Epic Beyond the Provider Empire

Health Grid’s systematic expansion into new healthcare domains

A Call to Action

Before you read this (fairly long) article, I have one (bifurcated) ask: that before, after, or during the time you read this article, you either:

Reach out to me if you want to discuss the topics of the article in more depth - I’d love to talk to more providers, payers, labs, medical device companies, or other organizations with unique perspectives on Health Grid

Let me know if you’ll be at ViVE or HIMSS! I’m looking to fill up my dance card with anyone and everyone who wants to talk about health data, regulatory changes, or whatever you’re working on.

In our previous article, we explored how Epic governs its vast provider kingdom - the complex ecosystem of third-party applications and developers that operate within its borders. We examined their varied programs, marketplaces, and partnership frameworks - from basic connectivity in Connection Hub to deep co-development in Workshop. But, while Epic's management of these traditional vassals remains a work in progress, they have set their sights on grander conquests: methodically expanding beyond the provider realm into every corner of healthcare. From payers struggling with prior authorization to labs managing orders across hundreds of health systems, Epic is creating new software categories that leverage their provider dominance to claim adjacent territories.

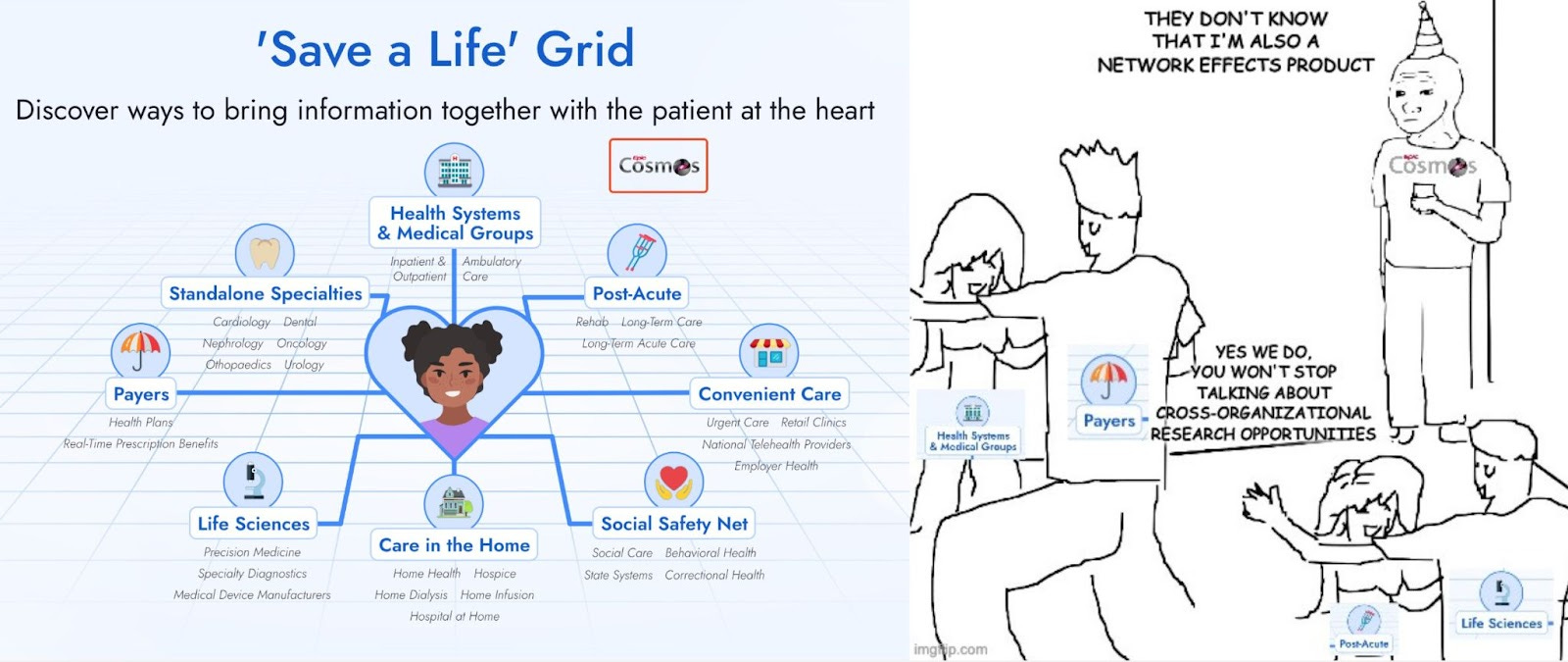

This expansion isn't happening through traditional conquest. Instead, Epic is taking a more sophisticated approach through what they call "Health Grid" - a collection of specialized products that establish new outposts for non-provider organizations to connect with Epic's vast network. It's a strategy that simultaneously solves real pain points while potentially positioning Epic to become the supreme system of record for entirely new categories of healthcare organizations.

In this article, we'll explore:

How Health Grid products work and why organizations are pledging their fealty

The strategic implications of Epic's expansion beyond its traditional borders

Epic's other initiatives to extend their dominion, from EpicCare Link to professional services

What this means for the future of healthcare technology

As we examine each piece of Epic's expansion strategy, a clear pattern emerges: Epic isn't just building features - they're attempting to systematically eliminate the borders of healthcare data exchange by replacing existing networks, forging new pathways where none exist, and establishing themselves as the central power through which all information flows.

Health Grid

If you’re looking to interact with Epic as a non-provider organization, you’re not always building an application and connecting to Epic’s APIs. One newer option is to buy software that they make specific to your use case. These offerings, grouped in Showroom under the Health Grid category, are specifically software sold to labs, medical device companies, payers, telehealth companies, and clinical trials.

The value proposition for Health Grid customers is to “install Epic once, scale your connectivity across all Epic provider sites effortlessly.” By having a Health Grid product on the non-provider side of data exchange, Epic can more tightly and uniformly manage the setup of connectivity, mapping, and error handling. While not yet built for all workflows, it aims to replace all the interfaces and APIs that would need to be set up point-to-point with Epic customers.

