An Epic Saga: The Origin Story

How exactly the Midwestern monolith has become healthcare's operating system

This article kicks off a series about how Epic grew to their current size, how to connect to them, and the threats to Epic long term. At HTD Health, we provide the strategy and execution for organizations to create, maintain, and thrive in a competitive health technology landscape coexisting alongside Epic. Whether rearchitecting your existing platform or launching net new products, our expertise in deep EHR integration, software-as-a-medical-device, payer workflows, and more help healthcare organizations navigate the complex world of health IT. Reach out to learn more:

The behemoth. The beast. The colossus of clout. To some, it’s the evil empire, a monopoly, a monstrosity of design, a blight upon those of the Hippocratic Oath. To others, it’s best of the worst, a piece of technology that actually just works. We speak, of course, of Epic Systems, the dominant yet inscrutable healthcare software juggernaut of our time.

This midwestern tech titan has chosen the path less trodden at every turn:

Remaining steadfastly rooted in the heartland while coastal elites dominate tech

Cultivating talent in-house, promoting solely from within

Crafting modern software with the digital equivalent of stone tools

Building their empire brick by brick, shunning the siren song of acquisitions

In a world of microservices and cloud-native applications, Epic stands as a monolithic monument to a bygone era of software development. Yet, like the Colossus of Rhodes, it bestrides the narrow healthcare world, its feet planted firmly in thousands of hospitals and clinics across the globe.

Epic is truly sprawling and multifaceted, with unbridled successes on one hand and abject derelictions of duty on the other. The programs and policies, the standards and formats, the relationships and roles all blend and overlap. And upon thorough examination, it becomes apparent that while Epic is dominant, it also has its Achilles Heel, clear weaknesses even as it reaches new heights of success.

As so many applications look to coexist with this company and deep questions are raised about how it uses this power, it’s worth first considering the factors leading to its ascent. So let's break down things piece by piece.

Today, we'll talk a little about who Epic is and how they got to where they are to ground us foundationally.

We follow it up to talk about the ideal state that developers and other groups hope for when dealing with Epic or any EHR, dig into the myriad ways one can interact with Epic, and compare it with the ideal we outlined.

Finally, we'll wrap things up by talking about how that delta exposes true threats to Epic's dominance.

So let's go on this odyssey together into a world of nuance. We are not here to chastise Epic. If you believe them to be abject evil, I'm here to show you they are something better. Conversely, if you believe they can do no wrong, I'm here to show you how much they can improve. We sit in a moment of perfect incentives to allow builders to build, providers to thrive, and patients to live healthy lives.

The Regulatory Capture Myth

In discussions about Epic's meteoric rise in the healthcare IT industry, a prevailing narrative often emerges: the theory of regulatory capture, a process by which regulatory agencies may be dominated by the interests they regulate and not by the public interest. This perspective, popularized by Bill Gurley, suggests that Epic, under the leadership of CEO Judy Faulkner, skillfully manipulated HITECH and Meaningful Use regulations to not only ensure widespread adoption of Electronic Health Records (EHRs), but to uniquely favor Epic's products. It's a compelling story, one that fits neatly into a convenient Manichean narrative of a savvy, eccentric business leader outmaneuvering the system for corporate gain.

Does everyone know who Epic is? It’s hard to know, because they’re not public. It’s a very large private company in Wisconsin that is the largest player in EHR software, medical records. And this is their CEO, Judith Faulkner. Now, in, get the year right, 2009, Obama put her on his Health IT Council. She was the only corporate representative. Should not surprise you that she’s a major donor to Obama.

…

So the the ONC decided the threshold of features you would need for your software to comply with this mandate. And I’m assuming they kind of took Epic’s feature set and plowed it into this spreadsheet. But they got the Department of Justice to enforce people that didn’t have the feature set that were getting the payments.

While appealing in its simplicity as an easy mental model, this theory fails to capture the full complexity of Epic's success and the broader healthcare IT landscape. The proof is available to those who want it:

Contrary to the claim, Epic was not the only EHR present in these committees. Cerner had representation in the Health IT Standards Committee

Furthermore, the Health IT Standards Committee was the committee responsible for making specific standards and criteria recommendations, not the Health IT Policy Committee Judy or anyone from Epic was on.

Far from a shadowy backroom deal, all aspects of the Health IT Policy Committee are subject to the Federal Advisory Committee Act, which means they were conducted in the public and are still available today.

Artifacts from the time period, such as this excellent blog by John D. Halamka, MD of the Mayo Clinic, show that the policy groups all tie back to broad industry coalitions, such as the National eHealth Collaborative.

All this to say - Bill Gurley’s self-admitted assumptions are at best mediocre analysis and in truth, unmitigated cope. The idea of incentivizing EHR adoption didn't require manipulation; it was already in motion, derived from President Bush's 10-year health information technology plan introduced in 2004.

It’s not just the inaccuracy and laziness that causes this perspective to consistently grind my gears. It also presents a false dichotomy between innovation and regulation, ignoring the fact that regulations often create new problems to be solved, spawning entirely new industries in their wake. Like fintech after Dodd-Frank, technological regulation is a tradeoff that opens up adjacent opportunities for innovation.

In healthcare IT, Meaningful Use created a fertile ground for interoperability start-ups with the cultivation of FHIR capabilities and virtual care companies via ubiquitous e-prescribing. Even the Particle v. Epic lawsuit is a downstream function of regulation - without widespread adoption of the C-CDA via HITECH, it’s hard to imagine nationwide health information networks existing to the same extent they do today.

The myopic focus on regulatory capture is infinitely frustrating not only because it misses the opportunities regulation presents and has “the refs are always on the Kansas City Chiefs side” energy, but also because it eschews basic analysis of the true drivers of Epic's success. As noted in the excellent (and also unbelievably long) HIStory by Vince Ciotti, at the time of Meaningful Use implementation, Epic was not the market leader, trailing behind competitors like McKesson, Cerner, and Siemens. So while it’s easy to imagine regulatory manipulation, Epic's rise can be more accurately attributed to a combination of smart strategy and excellent execution to capitalize on the unprecedented industry tailwinds of Meaningful Use. Central to this success is another concept widely recognized in tech and venture capital circles: compounding network effects.

Epic's Integrated Approach

From its inception, Epic has exemplified an approach centered on creating an integrated system. In this model, all users within an enterprise contribute to the same database, seamlessly building a shared patient record. This method not only solved immediate healthcare IT challenges but also created a self-reinforcing ecosystem that became increasingly valuable as it grew.

