antitrust precedents leave little leverage to push back. When monopolistic violations do occur, settlements typically involve financial penalties while leaving the underlying market structure intact, essentially allowing companies to pay for the right to continue anticompetitive practices.

The Economics of Expansion

This expansion imperative creates a predictable trajectory that we see playing out across every industry. At a basic level, it circles back to discussions earlier in the article. The ideal end state for software is to grow to encompass the fullest set of its customers’ needs. To provide more value unlocks the ability to extract more revenue. In short, these products will (barring externalities like regulation) follow Tidemark’s Vertical SaaS Knowledge Project arc:

This isn't just theoretical - it’s just how software companies across industries execute and win. As Parker Conrad of Rippling articulates in their analysis of compound software businesses:

"Generally speaking, Rippling's approach—building multiple products in parallel—isn't supposed to work. What's supposed to work instead is building 'best of breed' software: one narrow, point-solution SaaS product that does one thing well. We call this approach 'point-SaaS,' and it has been the strategy for most business software development for the last 15 to 20 years.

Because point-SaaS companies can amortize sales and marketing and R&D costs over only a single SKU, they will increasingly be at a pricing disadvantage to compound companies like Rippling. And clients that choose to buy artisanal point-SaaS products will increasingly pay a penalty for doing so."

It is a truism in all of sales that expansion of an existing customer is easier than selling to a new one. The CAC for net-new customers includes all those front-loaded costs: marketing spend to generate awareness, sales effort to build trust and overcome objections, onboarding resources, and often promotional pricing to get that first purchase. Cross-selling and upselling has much of that groundwork already paid for.

This expansion imperative is driven by the fundamental mechanics of the SaaS business model itself. As Bret Taylor (former CTO of Facebook and co-CEO of Salesforce) in his interview with Ben Thompson of Stratechery puts it:

“Broadly speaking, sales and marketing matter a lot in enterprise software companies and tend to be the gravitational center... With that, when you stop growing, the business model breaks down. That's where things like the Rule of 40 come from, where your growth rate and your EBITDA margin sort of need to be in lockstep... It is really about growth. As a consequence, you end up with a really customer-centric, go-to-market-centric orientation, and product serves that. The best enterprise software companies, that voice of the customer dictates their product roadmap, and they can really meet that demand. The worst ones stop innovating on the product and hold your feet over the fire in the sales process.”

Systems of record don't accidentally become extraction machines - they're following the most rational path available to them. Once they've achieved market dominance and high switching costs, the economics heavily favor growing wallet share, first by relentless feature expansion but, as that falters, often by bundling, lock-in, and ecosystem control. Growth becomes predicated on wringing every last drop out of a saturated market. The Tidemark framework shows this isn't a bug in B2B software - it's a fundamental feature. They win their category, expand their offerings, then extend through the value chain until they control entire ecosystems.

The Lifecycle of a System of Record

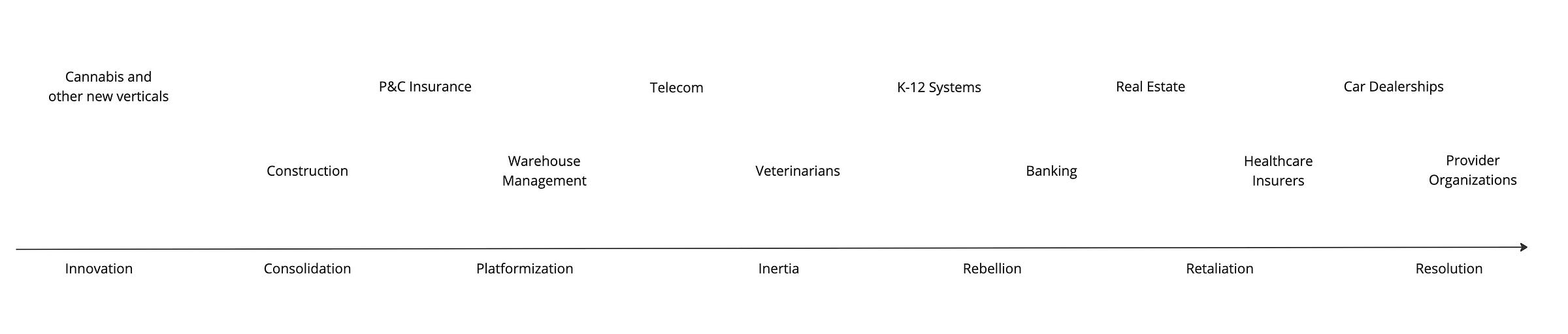

Using these examples, we can begin to trace a lifecycle of sorts:

Innovation: Software is adopted by greenfield verticals or sub-verticals—markets where workflows are still manual, fragmented, or underserved by digital tooling. Adoption is driven by the promise of productivity, data capture, and operational insight. Early entrants win by solving a single, painful problem deeply, often with no competition in sight.