It’s worth noting that, as of very recently, this was rebranded to ‘Save a Life’ Grid. I uniformly and concretely reject this new name. It is not clear at all yet what their intent was here, but at face value, it somewhat implies that organizations that choose not to use this software are not saving lives. There’s a certain amount of hubris to that claim in general, but especially for payers, labs, and clinical trials that are somewhat adjacent to clinical care.

Each Health Grid product aims to streamline the exchange of information to and from Epic’s dominant provider base for a specific use case. The non-provider organization becomes an Epic customer, does an Epic implementation to install and set up the software, and does the requisite work to connect to their provider trading partners.

All Health Grid products have strong network effects, where the value of the Health Grid product increases as each new customer uses it. This is a strategy Epic used very successfully with their Care Everywhere network for provider-to-provider exchange, a pivotal product in the growth of their provider customer base. With more payers exchanging via Payer Platform, more labs exchanging via Aura, and more clinical trials participating via Discovery, providers are further incentivized to become Epic customers and participate as well.

One additional benefit of this approach is that Epic is able to test and harden the standards and data exchange mechanisms that underpin different workflows more rapidly, which allows them to bring back recommendations and improvements to the broader community.

Each Health Grid product represents a serious headwind to existing middlemen and data exchange companies that create network-based products between Epic providers and non-provider entities, like clearinghouses, clinical data retrieval companies, care gap closure applications, lab integration tools, and clinical trial matchmakers. It doesn’t destroy their markets, but it certainly has the potential as a premium offering to eat away at a high-value segment (Epic customers) that produces the most volume.

Pricing details are non-public and scarce, but the general rumor mill is that all of them are quite expensive, meaning that smaller organizations are priced out with contracts starting in the low seven figures. Conversely, I’ve also heard that some of the Health Grid products (in particular, Aura) are volume-based, which in turn prices out the largest organizations.

Side note: Many of the Showroom entries have screenshots of the associated functionality that are worth checking out, so make sure to click through and review those entries to get a visual sense of the experiences, as I won’t be posting Epic screenshots here.

Systems of Record and Beachheads

Health Grid applications are not (today) the core systems of record for each of these organization types but aim to streamline the exchange of information to and from Epic’s dominant provider base.

However, Epic does offer core systems of record for some of these organization types. For instance, Epic has Tapestry as their core system of record (claims processing) for payers. Likewise, Epic offers Beaker as their core system of record (lab information system) for laboratories.

As enterprise software exhausts its initial addressable market, it grows in several recognizable patterns:

Eat the enterprise: The systems of record expand outwards to encompass all functions of the particular organization type they serve. The largest systems of record leave little breathing room for point solutions. This is not out of malice - it is universally true that the upsell of a new module to an existing customer is easier than the acquisition of a new customer for an existing module. Because of the principal-agent problem, enterprise customers seek a single throat to choke when things go wrong and will bias towards a default option from a known vendor over a net new product that is somewhat better.

International expansion: Untapped geographies have barriers to entry in terms of localization and internationalization, but that product investment can be less than entirely new markets, especially if targeting jurisdictions with high workflow and regulatory overlap.

Cross-organizational expansion: Systems of record typically expand beyond their initial customer type into adjacent organizations sharing similar core transactions. Salesforce grew from B2B sales CRM into serving financial services, life sciences, and government by building on customer relationships. SAP expanded from manufacturing ERP to retail and banking, using financial transactions as its foundation. Even specialized vendors like Yardi moved from multifamily property management into commercial real estate and student housing by leveraging their property accounting core. The key is identifying fundamental transaction types that exist across organizations and then building complementary capabilities that make the platform valuable to new customer types.

This last option has distinct upside but also major headwinds where organizations have already adopted a system of record. Core systems of record across all industries have tremendous switching costs stemming from three main barriers:

Workflow changes: Your new system of record will do things differently than the old one. Configuring your workflows in the new system and teaching your entire organization all the new ways of doing the jobs appropriate to their roles can take dozens or hundreds of people.

Data migration: As you move from one system of record to another, you typically want to minimize operational disruption. Foundational to that goal is a seamless transition of the data you need from your old database(s) to the new one(s). Scoping, testing, and executing this Extract, Transform, and Load process is a big effort. Migrations are inherently lossy as you transform data, so generally, there are pains as you do so.

Ecosystem integration: Most enterprises aren’t just their system of record but include a universe of orbiting point solutions integrated into the system of record. As the data migration is completed, these systems need to be redirected to the new source of truth.

The end result is that system changes are infrequent after an industry calcifies, as there must be tremendous ROI on the new software to recoup the cost of the switch. As a result, disrupting incumbent systems of record takes decades, especially for larger enterprises.

If Epic has aspirations of expanding to be the core system of record for non-provider entities, Health Grid seems to be a viable strategy to address an unsolved problem (managing integration with providers nationwide) as a beachhead. By building a small but valuable relationship with those entities, Epic can advance to adjacent opportunities within the enterprise. For instance, as Epic facilitates prior authorization via Payer Platform, it may lead payer customers to use their Utilization Review module of Tapestry. Bite-by-bite, they can make inroads with these novel organization types and eventually replace their systems of records.

Payer Platform

The center of the ongoing Particle v. Epic lawsuit, this Health Grid product has the highest adoption with 32 payers as customers, including many of the largest in the country (UnitedHealthcare, Humana, Centene and their subsidiaries, Elevance, Aetna, and more). It’s also the oldest Health Grid product, having been launched in 2018.

Provider-payer data exchange is one of the oldest interoperability infrastructures in the country, with ubiquitous digital eligibility and claims via clearinghouses. However, Epic Payer Platform (EPP) aims to go further:

Provider Collaboration

Enhance teamwork and efficiency with tools that facilitate secure data exchange and communication, task automation, and shared workflows among providers and payers, ensuring timely and coordinated member care.

Prior Authorization

Simplify the prior authorization process with integrated tools that automate requests, track approvals, and ensure compliance, reducing administrative burden and improving member access to care.