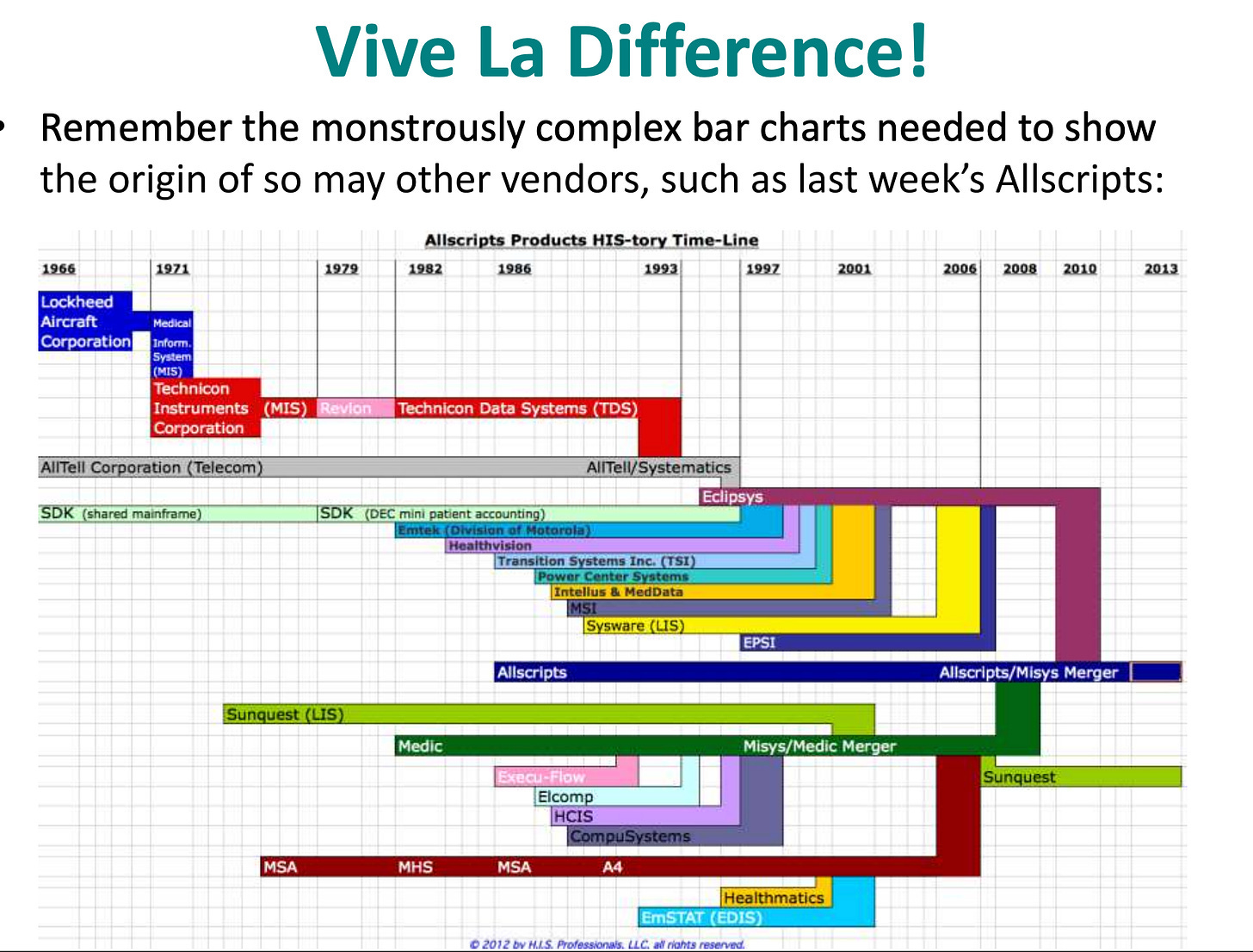

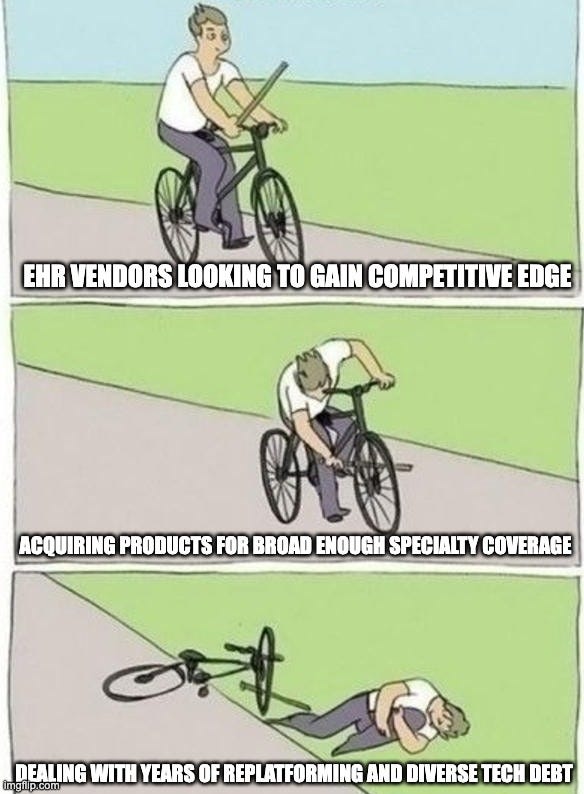

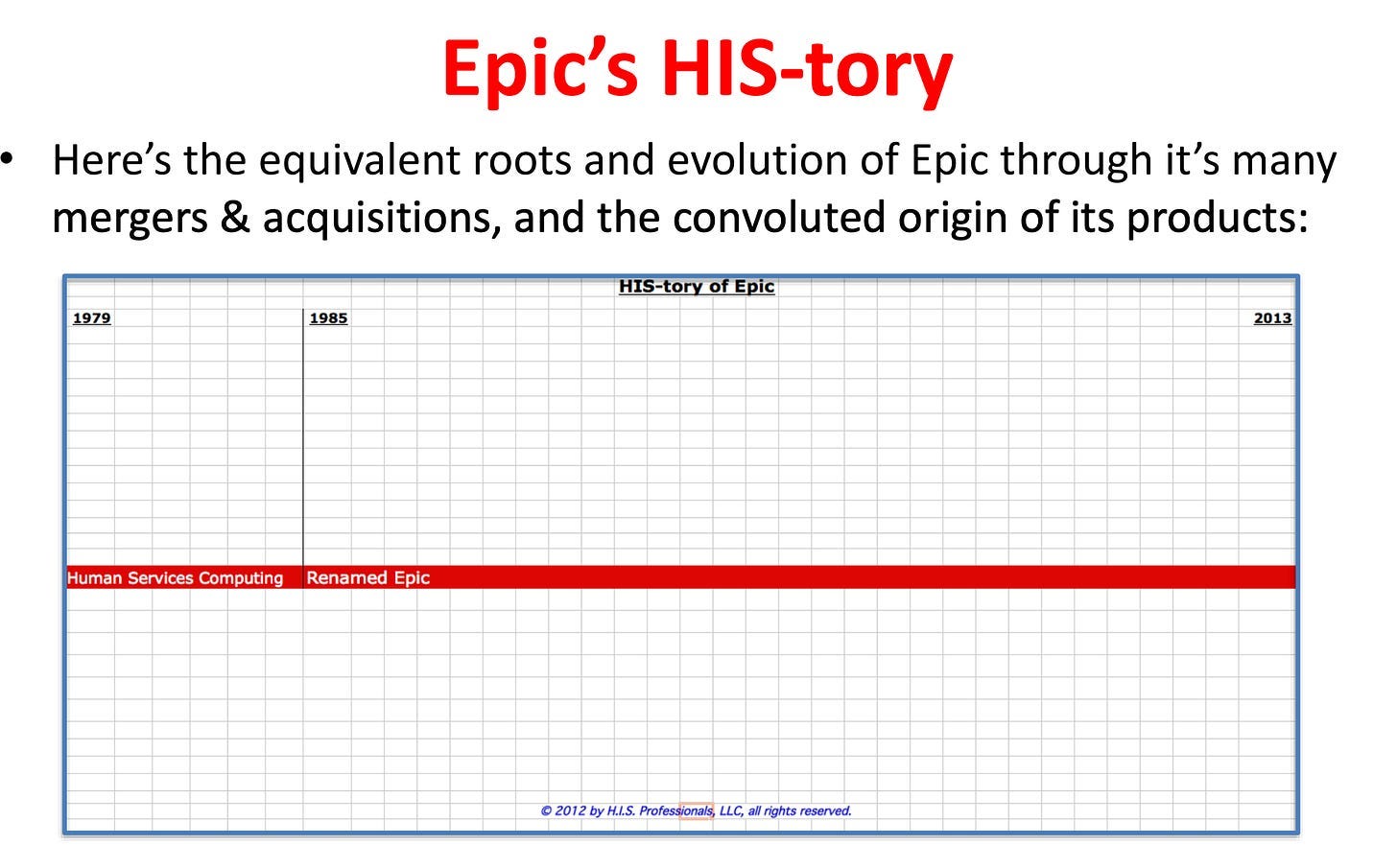

While a simple concept, a health system is an incredibly diverse set of actors and stakeholders. While spinning up an outpatient EHR is a large enough task unto itself, uniting the fiefdoms of different clinical, administrative, and financial departments under one vendor banner requires creating a lot of disparate software. Competing with products specialized in each of those unique clinical verticals is challenging, so most companies want to short-circuit the goal of providing the full range of software needed through mergers and acquisitions. Take, for example, Allscripts’ history:

While this spree of acquisition does in theory accomplish the one goal of owning a broad enough array of software to unite a health system under a single vendor, it makes the other goal unattainable - truly integrated software cannot be bolted together. The retrofitting and rewriting of these disparate software to achieve the seamlessly orchestrated coordination across roles and sharing of foundational data concepts represents a tremendous opportunity cost - any EHR that has to undertake that process ends up falling behind on the core features it needs to build or maintain to stay competitive.

Although some other EHRs such as Meditech or eClinicalWorks showed some resolve in terms of generally building instead of buying, Epic is the organization that remained most steadfastly wed to that vision while still managing to update to new technologies (see how they cut over their customer base to Hyperdrive while MEDITECH still struggles to get HCA off of Magic).