Consolidation: The market matures, and early winners begin acquiring rivals or expanding horizontally to lock in customers. Multiple point solutions are rolled up into suites, and the vendor landscape collapses to a few major players. Switching costs and network effects start tipping the market toward a dominant platform.

Platformization: The dominant players evolve from point solutions into full-stack platforms. Revenue expands through bundling, integration fees, user-based pricing, and usage-based monetization. Third-party developers are drawn in under terms dictated by the platform. Ecosystem strategy emerges not as benevolence, but as a mechanism of control and margin expansion.

Inertia: Customers stay now if for no other reason than they have no viable exit. Systems of record accumulate workflow and data gravity. Integration webs deepen. Internal teams build processes around vendor quirks. Switching requires not just migration, but change management across hundreds or thousands of people. Dissatisfaction rises, but so does entrenchment.

Middleware rebellion: Enter the middleware insurgents: startups and standards bodies pushing for openness and interoperability. Vertical-specific iPaaS solutions and abstraction layers emerge to bridge the gap between legacy systems and modern tools. At the same time, interoperability standards (like FHIR in healthcare, LTI in education, or TM Forum Open APIs in telecom) begin to formalize integration pathways. These forces challenge the closed ecosystems, but must still operate within the orbit of the incumbent.

Retaliation: Dominant platforms respond in kind. Legal battles, integration throttling, partner program restrictions, and sudden API pricing changes become weapons. Incumbents may sue disruptors, restrict access to critical data, or acquire and sunset rising challengers. The mask slips. The incentives become visible. The gloves come off.

Resolution or stasis: Eventually, something gives. Either regulatory forces compel openness, or the market hardens into an oligopoly. Some markets reset. Others ossify—until the underlying industry itself is disrupted.

Given all this, it is logical that the market for systems of record for the largest enterprises calcifies quickly when technology is adopted by a specific vertical. The time horizon for change is not months or years. It is decades. The incumbent and market-leading systems of record are overwhelmingly Gen-X (or even boomer) in vintage.

Even the newest of these are decades old! Beyond that, an undeniable pattern emerges: regardless of industry, the systems of record that achieve dominance tend to be founded in the same narrow window when that vertical first digitizes. Epic (1979), Yardi (1984), CDK Global (1972), and FIS (1968) aren't accidents. They represent the companies that happened to be positioned correctly when their respective industries made the transition from analog to digital operations. Once established, these platforms become virtually impossible to displace, creating technology landscapes frozen in time for decades.

The Persistence of Platform Lock-in

The death of systems of record is oft proclaimed. We saw it with the migration to the cloud, with open source, with the advent of the API ecosystem. We hear how it’s a viable pattern to integrate and surround the system of record. Pundits discuss how “systems of intelligence” or “systems of action” will disrupt the pattern.

Often we see the world the way we want it to be, rather than it is. It is certainly possible to build good businesses creating valuable point solutions in underserved markets. It’s even better to grow point solutions into network products that have incredible defensibility or to turn them into infrastructural products that can be used by tech-enabled organizations and systems of record alike.

But there are few real examples today of disruption of systems of record, at least in enterprise markets. Systems of record are durable. Replacement is a slog and an incremental battle won only with continuing, unwavering endurance. The time horizon is decades, not months or years.

This creates a fascinating paradox that consistently puzzles observers of B2B software markets. Even when superior alternatives emerge that are more flexible, more open, and more innovative, organizations continue to choose the incumbent platforms they openly complain about. As healthcare IT expert Bart de Witte recently observed:

"Given these advantages, it's puzzling to see major healthcare institutions like Berlin's Charité still opting for an EMR behemoth like Epic. The future clearly lies in more flexible, open architectures that can embrace rather than resist innovation."