Real-Time Prescription Benefits

Provide members and providers with instant access to prescription benefit information, including coverage details, costs, and alternative options, ensuring informed decision-making and cost-effective medication management.

The roadmap for EPP is for customers only, but looking at a few payer announcements like this, this, or this, EPP targets many other workflows between payers and providers that have not been digitally enabled at a regional or national scale:

Clinical data exchange from provider to payer: Payers need clinical data from their provider partners for care management, HEDIS, and quality measures, in addition to other use cases. This is the core use case most people fixate on and the one that underpins the antitrust case. This is where EPP started, and it provides the most value to payers.

Claims exchange from payer to provider: Payers have a longitudinal picture of diagnoses, procedures, medications, care team members, and more by distilling down claims. Adding this back to the provider’s longitudinal picture of the patient fills in many missing gaps from data sourced from health information exchanges.

Care gaps exchange from payer to provider: Enable payers to share identified gaps in care and quality measures directly with providers at the point of care, allowing for proactive intervention and closure of these gaps during patient visits, ultimately improving quality scores and patient outcomes.

Real-time decision support: Deliver payer-specific clinical guidelines, formulary requirements, and care protocols directly into provider workflows, enabling immediate clinical decision-making that aligns with coverage policies and evidence-based practices while reducing denials and appeals.

Electronic prior authorizations: Streamline authorization processes through automated, real-time determination of authorization requirements, submission of clinical documentation, and status tracking, integrated directly within provider workflows to reduce administrative burden and treatment delays.

ADT notifications: Facilitate real-time sharing of Admission, Discharge, and Transfer events from providers to payers, enabling timely care management interventions, reduced readmissions, and better transitions of care coordination.

Scheduling notifications: Exchange appointment scheduling information, enabling payers to track appointment adherence, coordinate transportation services, and proactively engage members to reduce no-shows and improve care plan compliance.

Provider network and ratings: Share up-to-date provider network information, including specialties, locations, quality scores, and member satisfaction ratings, enabling more informed referral decisions and helping maintain accurate provider directories.

Coverage discovery: Automate the identification and verification of patient insurance coverage, including coordination of benefits and coverage changes, helping providers reduce claim denials and ensure appropriate billing while helping payers maintain accurate member rosters.

Even core clearinghouse functionality like eligibility and claims may one day be rolled into EPP, based on some comments by Epic’s CEO, Judy Faulkner, at the 2024 User’s Group Meeting.

These workflows are enabled by a vast array of different standards and exchange mechanisms, if even defined today, and there’s a tremendous cohort of vendors that solve different pieces. Simply put, Epic Payer Platform (EPP) aims to solve all these workflows between payers and providers on Epic.

Even with a solid starting customer base, it is not clear yet that EPP will succeed, as reviews are mixed. It is expensive, pricing out many mid-level and regional payers. There are many, many competitive companies ranging from novel startups to entrenched clearinghouses that provide analogous services to some of EPP’s workflows that resent and will resist this initiative. Payer-focused efforts by national networks like TEFCA also provide some similar functionality to workflows like clinical data exchange. And, of course, the use of consolidated market power to enter an adjacent market has a risk of anticompetitive behavior and potential antitrust issues, although it is no longer per se illegal.

Perhaps the greatest risk, though, is that Epic jeopardizes its relationship with its core customer base of providers by cozying up with payers. There are some indications that this is already occurring via the Blue Ribbon program. As reported by Healthcare IT Today, the Blue Ribbon program asks payers to enable a variety of features that empower and reduce abrasion for providers, such as:

Using Clinical Data for Risk & Quality

Using Clinical Data for Claims

ADT Notifications

Sharing Clinical Data Back

Electronic Authorizations

Coverage Finder

With these in place, payers gain broad access to clinical data across the Epic community. While the word is that providers are not happy giving this data away to their sworn rivals given the deep mistrust between insurers and doctors, I do wonder if they understand that that ship has already sailed. If TEFCA or other health information networks succeed in scaling the Operations use case, the cost of clinical data will plummet. Beyond that, clinical data is already being given, borrowed, and stolen via the crafty nuances of business associates’ contracts, secondary use backflips, and simple abuse of health information networks. These pathways are inherently incomplete, asymmetric and one way. So getting back value in terms of not just reciprocity (payers sharing data back to providers) but also improved workflow (Coverage Finder and Electronic Prior Authorizations) honestly is an incredible deal in the not-so-distant future,.

Imitation is the greatest form of flattery, though, and it appears Oracle Health is headed down the same path as EPP:

Oracle Health Clinical Data Exchange is the first step towards offering payers a comprehensive platform to enable instant claim evaluation and processing and improve clinical decision making.

One has to wonder if other major EHRs like MEDITECH and athenahealth will follow suit as well.

Aura

Aura started as the Health Grid product for diagnostics laboratories, as listed here:

Aura

Aura brings the promise of precision medicine within reach for the entire Epic community. With Aura, you can collaborate with specialty diagnostic labs in a fraction of the time necessary to configure traditional interfaces.

And here:

Specialty Diagnostics

Epic brings precision medicine to the point of care by giving providers the ability to place orders for genetic tests and receive discrete results via the Aura network, all within their workflow rather than just in a PDF. Companies that provide specialty diagnostic testing use Epic to receive orders from providers and send back discrete results via the Aura network.

There’s less public press and fanfare here, so I’ll tell you what - as I allude to above, I was bullishly optimistic this was Epic’s attempt to reorient and rebrand their product naming towards the next generation with some Gen-Z bait. However, the product began as Epic Orders and Results Anywhere (ORA) network and was productized into the catchier Aura around 2023, when we began to see the earliest announcements of customer collaborations. It now has five separate categories of diagnostic labs it serves (Cancer Screening, Genetic Testing, Pharmacogenetic Testing, Precision Oncology, and Prenatal Testing), with 11 customers (Baylor Genetics, Caris Life Sciences, ClonoSEQ, Exact Sciences, Foundation Medicine, GeneDx, Guardant, Invitae, Myriad Genetics, Natera, Tempus)

The workflow and connectivity are simpler than Payer Platform in that there are fewer exchange points, but the value proposition is clear:

Compendium Management: Simplify implementation with Epic health systems by allowing labs to maintain their catalog of orderable tests and discrete result components that can be deployed to providers easily through Epic “Turbocharger” packages

Interface Connectivity: Create a single point of entry for all incoming lab orders and egress for all outgoing results over the Care Everywhere network, rather than dozens or hundreds of point-to-point interfaces.