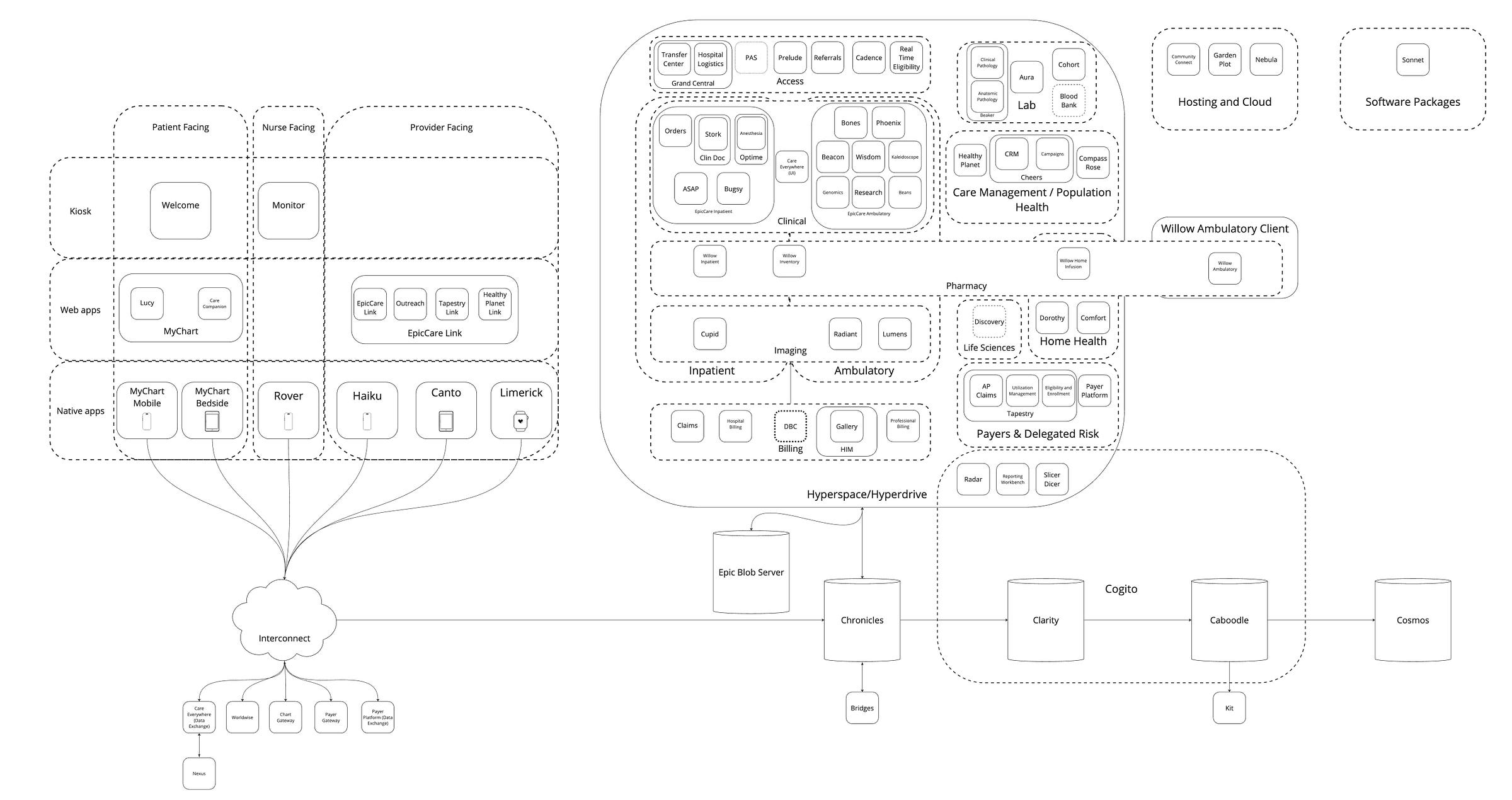

Epic's monolithic architecture is truly a wonder to behold, allowing for tight integration between different modules and ensuring data consistency across the entire system. Notice in the diagram how all applications and modules are built on that same underlying database (Chronicles), using a shared data model:

As evidenced in the diagram, Epic is strongly attracted to cute, quirky names for their products that aren’t necessarily clear or intuitive. While the second or third-order wordplay and puns can be fun to try and untangle on your own, a shared set of definitions is a good foundational resource for future articles. Fair warning - this is a long list given the sheer volume of software Epic has created, so I’ve added it as an appendix at the end.

All this to say, Epic is a monorepo of unfathomable size and complexity. Facilitating the broad range of workflows and users involved in the many modules and applications they’ve built over the years entails a massive data model. The Epic EHI Export specification gives us a small glimpse of this - while it does not include all the non-patient-related data structures, it alone has 2,541 tables, meaning the real size of the data model is even larger. This size, this complexity, and these decades and decades of code all funneling to a single shared instance are Epic’s undeniable and near-impregnable moat.

Network Effects: Epic's True Advantage

It is a feature, not a bug, that appeals to healthcare’s largest and most powerful health systems, offering a system that works across their entire enterprise. Intra-organizational network effects are strong here. With each new incremental user in a large health system that joins an Epic instance, these users contribute to the shared patient record, making it more comprehensive and valuable for all users. The more departments using Epic, the smoother the workflows between them, incentivizing full adoption across a health system. With a diverse user base all on the same system, Epic can develop features that serve multiple stakeholders simultaneously, creating a virtuous cycle of improvement.

While Epic's intra-organizational network effects are powerful, its inter-organizational network effects, primarily facilitated through Care Everywhere, are equally impressive. Epic's foresight in developing and implementing this module long before interoperability became an industry buzzword has created one of its strongest competitive advantages. This health information exchange platform, fully adopted by the Epic community, put them years ahead of other EHR vendors in terms of health information exchange. This level of seamless, widespread health information exchange creates a compelling reason for health systems to choose Epic, as it offers immediate access to a vast, established network of data-sharing partners.

While other EHRs and entities can certainly now plug into this ecosystem via Carequality and TEFCA, they merely tread water in doing so. By controlling both sides of exchange, Epic is able to make the intra-community experience deeper and richer than cross-EHR, much like Apple’s structuring of iMessage. For example, Epic chose to pilot non-diagnostic image exchange between Epic customers for some time before eventually releasing it to the broader Epic to non-Epic exchange. This approach is practical from a product management sense, hardening a feature in a controlled setting, but also plays to overall strategic in inter-organizational network effects.

Epic looks to extend this strategy with its slew of Health Grid products. While serving diverse workflows and use cases, all of these products can be uniformly described as offering differentiated tools for non-provider healthcare organizations to better communicate to Epic’s aggregate provider populations. By leveraging Epic’s strength in the provider market, Epic hopes to create new two-sided networks and create product wedge in adjacent markets:

Payer Platform: This facilitates all the connectivity between a payer and their provider partners, such as clinical data retrieval for case management, quality measures, and HEDIS reporting. It also facilitates electronic prior authorization and sending care gaps back to providers. This is a wedge product for Epic aimed at payers not yet using Tapestry modules. This module is central to the lawsuit against Epic.

Aura: Software that external labs can use to managing/distributing their compendium, receiving orders, and sending results. This is a wedge product for Epic aimed at labs not yet using Beaker.

Telehealth Anywhere: An Epic install tailored to telehealth organizations allowing for telehealth capacity to be shared/sold to other provider organizations. This doesn’t necessarily open up new markets aside from a small pool of telehealth applications, but hypothetically could also allow for deeper network effects across Epic’s pool of existing providers

Discovery: This yet-to-be-released module centralizes trial management for life sciences across Epic customers, streamlines setup with distributable builds, and facilitates point-of-care trial matching. It provides life sciences companies with anonymized patient population insights for trial feasibility, bridging clinical care and research to accelerate drug development and improve access to experimental treatments. There’s not yet a correlating product that this acts as a wedge for, but one could imagine it as a beachhead for future forays into creating a Clinical Trial Management System (CTMS).

These and other future Health Grid initiatives extend the already strong product moat of Epic’s network effects. With each new organization and user joining the overall ecosystem, Epic is more easily able to provide a longitudinal patient picture and offer a functional, digital experience end-to-end throughout the patient journey across interorganizational workflows.

Why Healthcare Chooses Integrated Systems

Clayton Christensen's theory of disruptive innovation offers a popular lens through which to view Epic's position. While this is hypothetically all possible in a modular system of disparate vendors, the reality is that there is generally higher friction, lossiness, and operational burden in implementing many heterogeneous products. This is not unique to healthcare and is a pattern that continues to repeat itself ad nauseum. IBM in the mainframe era, Apple’s product suite for consumer technology, or Tesla’s approach to automobiles all show how integrated systems produce reliable and efficient outcomes.

Not all markets and industries choose integrated systems, though. We see integrated systems dominate when:

The problem being solved is complex and interdependent

Customers value reliability and performance over flexibility

To be honest, it’s hard to think of industries that surpass healthcare in these two qualities. As noted earlier, healthcare delivery is an intricate dance of interdependent processes, from patient registration to diagnosis, treatment, billing, and follow-up care. As the care scales up beyond a single doctor or small practice, the interdependence exponentially increases, with Epic’s market share matching. With each press release of another major system, you see the same verbiage over and over - “a single unified system”, “a single platform across enterprises”, “enhancing connectedness”, all pointing towards this core value of a single, homogeneous system.