This puzzlement reflects a fundamental misunderstanding of how these markets actually work. The "advantages" of modular, open systems are real from a technical perspective, but they're irrelevant compared to the gravitational forces that keep organizations locked to their existing platforms: data gravity, workflow gravity, and account gravity.

In reality, we all hate the enterprise software we use. We all experience the pain of an experience that's tailored for the aggregate, that meets all the needs but excels at none, that was the choice of our company's executives and not the end users.

Just look at Gusto, Rippling, Paylocity, and Insperity. These are supposed to be the sleek, startup-era alternatives to legacy HR systems with low switching costs, vibrant competition, newer codebases. And yet… users still rage online about clunky interfaces, rigid workflows, broken features, and Kafkaesque support channels. One Paylocity user called the implementation “atrocious,” with a 55-minute support call that “left me so incensed I can’t even put it into words.” A former Gusto customer described their experience as “literally stuck on hold for hours over a tax issue until I tweeted at them”. Another complained about Insperity’s “ancient portal” and “horrific” onboarding UX. A Rippling user summed it up as “three months of onboarding purgatory and nothing worked.”

This remind us of the deeper truth of the Principal-Agent problem: the economic incentives of B2B software make end user satisfaction secondary to buyer priorities. Organizations simply lack the ability to risk their operational continuity on unproven alternatives, the foresight to plan for such lengthy transitions, and the wherewithal to invest in the massive cost of migration, regardless of their technical superiority.

From Lock-in to Line Item

The durability and cash-generating potential of these dynamics haven't gone unnoticed by sophisticated investors. Specialized private equity firms like Constellation Software, Thoma Bravo, and Francisco Partners have built entire investment strategies around acquiring these entrenched systems of record, recognizing them as some of the most defensible assets in the software universe.

Constellation Software

While the PE firms that dabble with systems of record are mildly interesting, if you’re not familiar with Constellation in particular, you gotta do a deep dive. This $29B market cap company is led by Mark Leonard, who does not map to the conglomerate-founder-archetype you imagine:

In addition to aspirational beard flow, he is ultra private, with only 3 public photos. But he has perfected the art of acquiring "boring" vertical market software companies with exactly the characteristics we’ve discussed: high customer retention, mission-critical functionality, and switching costs that make churn virtually impossible. In doing so, he’s built one of the top 10 most valuable software brands, in the same league as ServiceNow and Quickbooks. They’re also one of those fundamentally unique companies in a lot of other ways - holding companies forever, compensation tied to ROIC, and a decentralized operational model:

Unsurprisingly, there are plenty of healthcare systems of record in their subsidiaries. In Harris Computer alone, we see numerous popular electronic health records:

Altera (artist formerly known as Allscripts)

AmazingCharts (outpatient EHR)

GEMMS (cardiology practice management)

Harris Healthcare (assorted EHRs)

iMDsoft MetaVision (ICU EHR)

MEDHOST (inpatient EHR)

prognoCIS (cloud practice management)

Given Altera and MEDHOST are both top 10, if Constellation’s healthcare holdings were measured in the aggregate, I wonder where they’d rank on the top market share.

The Cycle Continues

Inevitably, in the discussion of this framework, anecdotes are weaponized as counterfactuals. We want to believe that healthcare is uniquely afflicted by this disease and seek to disprove the reality by isolated examples of 'good' platforms or exceptional cases where integration remains seamless.

Horizontal B2B software that operates across industries has a proclivity towards openness by necessity, as their growth depends on integrations, extensibility, and embedding themselves into as many workflows as possible. APIs, integrations, and ecosystem play are table stakes when adoption depends on fitting into every stack.

There are also industries like e-commerce that are younger in age. Born in the era of APIs, openness and connectivity with other applications is a necessary attribute from a competitive landscape perspective. In these younger verticals, API-first design isn’t a philosophical stance; it’s a market imperative more easily followed given greenfield build.

But you either die a hero or you live long enough to become the villain. The symptoms we see over and over are indicative of the underlying equilibrium of the system. Even the white knights of our SaaS anecdotes fall victim to the inherent and structural incentives of these markets - the systems of record we see as beacons of openness and platform-mindness bend towards this outcome over time:

Slack, the workplace messaging app now owned by Salesforce, was known for its ecosystem of free APIs for developers, but recently blocked other software firms from searching or storing Slack messages. Salesforce said it was "reinforcing safeguards around how data accessed via Slack APIs can be stored, used, and shared” as it restricted data usage and tightened app distribution to funnel exclusively through Slack Marketplace.