Supporting Documentation: Include important clinical information (like relevant diagnoses, progress notes, or prior pathology reports) alongside the order to the lab in order to improve technician and pathologist experience and reduce billing problems.

This may not seem like a lot of value, but when customers are reporting a drop from 6 months to 1.5 months (78% decrease) in the implementation time for new health system customers, you can start to understand the exact return on investment in terms of operational costs. The reviews from providers are also quite strong. Additionally, there are other potential provider-lab workflows that may be valuable for Aura to facilitate in the future to add more value, as well, such as the ability for providers/patients to see availability and schedule their collection appointment with the lab or facilitation of lab-payer interactions as Aura takes off in parallel to Epic Payer Platform.

This is a beachhead for Epic to sell to labs that built or purchased an LIS other than Beaker. The connection point between Aura and their LIS will be a point of friction in some regards - as new health systems are added on, there will likely be some work in the LIS to provision and deal with that. The customer relationship may allow Epic to eventually replace the legacy LIS over time (or at least have all major labs as customers). Epic also announced a planned Blood Bank module, which increases its appeal as an all-encompassing LIS in this push.

Aura supposedly has a volume-based pricing component, which works well for labs doing novel, expensive tests, but likely needs adaptation if they ever want to expand into the largest general purpose labs that perform more routine testing with thinner margins.

Interestingly, the Aura program is morphing and expanding as it adds sub-categories for medical devices:

Medical Device Manufacturers

Orders for medical devices, such as cardiac monitors, are sent to device manufacturers over the Aura network—no need for point-to-point interfaces. Readings from the devices flow directly into Epic, giving providers a real-time view of patients’ vital signs.

The first medical device customer is iRhythm Zio, a wearable, single-use cardiac monitoring device that helps clinicians diagnose arrhythmias. At first, I was a bit confused as to why they lumped it into Aura, but this PDF shows that the workflow and value proposition are very similar: receiving orders from Epic providers and sending end-of-wear results back to them. They plan to expand to the continuous glucose monitoring use case (like Dexcom and Freestyle Libre) as the next category of medical devices, threatening a whole host of remote patient monitoring integration solutions.

Lastly, Epic indicated at their 2024 Users’ Group Meeting that they intend to further extend Aura to surgical implant manufacturers:

Surgical Implant Manufacturers

Healthcare providers and surgical implant manufacturers stay in sync about the timing and materials for upcoming surgeries, helping coordinate resources such as implants, trays, clinicians, and support staff. (Future)

Details about this particular flavor of Aura are sparse, and no customers have been announced. However, all Health Grid products have parallel existing point-to-point interfaces, so we can look at those to determine potential details and customers. The Outgoing Inventory Depletion interface seems to correspond most closely with the description above. Similarly, manufacturers known for pacemaker implants, like Medtronic and Boston Scientific, are likely high on the target list. Epic could possibly deepen integration points with equivalents to the Incoming Materials Management or Incoming Surgical Resource Data interfaces to allow manufacturers to synchronize exact inventory details.

For the new sub-categories, one nuance worth tracking is that while payers and laboratories are HIPAA-covered entities, organizations in the medical device and surgical implant manufacturers subcategories are more strictly business associates, which means data flow is slightly more restricted. I’m curious how Epic and its customers manage this properly.

The Things Epic Does Not Do

Looking at the medical device and surgical implant varieties of Aura, our hypothesis seems to break down. If Health Grid products aim to replace existing networks between providers and external organizations as a beachhead to selling new systems of record, what is the network Epic aims to replace here?

The closest related network seems to be GHX (Global Healthcare Exchange), which operates the largest healthcare supply chain network connecting providers and manufacturers. GHX was founded in 2000 by major medical device manufacturers and has since become the de facto standard for healthcare supply chain transactions. They process over 85% of medical-surgical supply transactions in the US healthcare market, connecting thousands of suppliers with provider organizations through their electronic trading platform.

GHX provides several key services that overlap with Epic's apparent ambitions for surgical implant manufacturers in Aura. Their platform handles Electronic Data Interchange (EDI) for purchase orders, acknowledgments, and invoicing, while also managing price synchronization and contract management between parties. They offer inventory visibility and demand planning capabilities, along with specialized solutions for operating room supply chain optimization and implant case scheduling and resource coordination.

By extending Aura to surgical implant manufacturers, Epic could potentially disintermediate GHX's role in coordinating implant cases and associated supply chain transactions between manufacturers and Epic customers. This would mirror their strategy with other Health Grid products - creating a direct, Epic-managed connection that replaces existing networks and intermediaries. However, GHX's entrenched position and broader supply chain capabilities beyond just implants make them a formidable incumbent in this space.

However, the system of record GHX typically integrates with is an Enterprise Resource Planning (ERP) system. Epic today does not make an ERP.

While Epic has continued over the years to broaden the aperture of its ambition and build modules for seemingly every department, role, and function in a provider organization, there are software types they have explicitly stayed away from and coexisted peacefully with. Historically, these were:

Document Management System (DMS): Enterprise-wide document repositories that manage the lifecycle of documents from scanning and indexing to storage and retrieval. While Epic has basic document capabilities, they've left comprehensive document management to specialists like OnBase. DMSs require expertise in areas like OCR, retention policies, and non-clinical document types that aren't core to Epic's mission.

Picture Archiving and Communication System (PACS): These systems manage the storage, distribution, and visualization of medical images. While Epic's Radiant module handles ordering and reporting, they've partnered with PACS vendors like Sectra and Agfa rather than competing. This makes sense, given the specialized hardware requirements, complex visualization needs, and constant evolution of imaging standards.