Furthermore, the table stakes of wanting to deliver patient care at the highest level force prioritization of reliability over flexibility - a system crash or data inconsistency could literally be a matter of life and death. HIPAA’s Security Rule and Privacy Rule put additional pressure here, as noted in the “The Gang Explains Information Blocking: HIPAA”:

However, given how vague it is in letting covered entities define their safeguards, it left a lot of handwaviness. When HIPAA compliance means many different things to different people all at the same time, it means nothing at all. With the rules unclear, but the penalties possibly crippling, people naturally sought certainty.

For these reasons, hospital executives and IT leaders seek certainty. A vendor that is already contracted offers a level of certainty that a new, unproven vendor cannot. So the unfortunate selection for so many healthcare enterprises will be to default to fewer vendors for the safety and lower activation energy it offers. Although integration is often cited as the primary challenge for digital health companies, technical barriers are rarely the underlying issue. Resoundingly, the real obstacles are organizational and political.

It is not the ideal situation. Like most enterprise software, it is trivial to find points of improvement in the user experience, the burden of documentation, the overwhelming nature of its sprawl. But in the spectrum of available inpatient EHR options, it is the best of available options, consistently beating the competition.

The results speak for themself:

The Disruptor’s Dilemma

As one gains a deeper understanding of the EHR landscape, it's natural to wish the world to be different. And could it be? Could a new entrant successfully counterposition and outmaneuver Epic?

Whenever there’s a discussion about whether a new EHR will disrupt Epic, the diagram above can be centering. The bulk of new entrants are competing with a single tile in this massive puzzle (most often the vanilla EpicCare Ambulatory piece), so their core belief is that unbundling Epic and creating a modular ecosystem is both feasible and desirable. Market trends tell us otherwise, but the question remains: is Epic truly impervious to disruption?

While Epic's comprehensive, tightly integrated system is undoubtedly a strength, our friend Christensen might argue (from the grave) that it's also a potential vulnerability. While the integrated nature of Epic is a headlining feature of their value proposition for large health systems, the complexity and feature-richness that serve those bigger providers so well could be overserving smaller providers or specific healthcare niches. This creates opportunities for simpler, more focused solutions to gain footholds in underserved segments:

Small practices: Small practices don't operate with the same administrative capacity as large organizations and demand lower costs and simpler, often SaaS-based setup and control of their own destiny. While there is Garden Plot, a shared environment for smaller groups to be able to use Epic, it comes with the inherent drawbacks of its namesake. Community gardens aren’t for everyone - small practices often value complete control and ownership. Relatedly, the slimmed-down Sonnet structure offered by Epic to appeal to the long tail of practices has failed despite numerous attempts to launch.

Unique specialties: Epic historically had generalized inpatient and outpatient software that could be customized to meet specialty needs, but increasingly has diversified its specialty-specific offerings, with options like Wisdom, Lumens, and Beans. However, some specialties, especially in the outpatient space, are less regulated by EHR certification and thus both overserved by Epic’s complexity and underserved in regards to very specific specialty needs.

The unfortunate fact, though, is that these opportunities are not greenfield in nature at this point. There are dominant incumbents and entire competitive ecosystems in each fractally smaller niche to be deposed - athenahealth for general outpatient, SimplePractice for behavioral health, WebPT for physical therapy, and many others. Even newer emergent underserved areas, like tech-enabled care organizations and virtual care, have been snapped up by the likes of Canvas, Elation, Healthie, and Medplum. These EHRs have saturated the small practice and unique specialty opportunities, by and large.

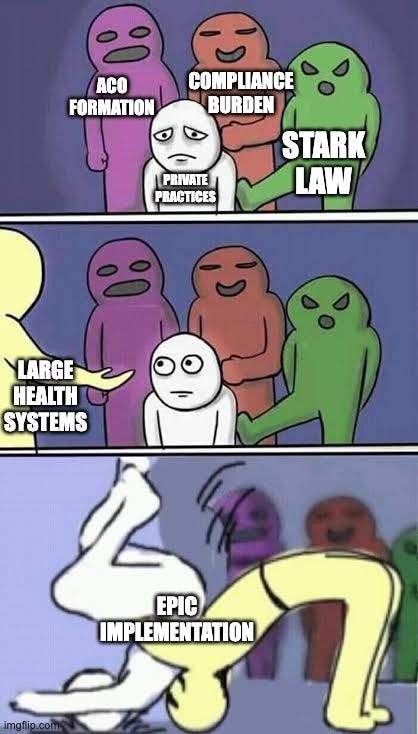

Furthermore, much ink has been spilled on the dwindling supply of small practices. Numerous factors, including vertical integration incentivized by Stark and anti-kickback laws, increased compliance costs with spiraling regulation, and the rise of ACOs/value-based care incentivizing sprawling networks to manage populations, combine to create mega-health systems that have that innate bias towards integrated EHRs. While disruptive new outpatient EHRs focus in on those aforementioned niches, the overall piece of the pie available to them continues to shrink as Epic’s inexorable gravitational pull radiates further and further outward by the passive forces of healthcare’s changing landscape.

The best hedge these EHRs have against this trend is to build their own network effects, turning their disparate user bases into a tightly coordinated and collaborative community with seamless workflows between customers. While basic clinical data sharing is fairly well-trodden table stakes at this point, the bulk of the interoperability iceberg has yet to be uncovered - referrals, comprehensive provider-to-provider messaging, shared care planning, and coordinated scheduling across organizations are just a few examples of untapped potential. By focusing on these areas, EHRs can create a more interconnected ecosystem that provides significant value to their users, making it harder for customers to switch to alternative systems.

Conclusion

Epic's dominance in healthcare IT is no accident. Moreover, it’s not the result of nefarious covert operations and market manipulation. It's the result of a carefully crafted strategy that leverages integrated systems, network effects, a weak and diminishing pool of competition, and a deep understanding of healthcare's unique needs. From its monolithic architecture to its community-wide interoperability through Care Everywhere, Epic has built a system that's more than the sum of its parts.

While potential vulnerabilities exist in niche markets and smaller practices, Epic's gravitational pull continues to expand, making disruption at the EHR level increasingly challenging. Epic's dominance in this landscape isn't just about technical superiority or integration capabilities. It's about risk mitigation and organizational inertia.