Atlassian, the Australian software company behind popular workplace tools Jira (project management) and Confluence (team collaboration), launched its own enterprise search service Rovo after making an unsuccessful multibillion-dollar effort to acquire Glean, a fast-growing AI search startup, in late 2023. Since February, Atlassian has imposed limits on how often outside firms can pull data from its apps via its application programming interface.

Shopify, the dominant system of record for e-commerce, has had an antitrust lawsuit brought against it by Sezzle for self-preferencing their own Buy-Now-Pay-Later offering by adding a 1%-2% penalty for third party BNPL products.

Automattic, the commercial steward of WordPress (which powers more than 40% of the web) is now embroiled in a lawsuit from WP Engine. The suit alleges that Automattic is using control over WordPress.org and its trademark licensing to exclude competitors, impose royalties, and extract commercial advantage, all under the banner of “open source.”

Notion, a popular app for note-taking and project management, has added its own enterprise search feature and now appears to making plans to adjust rate limits to balance for demand and reliability.

Figma, a popular system of record for software design, began limiting API access to search across a user’s files, hurting the ability for enterprise AI companies dependent on such search.

It’s pretty damn ironic that the rise of AI (and LLMs in particular) push even the most open platforms toward closure. They represent a massive new layer of software value creation, allowing tech businesses to capture not just CapEx but also OpEx, shifting from selling tools to selling outcomes. As copilots and agents become the primary user interface, platform vendors are racing to secure the interface layer, even if it means closing doors they once proudly opened. This is the opening salvo - we will see more of this trend as platforms struggle to sell their AI products, like Slack AI.

The B2B lifecycle isn’t a relic of legacy software from the 1980s and 1990s. Even the cloud-native, API-first darlings of the modern era are bending toward the same outcome. At a certain scale, as a business begins to falter, the economic gravity becomes inescapable. Every integration becomes a leak. Every open API becomes a lost upsell. If even our paragons of openness are eventually pulled into this orbit, we have to ask: is sustainable openness possible? Or is the platform always destined to become the moat?

Conclusion

Well, we can’t end on that note, can we? It is not all woe and gloom - competition and is certainly possible, now more than ever.

I started the article by saying how similar our situation is in healthcare to other industries, so perhaps I’ll contradict myself to end things. We are different in our industry. But that is because we are ahead, not behind. Healthcare technology is the pioneer on the next frontier in resetting the natural balance of B2B software and creating a new equilibrium. The regulation we so bemoan is actually the grandest experiment to that extent that we’ve seen in technology (at least in the US):

Our systems of record are required to conform to a uniform API via FHIR, a fundamentally unique approach, with defined pathways for patient access, provider access, and bulk extraction.

There’s increasingly a scrutiny of market dominance with perspectives that antitrust measures and rules built for analog world (or even the consumer tech) may not properly address the fractal nature of B2B tech markets.

Most powerfully, information blocking offers a potential prospective antidote to the anticompetitive behaviors that often are defaulted to by incumbents.

In the next article in the series, we will examine this regulatory experiment in rebalancing the scales under the lens of the threat it poses to Epic, but also EHRs more generally. Systems of record in other industries should take note - the frustration is boiling over in healthcare, but it as a vertical is the first, not the last, in that regard.

Editor Hype Session

I want to thank the various editors and reviewers for their insights and perspectives:

Alex Johnson, author of Fintech Takes, the leading perspective on financial technology

Ben Lee, author of Quite a Few Claims and founder of stealth AI company

Brad Hargreaves, author of Thesis Driven, the best real estate and property management Substack out there

Brad Thorson, my partner-in-crime at HTD Health

Colin Keeler, my twin and cannabis business leader

Dan Bonistalli, an exceptional product talent at Innovaccer

Dhruv Ragunathan, very smart interoperability mind at Ellkay

Emily Lu, medical leader at Tia Health

Ethan Wolin, bringing the payer perspective

Josh Napravnik, product leader at PointClickCare and autarch encyclopedist

Kevin Wang, GM of Sword Predict

Maggie Faust, AI advisor and sharp mind with great editorial pushes

Matt Schaefer, founder and partner at Farseen Advisors

Pryce Ancona, leading solution engineer at Redox

All great people worth knowing and connecting with!

This was legit Sunday reading

Unreal article, very well done.