Enterprise Resource Planning (ERP): ERPs manage core business processes like finance, supply chain, and HR. While Epic touches these areas through revenue cycle management, they've left comprehensive ERP functionality to vendors like Oracle and SAP. Building a competitive ERP would require expertise in non-clinical processes and significant development resources that could be better spent on clinical workflows.

However, the walls between these traditional domains have begun to show cracks. Epic's recent launch of Gallery, their first true document management system, sent tremors through the DMS landscape. Whispers of a potential PACS offering have circulated through industry channels. Like a medieval castle's defenses being tested by new weaponry, these once-impregnable boundaries between Epic and adjacent systems are facing unprecedented pressure.The surgical implant manufacturer sub-denomination of Aura certainly feels like this is an opening gambit for Epic to also take the plunge into the ERP space. As Oracle has purchased and revamped Cerner, its leaders have pushed the unity of their EHR and ERP as a differentiator. So Epic could be considering launching an offering there in reply, using this foray with Aura to build up some muscle. They already have several other building blocks in place across supply chain and finance: Willow Inventory manages medication supplies, OpTime handles surgical supplies, and Phoenix tracks devices and equipment.

Their strategy might involve building on these existing tools while using Aura relationships with surgical suppliers as a testing ground before gradually expanding into core ERP functions like HR and procurement. However, significant challenges remain - ERP requires expertise outside healthcare, established vendors have decades of experience, and health systems may resist further Epic consolidation. Rather than launching a full ERP immediately, Epic might start with a focused "Healthcare Operations Platform," expanding based on market demand and their success with surgical supply chain management through Aura.

Telehealth Anywhere

Not gonna lie - Telehealth Anywhere feels a bit out of place in Health Grid. It doesn’t represent a bold foray into a non-provider organization. However, pure telehealth organizations are non-traditional providers for Epic, breaking many assumptions around location and time zones. Telehealth also represents a novel, disruptive threat to its core customer base.

Telehealth Anywhere seems to have emerged as an "adjacent possible" network feature based off of existing provider usage. It is also a way for Epic to control a nascent threat (telehealth) by allowing Epic customers to offer seamless, white-labeled telehealth services to other Epic customers. With Telehealth Anywhere, Keycare’s provider customers can offer virtual urgent care, primary care, and behavioral health without building out those functions themselves. Backed by Care Everywhere exchange, event notification upon appointment completion, and slick MyChart integration, it’s far deeper than most competing third-party telehealth companies can go.

It is clearly aimed at national telehealth providers, as well as existing Epic customers who want to resell their telehealth capacity:

National Telehealth Providers

Offer on-demand or scheduled video visits or message-based e-visits. With Telehealth Anywhere, you can offer visits from partner organizations, including local organizations using Epic or national telehealth providers.

However, today, only one organization (KeyCare) operates as an ambulatory suite customer specializing in virtual visits through the THA network. Most health systems using THA/KeyCare already maintain robust telehealth capabilities within their Epic instances for scheduled appointments. THA complements these existing capabilities, allowing organizations to extend their virtual care offerings without building out additional infrastructure.

The current limited adoption of organizations offering services through THA likely stems from several factors: cost (Epic instances are not cheap), addressable market (there are only so many Epic customers, many of whom already have telehealth solutions), and configuration difficulty (perhaps the setup, which I imagine includes Book Anywhere, is challenging). Additionally, Keycare also had the benefit of starting from a fresh slate when choosing Epic, but major telehealth providers like Amwell and Teladoc have existing EHRs from which they’d have to migrate. There are also international considerations - some of those major national telehealth companies already operate in countries that Epic has not entered yet, precluding them from migrating.

Rather than a king-making move, THA represents an organic extension of Epic's capabilities, developed in partnership with early adopters like KeyCare who saw and seized the opportunity to build upon this network feature.

Discovery

Discovery is not yet formally out in the wild per the Showroom page, but there is some detail about it here though:

Clinical Trials

Discovery, Epic’s life sciences platform, builds on the research toolset. It helps clinical trials reach a larger and more representative population, reduces friction at study start-up and in sharing trial-specific evidence with sponsors, and speeds up access to cutting-edge care for patients who qualify for investigational treatments.

I wonder if they’re just waiting to get a critical mass of customers (perhaps even their first) to list. They likely want to conclude their first clinical trial or have a specific case study to point to before expanding the section. Regardless, life sciences companies should be already aware / paying attention.

The value proposition is clear:

Study Creation: Allowing life sciences companies to quickly set up clinical trials by doing the Epic build needed and then distributing that build to all of the sites (the "Turbocharger" model we see in use with Aura already)

Site Identification: Providing life sciences companies with a tool to identify relevant institutions and patient populations for their studies based on specific criteria using Cosmos, streamlining the process of finding suitable research sites and participants.

Study Activation: Making it easier for providers to find clinical trial opportunities for patients at the point of care through clinical decision support or other activities that can surface available trials

Study Management: Enabling life sciences companies to track their clinical trials across multiple Epic sites rather than going through a contract research organization (CRO).

In particular, for point 4, just like the Payer Platform eats into the business of clearinghouses, this potentially eats into the business of organizations that provide similar de-identified cohort services across EHRs, like traditional Datavant for life sciences. It could also eat into the somewhat messy business of organizations that today use secondary use to provide data sourced over health information networks to clinical trials and life science companies, like Pluto Health. Following the core systems of record theory, Epic’s ultimate ambition may be to offer an Electronic Data Capture (EDC) and clinical trial management system (CTMS) and compete with the likes of Medidata and Veeva.

The Future of Health Grid

If the aspiration powering Health Grid products is to replace existing networks and move into all the non-provider organizations that operate in healthcare, it sparks fun prognostication about what other groups might be next, especially where Epic already has a related system of record offering.

For instance, Epic already has a fairly robust outpatient pharmacy information system offering in Willow Ambulatory. While Surescripts is a well-established titan in terms of baseline e-prescriptions and medication history, there are still many provider-pharmacy interactions that are underserved today:

Fill status updates: While pharmacies can send basic dispense notifications, there's no standardized way to communicate partial fills, substitutions, or patient consultation outcomes back to providers. A Health Grid product could enable real-time bidirectional communication about fill status, patient education, and adherence issues.