This reality presents a significant challenge for the healthcare innovation ecosystem. For digital health companies and startups, success in this environment often requires more than just superior technology. It demands a deep understanding of hospital politics, a strategy for overcoming organizational inertia, and the ability to demonstrate value that outweighs the perceived risks of adoption.

Unless you have an incredibly deep wallet to rebuild the many modules and functionalities, the path to success most often involves finding ways to complement and integrate with Epic rather than attempting to replace it outright. Luckily, just like Epic has built so many tables and modules, they accordingly have built a variety of interfaces, APIs, imports, and surrounding programs that applications can use to co-exist. In our next installment, we'll dive deep into the practical realities of coexisting with Epic. We'll explore the myriad ways organizations can integrate with this healthcare IT giant, from Vendor Services and Connection Hub to Workshop and Health Grid.

See you then.

A big thank you to all who assisted or edited: Jim Doscher, Jim St. Clair, Philip Ballentine, Ben Lee, Adam Carewe, Lisa Bari, Nick Neral, and Seth Joseph.

Also a big thanks to the many members of the Epic Alumni Slack community who helped with the mega-diagram and descriptions: Mike Sobolewski, Kevin Huang, Kelsey Creveling, Vikas Chowdhry, Jason Dong, Eli Gold, Nick Nunez, Josh Anderson, Ben Gold, Matt Brundage, Alex Savage, Bri Buch, Neil Gaynor, Chase Young, and anyone else I may have missed.

Appendix: Epic Modules

Inpatient: A loose grouping of all the applications that are used when patients are admitted to the hospital, where the flow is typically: admit, assign bed, assess, treat, monitor, document, coordinate care, and discharge. The Inpatient applications are the Rube Goldberg machine of Epic, intertwined and interlocked to somehow fit together into a comprehensive system managing the complex, multifaceted nature of hospital care.

EpicCare Inpatient Orders: Encompasses inpatient ordering (obviously) but more comprehensively the workflows of doctors in that setting.

EpicCare Inpatient Clinical Documentation (ClinDoc): Inpatient yin to the yang of Orders, this is focused on nurses, their documentation workflows, and the tools they use for patient care and assessment in the hospital setting.

ASAP: Emergency room module. ER workflows are somewhat funny in that they’re ambulatory (you often walk in), but they lead into an inpatient flow.

OpTime: All things surgical, including scheduling, operative documentation, and pre-op/post-op tools. One of the two main scheduling modules along with Cadence.

Anesthesia: Fairly obvious, but a module for anesthesia information management. Heavily interconnected with OpTime.

Stork: Obstetrics-focused module. While it has some outpatient components, its lineage is distinctly Inpatient in nature.

Bugsy: A module for infection and antimicrobial control. Works well with Epic’s lab system, but lift is higher when the hospital uses a different Lab Information System.

Ambulatory: The applications that relate primarily to outpatient care, with a generalized patient journey of: schedule visit, check-in, rooming, exam, diagnosis/treatment, orders, documentation, check-out, billing. Whereas the applications in inpatient are fairly differentiated, most of the apps here could be classified as “Ambulatory plus some specialty-specific documentation or reporting”

EpicCare Ambulatory: Epic’s general all-purpose outpatient EHR suite. All the standard stuff most people think about when they think “EHR” - note writing, e-prescribing, ordering, chart review.

Beacon: Oncology module that adds a lot of unique cancer-related care planning (medication protocols) and documentation, like oncology treatment summaries.

Kaleidoscope: Opthamology module. Has some unique documentation for eye exams and glasses or contacts prescriptions. While it has a heavy imaging component, the overall flow is ambulatory (the imaging is usually interpreted as part of the office visit itself).

Genomics (Pedigree): Should be obvious. Has strong integration for discrete genetics results from external labs, which allows for genomics-specific documentation like family trees.

Wisdom: Dental module. Has fun tooth charts and other oral health-specific documentation.

Phoenix: Adds a bunch of bells and whistles around OpTime for transplant patients, such as waitlist management, unique documentation, and registry reporting.

Beans: Nephrology module. Dialysis care planning and scheduling, as well as specific documentation tools

Bones: Orthopedics module with some light sports medicine stuff. Plays well with OpTime

Imaging: Applications used in both inpatient and outpatient contexts, where the flow is typically: order imaging study, schedule appointment, tech performs scan/imaging, specialty provider analyzes results and sends findings to ordering provider and patient.

Radiant: The radiology information system. Plays well with Cadence for scheduling. Used for radiology worklists and documentation, but actual diagnostic images sit in an external picture archiving and communication system (PACS), as Epic doesn’t make one (yet).

Cupid: The cardiology information system. Many cardiology procedures like echocardiograms are just Radiant workflows with a few unique data elements, but invasive cardiology procedures actually overlap with and look a lot like OpTime.

Lumens: The reporting module for endoscopy, bronchoscopy, ureteroscopy, and any “long snake of a scope goes down a patient’s lumen (body cavity or tube)”. Built on the Radiant chassis as endoscopy and the like have a similar workflow to radiology, except that it’s often video instead of still pictures.

Lab: Applications used in managing laboratory tests and results. The typical workflow includes test ordering, specimen collection, sample processing, analysis, result reporting, and communication to providers and patients.

Beaker Clinical Pathology: The general lab workflows, like chemistry, hematology, and microbiology, where instrument integration returns measurements and there isn’t an interpreting pathologist (the result of the test is returned to the ordering physician)

Beaker Anatomic Pathology: Specialized for workflows requiring pathologist interpretation. Manages processes for tissue-based diagnostics (e.g., biopsies, surgical specimens) and supports specimen accessioning, grossing, tissue processing, and slide preparation. AP’s workflow is in some ways like radiology, with pathologist review, diagnosis, and reporting mirroring radiologists’ interpretation.

Aura: A Health Grid product aimed at external specialty diagnostic labs that don’t use Beaker, but want to more easily and scalably integrate with Epic’s provider customers. It’s both a pithier name for the Orders & Results Anywhere / Worldwise network as well as the software that labs install for managing/distributing their compendium, receiving orders, and sending results.

Cohort: Epic’s first attempt at a lab information system. From hazy recollection, this was a text-based interface and predated Hyperspace. It’s very difficult to find detail about this and why they rebooted with Beaker, but possibly still in use for some state labs or perhaps in Canada.

Blood Bank: This product was just announced at UGM and represents new growth of their lab business, with tight coupling to EpicCare Inpatient (where transfusions occur). This module handles the complex processes involved in blood product management, including donor management and screening, blood processing and inventory management, cross-matching for transfusions, transfusion order management, tracking of blood product usage and wastage, and compliance with regulatory requirements (which are fairly rigorous for blood banking). More adjacent to lab than a true lab workflow, but blood banks blood banks are typically managed within the laboratory department of a hospital.