Real-time pharmacy inventory status: Current systems don't effectively share stock levels, leading to prescription rewrites when medications are unavailable. A Health Grid solution could enable providers to see real-time inventory across pharmacy networks before prescribing.

Direct scheduling for pharmacy services: As pharmacies expand into clinical services (vaccinations, testing, counseling), there's no integrated scheduling system. A Health Grid product could extend Epic's scheduling capabilities to pharmacy services.

Pharmacy to pharmacy transfers: Current transfer processes are manual and phone-based. A Health Grid product could digitize and automate prescription transfers while maintaining required documentation.

Public health is another area where Health Grid could naturally expand. Most interactions between providers and public health agencies still rely on a patchwork of reporting systems, registries, and manual processes. While Epic users can report to some public health systems through their existing EHR and TEFCA has aspirations of facilitating some public health use cases, there's no unified network for all public health data exchange. Public health agencies areSimilarly, a new Health Grid product could standardize reporting for notifiable conditions, immunization registries, syndromic surveillance, and vital statistics while enabling bidirectional communication for outbreak alerts, contact tracing, and population health initiatives. It might also allow Epic to launch and displace incumbent public health systems of record.

Health Grid Adjacent

While Health Grid represents Epic's flagship strategy for expanding into non-provider organizations, it's not their only approach. Epic has developed several adjacent offerings that, while not full Health Grid products, similarly extend their reach beyond traditional provider boundaries. These solutions showcase Epic's layered approach to market expansion - from lightweight connectivity points to full software implementations.

Cosmos

If other Health Grid products represent Epic's expansion beyond providers through network effects products, Cosmos represents their parallel expansion through de-identified data network effects. Even though Cosmos isn’t listed as a Health Grid offering, it is perhaps a wayward step-sibling, as is amply visible by its presence in the Health Grid products page:

Cosmos began as a collaborative research dataset but has evolved into a strategic asset that both fortifies Epic's provider relationships and creates new opportunities for expansion. At its core, Cosmos is a massive clinical dataset created by pooling information from Epic health systems - currently encompassing 294 million patients, 1,633 hospitals, and 37.9K clinics. What makes Cosmos unique isn't just its scale but its comprehensive nature. Unlike claims databases or traditional research datasets that capture narrow slices of patient care, Cosmos includes the full longitudinal patient record shared via Care Everywhere, from mundane outpatient visits to complex inpatient stays.

The value proposition of Cosmos has four distinct layers:

Provider Value: At the point of care, Cosmos powers tools that help clinicians make decisions for the patient in front of them. Features like "Best Care Choices" show how similar patients responded to different treatments, while "Look-Alikes" helps physicians handling rare cases find and collaborate with peers who've seen similar presentations. This creates immediate practical value that encourages health systems to participate.

Population Health Value: For clinicians and health systems, Cosmos serves as a powerful epidemiological tool that enables real-time population health monitoring and benchmarking. Providers can quickly compare local trends against national patterns to identify anomalies, validate concerns, and make data-driven decisions about resource allocation and clinical workflows. This capability proved particularly valuable during COVID-19, but extends to tracking everything from seasonal disease patterns to unexpected clusters of conditions. As demonstrated by emergency medicine departments using Cosmos to analyze neonatal jaundice rates, this real-world benchmarking helps distinguish between local operational issues and broader epidemiological trends.

Research Value: For academic institutions and researchers, Cosmos offers a massive, standardized dataset that enables large-scale studies of real-world clinical practice. The rapid publication of Cosmos-based research in major journals during COVID demonstrated its power for time-sensitive analysis. Epic's "dual-team" research process and public EpicResearch.org website position them as facilitators of clinical discovery rather than just software vendors.

Strategic Value: Perhaps most importantly, Cosmos creates network effects that strengthen Epic's position. As more organizations contribute data, the insights become more valuable, making Epic essential infrastructure for both clinical care and research. It's no coincidence that Epic prominently features academic medical centers like Duke, Stanford, and UF Health in their Cosmos marketing - their participation validates the platform for others.

Epic emphasizes that Cosmos goes beyond being just a data warehouse - it's representative of the U.S. population across age, race, ethnicity, coverage status, and social vulnerability factors. This helps address historical biases in medical research. The data also flows through rigorous de-identification and governance processes overseen by a 15-member elected council.

The governance aspect is particularly notable. Epic has structured Cosmos with careful controls around data usage - it cannot be sold, line-level data never leaves the secure portal, and it cannot be used for advertising or market comparisons. Violations result in permanent loss of access. This positions Cosmos as a trusted research utility rather than a commercial data product.

Looking ahead, Epic continues expanding Cosmos' capabilities. They've moved from basic retrospective analysis to increasingly sophisticated tools that can identify drug side effects before human researchers spot the patterns. The platform's ability to bridge between research insights and clinical practice could make it indispensable infrastructure for evidence-based medicine.

However, this expansion hasn't been without controversy. As seen in the ongoing Particle lawsuit regarding payer access to clinical data, Epic's increasing control over healthcare data flows raises antitrust concerns. Their careful governance approach with Cosmos may be as much about pre-empting regulatory scrutiny as protecting patient privacy.

Regardless, the platform’s potential is not limited to just providers. As mentioned earlier, Cosmos’ massive clinical dataset also powers Discovery, Epic's entry into life sciences research. Where traditional clinical trials struggle with patient identification and site selection, Discovery leverages Cosmos data to help match studies with relevant patient populations and research sites. By integrating trial management directly into clinical workflows and surfacing opportunities at the point of care, Discovery aims to streamline what has historically been a fragmented, inefficient process. Cosmos exemplifies Epic's sophisticated approach to market expansion: create immediate practical value while building network effects that increase switching costs and create opportunities for future growth

Payer Gateway

Payer Gateway is Epic's lighter-weight service for payers that enables them to receive clinical data from Epic healthcare organizations. It's a standardized connection point that lets payers request and automatically receive clinical summaries from Epic providers, either as visits happen or on demand. The key is that it uses standard protocols (IHE XCPD/XCA and Direct) and delivers data in a standard format (HL7 CDA XML documents).

While some payers want the full capabilities and strategic partnership that comes with Payer Platform, others just need a reliable way to receive clinical data from Epic providers. Payer Gateway meets this simpler need using industry standards, similar to how Chart Gateway provides standardized connectivity for life insurance companies' more focused use case.

Think of the difference between Payer Platform and Payer Gateway like the difference between buying a house versus getting a mailbox - Payer Platform is comprehensive software that payers purchase and implement to enable deep bidirectional data exchange and workflow integration with Epic providers. In contrast, Payer Gateway is simply a standardized way to receive clinical data from Epic organizations without having to implement Epic's software.

As nationwide networks like Carequality or TEFCA roll out the Operations use case for payers, we can expect this option to be deprecated and folded into that pattern as redundant.

Chart Gateway

Chart Gateway is Epic's service that streamlines how life insurance companies get medical records from Epic healthcare organizations. Instead of the traditional approach where insurers have to fax or mail record requests to each hospital individually, Chart Gateway provides a single digital channel. Insurance companies can submit record requests electronically, and Epic healthcare organizations can process and deliver those records through their existing Epic workflows.

Chart Gateway differs from Health Grid in that it’s a connectivity point and not standalone software sold to life insurers. Epic could hypothetically create a Health Grid product that packages up Chart Gateway connectivity and offers more value to life insurers with a simpler experience, but perhaps the interactions between these entities and providers isn’t complicated enough to warrant that investment.

As a connectivity point for the exchange of clinical data, it does have some cognitive, functional, and competitive overlap with nationwide health information networks like Carequality and TEFCA. These don’t serve the life insurance use case today, but could easily on the technical front and many aspire for them to. If that comes to fruition, demand for this product could change.

EpicCare Link

EpicCare Link is a web-based portal product that lets Epic healthcare organizations offer non-Epic providers a way to interact with them. Think of it as a lightweight version of Epic - doctors' offices, specialists, and other external providers can use it as a provider portal to view patient records, place orders, schedule appointments, and exchange messages with Epic hospitals and clinics.

The key thing to understand is that it bridges the gap between Epic and non-Epic healthcare providers. For example, if you're a small primary care practice that refers patients to a large Epic hospital system, EpicCare Link lets you see your patients' hospital records, make referrals, and coordinate care without having to buy and implement the full Epic system yourself.

In that way, it serves as an alternative to various nationwide networks - rather than send a referral over DirectTrust, a provider could use EpicCare Link to place it. Likewise, rather than pull data via Carequality, a provider may log in to a patient’s chart.

While it’s not part of the Health Grid categories, it has distinct similarities in the way that it extends Epic beyond its installed base, pushing their reach beyond their direct customers and potentially making these external providers more likely to choose Epic for future upgrades, since they're already familiar with Epic's interface and workflows.

Epic has variations for other users and use cases:

Tapestry Link: A variant of EpicCare Link for health plan customers to offer their affiliated providers a portal to assess eligibility, submit claims, and check prior authorizations.

Healthy Planet Link: An extension of Epic's population health management tools (Healthy Planet) for non-Epic users, allowing them to participate in care management and quality improvement initiatives through EpicCare Link.

The Other Stuff

Vendor Services, Showroom, and Health Grid are the most intriguing and useful programs for external vendors to understand in the Epic suite, but there are others. For the sake of being a comprehensive and complete resource, we’ll discuss these briefly below:

Supply Shop

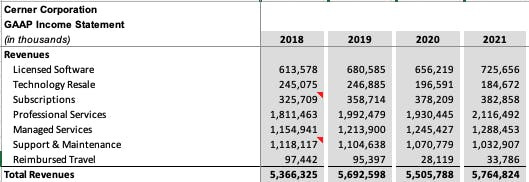

One fascinating fact about Epic is that despite being the largest EHR in the country, they are not the highest revenue or most profitable EHR in the country. As reported by Ashley Capoot in CNBC:

Epic generated revenue last year of $4.9 billion. Cerner, Epic's top rival in the electronic medical records market, went public in 1986 and was acquired by Oracle in 2022 for over $28 billion. According to Oracle's financials, Cerner contributed $5.9 billion in revenue in fiscal 2023.

Health Tech Nerds (HTN) had a vibrant discussion about this discrepancy in the Slack community, noting that (in addition to a larger international footprint) over 50% of Cerner’s revenue is derived from services:

So from a numbers perspective, it seems Epic has room to grow there and might be expanding this capability to better serve their customers in various ways with in-house services offerings.

As an aside, conversations like this one, in addition to hiring opportunities and in-depth operator discussion, make HTN a must-join community for anyone building in digital health. I’m consistently shocked at how many people still haven’t heard of it or joined.

All of these programs in Showroom are Epic’s own professional services for health system customers, so they’re not directly pertinent to external organizations and vendors.

Level Up: A free service where Epic works directly with organizations to optimize their system. The focus is on implementing important features and enhancing system performance at no additional cost to the client, helping organizations maximize their Epic investment.

Extra Help: A flexible staffing solution where organizations can get temporary assistance from experienced Epic staff members who have additional capacity. It's designed for short-term needs and offers "fractional" help, meaning they can get part-time or project-based support rather than full-time staff.

Boost: The oldest and most well-known professional services arrangement by Epic. This service focuses on providing staff augmentation specifically for project management (PM) and technical roles. It's designed to supplement existing teams with additional expertise in these specific areas when organizations need extra capacity or specialized skills.

EpicCorps: Leadership staff augmentation. Similar to Boost, but providing temporary leadership personnel to help guide and manage teams or projects, rather than technical and PM roles.

Emeritus: A unique service that leverages the expertise of former health system leaders and clinicians. These experienced professionals can support strategic initiatives, fill temporary leadership positions, or mentor new leaders.