Pharmacy: Applications managing medication processes across healthcare settings. Covers order verification, drug preparation, dispensing, and inventory management. Integrates with other EHR modules to ensure safe, effective medication management throughout the care continuum.

Willow Inpatient: Epic's pharmacy module for managing medication processes in hospital settings. Handles order verification, drug preparation, dispensing, and administration tracking for inpatients.

Willow Ambulatory: Epic's outpatient pharmacy module. Manages prescriptions, refills, and medication reconciliation for patients not admitted to the hospital or to be picked up upon discharge.

Willow Inventory: Epic's pharmacy inventory management system. Tracks stock levels, manages the ordering and receiving of medications, and supports efficient supply chain operations for pharmacy departments. The closest thing Epic has to an ERP.

Home Health: Epic's suite of applications designed to manage care delivered in patients' homes.

Dorothy: Epic's module for managing home health care services. It supports scheduling, documentation, and coordination of care for patients receiving medical services in their homes. This includes managing care plans, tracking visits, and documenting assessments and interventions.

Comfort: Epic's hospice and palliative care module. It's designed to support end-of-life care, focusing on symptom management, family support, and coordinating interdisciplinary care teams for patients in hospice settings or receiving palliative care at home.

Willow Home Infusion: A specialized component of Epic's pharmacy suite focused on managing medication therapies administered at home. It supports the unique workflows of home infusion services, including order management, compounding, delivery logistics, and patient monitoring for those receiving IV medications or nutrition at home.

Care Management/Population Health: Epic's suite of tools for managing patient populations and coordinating care across the health system

Healthy Planet: Epic's population health management module. It provides tools for analyzing patient populations, identifying high-risk patients, coordinating care across settings, and tracking quality measures. Supports value-based care initiatives and chronic disease management programs.

Compass Rose: Epic's care management tool. It helps care coordinators and case managers track patient care across the continuum, manage complex cases, and coordinate interventions for high-risk patients. Supports care plan creation, task management, and communication among care team members.

Cheers: Epic's patient outreach and engagement module. It facilitates patient communication, health education, and wellness program management. Supports targeted outreach campaigns, appointment reminders, and health maintenance tracking to improve patient engagement and preventive care.

Access: Applications related to patient registration, scheduling, and admission processes across various care settings.

Prelude: This module focuses on patient registration, status, identity, and disposition. It also helps manage insurance functions and keeps patient medical records up to date. Prelude is also known as ADT Patient Registration.

Grand Central: The inpatient-specific counterpart to prelude, with admission, discharge, and transfer (ADT) functions that help track and manage patient stays. It also includes tools for bed planning/capacity management, patient location, and housekeeping (environmental services or EVS) management.

Hospital Logistics: A bundle of EVS and Transport (logistics for moving patients within the hospital)

Transfer Center: Module for external movement of patients. Handles incoming/outgoing transfers from/to other health systems

Cadence: Epic's scheduling module, handling complex scheduling rules, resource management, and integration with other modules. While primarily designed for outpatient settings, Cadence's versatility and Epic’s integrated nature allows it to overlay admissions for things like radiology or cardiology.

Referrals: Manages the process of patient referrals between providers, tracking the lifecycle of referrals from initiation to completion.

Real-time eligibility: The insurance verification capabilities of Epic to maximize reimbursement. So closely related to Prelude that I thought they were one, but have had editors forcibly correct me.

Patient Administration System (PAS): I don’t fully understand this module, but it’s a fun Access/Clinical crossover module for tracking patients in certain government-funded/socialized medicine countries, such as the UK and Denmark, with specific regulatory requirements like deadlines and clinician review.

Billing: Modules handling the financial aspects of healthcare, including charge capture, claims submission, and revenue cycle management for both hospital and professional services.

Resolute Hospital Billing: Epic's module for managing hospital billing processes, including charge capture, claims submission, and revenue cycle management for inpatient services.

Resolute Professional Billing: Handles billing for professional services provided by physicians and other healthcare providers, managing the entire billing cycle from charge capture to payment posting. Designed for outpatient, but often used for specific charges in inpatient settings too.

HIM (Health Information Management): Medical record management, including coding, release of information, scanning, identity management, and chart deficiency tracking. It’s a pretty scattershot grab bag of functionalities in general.

Claims: All the pieces for the claims submission process, from ensuring accurate and timely claims submission, tracking claim status, and managing denials and appeals. For obvious reasons, integrated closely with Resolute Hospital Billing and Resolute Professional Billing

Diagnosis Behandeling Combinatie (DBC): A Dutch-specific module for billing. The Netherlands was Epic’s first international country, so they did a one-off here that I imagine they sorta regret. Since then, most international functions have been rolled into the related US application in order to reuse functionalities across geographies and prevent rework.

Payers & Delegated Risk: Solutions designed for health insurance companies and organizations managing risk-based contracts, covering core payer functions and facilitating payer-provider interactions.

Tapestry: Epic's comprehensive solution for health insurance companies and organizations managing risk-based contracts. It handles core payer functions like claims processing, member management, and benefits administration.

AP Claims: "Automated Processing Claims," a module designed to streamline and automate the claims adjudication process, improving efficiency and accuracy in claims handling.

Utilization Management: A module that helps manage and optimize healthcare resource utilization. It supports processes like prior authorization, concurrent review, and discharge planning to ensure appropriate use of healthcare services.

Eligibility and Enrollment: Manages the process of determining patient eligibility for various health plans and programs, as well as handling the enrollment process. This module is crucial for payers in managing patient coverage.

Payer Platform: A Health Grid and Worldwise product, this facilitates all the connectivity between a payer and their provider partners, such as clinical data retrieval for case management, quality measures, and HEDIS reporting. It also facilitates electronic prior authorization and sending care gaps back to providers. This is a wedge product for Epic aimed at payers not yet using Tapestry modules.

Life Sciences: Tools designed to support clinical research, trial management, and collaboration between healthcare providers and life sciences companies.

Discovery: A Health Grid and Worldwise product, this yet-to-be-released module centralizes trial management for life sciences across Epic customers, streamlines setup with distributable builds, and facilitates point-of-care trial matching. It provides life sciences companies with anonymized patient population insights for trial feasibility, bridging clinical care and research to accelerate drug development and improve access to experimental treatments.

Databases: The various database systems Epic uses to store, manage, and analyze healthcare data, from transactional databases to data warehouses and research datasets.

Chronicles: Epic's primary transactional database that stores real-time patient data and supports day-to-day operations. This thing is an absolute workhorse, as evidenced by how much gets funneled in here. It’s interestingly a hierarchical database, which is rare in the era of relational and NoSQL dominance.

Blob Server: Typically most Epic customers have a separate Document Management System (mostly commonly Hyland as that industry has consolidated). However, sometimes files are generated in Epic itself or sent in from ancillary systems. The Blob Server is where that’s stored, with references from appropriate masterfiles in Chronicles. Epic is in the process of revamping this into a full-blown DMS, although that has yet to be formally launched.

Clarity: A relational reporting database that contains a copy of Chronicles data, optimized for analytics and reporting purposes. This is synchronized on a daily.

Caboodle: Epic's data warehouse solution, designed for advanced analytics and population health management. A subset of all the data in Clarity is data-modeled and surfaced in Caboodle.

Cosmos: Epic's de-identified, multi-organization data set used for research, benchmarking, and population health studies. This is actually a standalone instance of Epic storing the information transmitted via Care Everywhere, including its own Chronicles, Clarity, and Caboodle instances. Data is then served back from Cosmos de-identified via Slicer Dicer.

Kit: The set of APIs for running SQL against Caboodle as a third party vendor. Direct Clarity access is increasingly something Epic tries to prevent for any analytics or bulk data applications, funneling groups towards this access pattern as part of Vendor Services.

Cogito ergo sum (Reporting Tools): Epic's suite of business intelligence and analytics software, providing various options for data analysis, visualization, and reporting.

Radar: A dashboard tool for embedding visualizations and reports into provider workflows in Hyperspace.

Slicer Dicer: An ad-hoc analysis tool that allows end-users to explore data and create custom reports without needing to write complex queries. It provides a user-friendly interface for slicing and dicing data across various dimensions and measures.

Reporting Workbench: A tool for creating and managing standard reports within the Epic system. It allows users to design, schedule, and distribute reports using data from various Epic modules. Reporting Workbench is often used for operational reporting and regulatory compliance reporting - it can also be used for exporting flat files of data.

User interfaces: The various interfaces through which users (healthcare providers, nurses, patients, and administrators) interact with Epic's systems, including desktop applications, web interfaces, and mobile apps.

Hyperspace: The traditional desktop client interface for Epic, used by most healthcare providers until recently. Written in Visual Basic.

Hyperdrive: Epic's web-based user interface, using a custom Chromium build called Electron. Hypothetically more modern and user-friendly than its predecessor, Hyperspace, but really just to allow for easier deployment and code updates.

Canto: Epic's tablet user interface for providers, optimized for larger mobile screens.

Haiku: Epic's smartphone user interface for providers, offering key EHR functions on-the-go.

Limerick: Epic’s Apple Watch user interface for providers.

Rover: Epic's mobile application for nurses, supporting bedside documentation and medication administration.

MyChart: Epic's patient portal that allows patients to access their health information, communicate with providers, schedule appointments, and manage their care online.

Care Companion: A feature within MyChart that provides personalized health and wellness recommendations, helping patients manage chronic conditions and stay on track with their care plans.

Lucy: A personal health record tool within MyChart that allows patients to aggregate and manage their health information from multiple sources, including non-Epic healthcare providers.

MyChart Mobile: Native app version of MyChart for Android and iOS. Typically a subset of the features available via MyChart on the web.

MyChart Bedside: An inpatient version of MyChart designed for use on tablets in hospital rooms. It provides patients with access to their care team, daily schedule, lab results, and educational materials during their hospital stay.

EpicCare Link: A web-based tool that allows external providers and organizations to securely access patient information and collaborate with Epic users.

Tapestry Link: A variant of EpicCare Link for health plan customers to offer their affiliated providers a portal to assess eligibility, submit claims, and check prior authorizations.

Healthy Planet Link: An extension of Epic's population health management tools (Healthy Planet) for non-Epic users, allowing them to participate in care management and quality improvement initiatives through EpicCare Link.

Welcome: Epic's module designed to enhance the patient arrival experience and streamline front-desk operations. It facilitates efficient patient check-in processes, including self-service kiosks and mobile check-in options (via MyChart). Welcome manages queue management, verifies patient information, collects copayments, and integrates with scheduling and registration workflows.

Monitor: Allows healthcare practitioners to monitor patient’s vital signs, such as blood pressure, heart rate, etc. Can integrate video via third-party cameras, so used for telesitting and remote patient monitoring.

Integration, Interoperability and Data Exchange: Solutions facilitating data sharing and communication between Epic systems and both internal healthcare IT systems and external healthcare organizations

Bridges: Epic's tools that facilitate data exchange between Epic and external systems via interfaces. It supports a wide range of integration protocols and standards, although heavily focused on HL7v2 historically. It has some lightweight transformation capabilities, such as field mapping, but most Epic customers supplement with a third-party interface engine.

Care Everywhere: Epic's health information exchange platform, allowing Epic customers to share patient data with other healthcare organizations.

Happy Together: A feature that takes aggregated patient data from multiple sources (including non-Epic systems) and ensures it’s shown in a single, unified view within Epic, rather than a separate “external information” activity.

Nexus: The TEFCA Qualified Health Information Network offered by Epic to their customers. Overlays Care Everywhere and acts as a on-ramp for the newest health information network.

Worldwise: The infrastructure and concept for network-based products, spanning Aura and Book Anywhere and any other things built using that Interconnect infra.

Chart Gateway: An Epic service that allows life insurance companies to request and retrieve medical records from health system customers

Payer Gateway: An Epic service that allows health insurance companies to request and retrieve medical records from health system customers

Hosting Models: Different deployment options for Epic's software, catering to various organizational sizes and needs, from full implementations to cloud-based solutions for smaller practices.

Community Connect: A program that allows larger Epic customers to extend their Epic system to smaller, affiliated healthcare organizations.

Garden Plot: A shared, cloud-based Epic environment for smaller practices that don't need a full Epic implementation.

Nebula: Epic's Azure instance, where they host various services for their customers such as Worldwise.

Software Packages: Bundled Epic solutions designed for specific market segments or use cases, such as smaller healthcare organizations.

Sonnet: A scaled-down version of Epic designed for smaller hospitals and health systems, offering core functionality at a lower price point. This always struggled to take off - not sure it’s still offered.

Great start to the series, Brendan!

A lot of great messaging in here as it relates to the buyers at the health system. Saving for the future!!