BID Services: This service specifically focuses on advanced analytics, offering expertise through Cogito (Epic's analytics platform). It's designed to help organizations better understand and utilize their data for decision-making and improvements.

Green Team: A specialized service focused on medical billing (the “green” coming from greenbacks). It provides temporary assistance from billing specialists, helping organizations optimize operations or hit certain metrics.

Professional services are a distinctly different skill set and muscle with a lower margin than software sales and delivery. For years, Epic was happy to allow external consulting firms like Nordic and Bluetree to help their customers’ staffing needs. However, with all the Supply Shop initiatives, Epic seems intent on filling this gap.

Revcyclers

Listed under Products & Services in Showroom, Revcyclers (a paronym of “recycler,” most likely) is the only category that lists external professional service partners, although the word on the street is that several general purpose consulting groups do have informal agreements in place.

The two today are:

Ensemble Health Partners: Primarily specializing in revenue cycle management (RCM) and financial operations for healthcare organizations. Founded in 2014, they’ve grown tremendously in the past decade, listing over 10,000 employees today.

Impact Advisors: Typically serves in an advisory and implementation capacity, helping organizations plan and execute technology initiatives, but has a specific financial performance offering. Founded in 2007 and with a headcount of around 1000, they’re probably more project-based.

Per the announcement by Ensemble and Impact’s description, this partnership provides:

Access to Epic-led training content

Recommendations on best practices for using Epic software

Insights into Epic’s product development roadmap and new features

Broad access to Epic’s billing, analytics, and reporting tools

While there aren't many public details about the extent of this partnership, it likely centers around providing Guesthouse accounts to Ensemble and Impact. Guesthouse is an Epic tool that allows people, particularly offshore workers, to use Epic's systems without accessing Epic's intellectual property.

Cornerstone Partners

A relatively forgotten category in Showroom, these are the technology partners that Epic uses themselves.

Microsoft is a key partner for Epic. Epic staff use Windows PCs, Outlook, Teams, Sharepoint, and the rest of the Microsoft 365 Business suite. They also use Microsoft Azure for hosting and AI.

Intersystems underpins Epic with their Caché/IRIS data platform as the primary database technology since Epic's early days.

Suffice to say, there aren’t likely to be many additions or changes to Cornerstone Partners, although I’m sure there are thousands of companies that would be champing at the bit to do so.

Conclusion: The Expanding Epic Universe

As we conclude our exploration of Epic's complex ecosystem, several fundamental patterns emerge that illuminate both Epic's strategy and the future landscape for healthcare technology vendors.

Epic's approach to external partnerships has evolved dramatically, moving from historical wariness to a more nuanced strategy of controlled collaboration. This evolution isn't random but follows clear strategic principles that balance Epic's core interests with market demands:

First, Epic maintains tight control over its intellectual property while systematically commoditizing complementary products and services. The Toolbox program exemplifies this approach – standardizing integration patterns for complementary products like bedside TVs and payment devices while maintaining Epic's core EHR dominance. This allows Epic to enhance its platform's value while preventing any single complementary vendor from gaining too much leverage.

Second, Epic's expansion beyond traditional provider organizations through Health Grid represents a sophisticated market entry strategy. Rather than immediately attempting to replace existing systems of record, Epic is establishing beachheads through focused solutions to specific pain points. Whether it's streamlining prior authorization through Payer Platform or simplifying lab integration through Aura, these initial connections could eventually evolve into deeper relationships and potentially full system replacements.

Third, Epic's developer programs reveal a careful balancing act between openness and control. While Epic has made strides in transparency through Open Epic and standardization through FHIR, the Vendor Services program's evolution suggests a preference for controlled, strategic partnerships over broad ecosystem enablement. This approach allows Epic to maintain quality control and strategic alignment while still supporting necessary integrations.

The healthcare technology landscape is thus entering a new phase where success requires understanding and navigating Epic's expanding influence. For vendors, this means:

Understanding your position in Epic's strategic framework is crucial. Are you a complement they might want to commoditize, a potential substitute they might view as a threat, or an adjacent service they might want to absorb? This positioning should inform your integration and partnership strategy.

Investing in relationship building at multiple levels – with Epic directly through their various programs, with their provider customers who can advocate for your solution, and with other vendors in the ecosystem who face similar challenges. Success increasingly requires orchestrating all these relationships effectively.

Maintaining strategic flexibility as Epic's programs and priorities evolve. The deprecation of App Orchard and evolution of Vendor Services demonstrates how quickly the ground can shift. Vendors need to be prepared to adapt their integration and go-to-market strategies as Epic's approach evolves.

Looking ahead, several key questions will shape the ecosystem's evolution:

Will Epic's Health Grid strategy successfully expand their influence into adjacent markets, or will regulatory scrutiny and market resistance limit this expansion? The ongoing Particle lawsuit and potential antitrust concerns could significantly impact Epic's ability to leverage its provider market position into other segments.

How will Epic balance the competing demands for openness and control in their developer programs? The tension between enabling necessary integrations while maintaining strategic control over their platform will likely continue to shape program evolution, especially in light of information blocking regulations.

What impact will emerging technologies, particularly AI, have on Epic's strategy and ecosystem? The Workshop program's focus on ambient voice recognition suggests Epic recognizes the need for strategic partnerships around transformative technologies.

We’ll examine these themes in the context of risks to Epic in the next article in this series. Until then, thanks for reading.

A big thanks to Colin Keeler, Dave Grosser, Eric Valentine, Brian Bray, Jonathan Perlin, Thomas Kasl, Joe Galea, Melissa Schneider, Shivi Singh, Vikas Chowdhry, Kahaan Shah, Josh Anderson, Nick Nunez, and Madeline Sall for all thoughts, insights, and edits.

This article on Epic is for informational purposes only. The author has no official relationship with or endorsement from Epic Systems Corporation. All trademarks, service marks, and trade names referenced in this presentation are the property of their respective owners. The information provided here is based on publicly available resources and does not represent official guidance from Epic Systems Corporation. Please refer to their website and contact their representatives for the most up-to-date guidance.

Epic has already internally announced they are releasing an ERP

Great read!