March Monthly Review: Spring Conference Maxxing

Lots of EHR news, some Wikipedia conspiracies, and a monumental information blocking decision

As you will read below, we are through conference season (or at least I am). If you weren’t able to make the HIMSS HIE forum keynote, no worries - we’ve got you covered.

HTD Health will be hosting a session to run it back on Wednesday, March 26th, running through all the content and memes - the stages of infrastructure network growth, ubiquity, the Judy Faulkner to Jonathan Bush scale, the effects of AI on health information exchange, and more. Make sure to sign up!

It’s mid-March and we’ve made it through the spring conference gauntlet. This is not to say we are out of the woods quite yet - healthcare technology is nothing but an endless, fractal parade of conventions, symposiums, forums, and niche conclaves. However, quite a few of the general purpose, “brand name” conferences all fall in Q1:

JP Morgan Healthcare Conference: January in San Francisco, inevitably inviting complaints from East Coasters about travel so shortly after the holidays. This investment-focused event brings together healthcare executives, biotech leaders, and investors for major partnership announcements and financial outlooks. The events around the conference are the draw for many - I couldn't tell you where the actual conference is held, but the hotel lobbies, restaurants, and side events throughout the city create a week-long dealmaking environment that sets the financial tone for healthcare for the year ahead.

CES: Early January in Las Vegas. Overwhelmingly large with over a 100,000 attendees. While primarily a consumer tech show, CES has developed a robust digital health section showcasing wearables, remote monitoring solutions, and consumer wellness innovations. Offers early visibility into technologies that may eventually transform healthcare delivery.

ViVE: Late February/early March in fun, second-order conference cities like Miami, LA, and Nashville. CHIME (College of Healthcare Information Management Executives) had been running its CIO Forum alongside the HIMSS conference for years, with HIMSS providing financial support. The relationship soured when they couldn't agree on economic terms and revenue-sharing arrangements for future collaborations. In the wake of that divorce, CHIME and HLTH partnered to create this newer conference explicitly focused on digital health transformation and technology leadership. It primarily attracts digital health startups and technology vendors with a handful of health system CIOs.

HIMSS: March in Las Vegas, Orlando or Chicago (but increasingly just Las Vegas). It’s now the largest and most prominent health IT conference globally featuring major product announcements, policy updates, and interoperability advancements and exhibitions from thousands of vendors from established EMR vendors to emerging AI solutions. However, it began as a much smaller educational meeting for members of the Hospital Management Systems Society. In the 1990s and 2000s, powered by the healthcare IT boom, it transformed into the industry event format we know today.

SXSW: Mid-March in Austin. Features a growing Health & MedTech track that showcases cross-industry healthcare innovation. Originally launched in 1987 as a music festival, SXSW expanded to include film and interactive technology in 1994. The health track emerged organically in the 2010s as digital health startups began appearing in the innovation showcases, eventually becoming formalized as the Health & MedTech track around 2015. For that reason, it has an ultra-hip vibe that showcases consumer-focused and design-oriented perspectives to healthcare challenges.

Conferences are, of course, products, so a product management lens reveals how conferences operate within their ecosystems. They are created, planned, marketed, and released with different features and pricing structures. Incumbent conferences, shackled to their existing clientele and the process they’ve accumulated over the years, often suffer from the same challenges as mature products: innovation inertia, feature bloat, and resistance to change. Their accumulated processes and existing customer base create switching costs that hinder rapid transformation and operational frictions that create a suboptimal experience. Meanwhile, conference "startups" can enter the market with streamlined experiences, novel formats, and targeted value propositions that address unmet needs or underserved segments.

Conferences as products thus roughly fall into three categories:

Industry conferences for business development and partnership

Special interest conferences for networking and community

Academic conferences for learning

These are not mutually exclusive by any means, but if you squint at the floor plan of a given conference, you’ll generally get a sense of what its core focus is. Industry conferences like HIMSS, CES, or ViVE typically allocate most of their physical space to exhibition halls and meeting rooms for business development, with small stages orbiting. Academic conferences like FHIR DevDays or AMIA (American Medical Informatics Association) typically feature more amphitheater-style rooms for presentations, poster halls for research, and smaller breakout rooms for specialized discussions, with minimal commercial exhibition space allocated to a handful of sponsors. Special interest conferences like SXSW often prioritize spaces for cross-pollination and spontaneous interaction - featuring more lounges, interactive experiences, and open networking areas. The emphasis is on bringing the right people together rather than formal deal-making or structured learning.

While conference organizers certainly have their paved path they’d like you to stay on, conferences are more often a blank canvas upon which you can choose your own adventure. The focus of any conference can be utterly orthogonal to a particular attendee’s goals for that event. It is perfectly viable to attend an academic conference and close deals. It’s certainly possible to participate in an industry conference and learn something from a panel (albeit generally not at HLTH or ViVE). You can find a new role, raise money, make a friend, or absolutely send it playing craps in a smoke-filled room. You do you. The world is your oyster.

A few other disorganized opinions about optimizing conferences that are fairly obvious but potentially helpful to newer attendees:

Goal Setting: The main cost of a conference is generally not financial, even for events with egregious fees like HLTH or ViVE. It’s opportunity cost. The time and energy spent traveling and attending can be allocated elsewhere. So it’s pretty important to set criteria for success in advance. One sale is enough for those focused on business development to validate your spend. For educational or networking ambitions, your criteria are more subjective and variable, such as market research on a new product area or bringing back learnings and education to your company, but you should set it nonetheless.

Conference Choices - Think critically about the conferences you attend in light of your goals. While you can pave your own path and find success at any conference, full mismatches between organizer intent and your objectives mean you’ll be sledding uphill. Candidly, there’s no way in hell I’m attending HLTH or ViVE solely for education. Similarly, I’m not attending AHIP if my goal is to sell to providers.

To Ticket or Not to Ticket - In light of that first point, you should lean towards buying the ticket. For most goals, you are going to maximize success by removing friction - the friction of asking people to leave to meet you, the friction of sneaking into the conference, You’ve already committed your time to the event, so remove all barriers so that you maximize your time. Morever, it makes you more accountable for achieving your goals. JPM (and possibly SXSW) are the exceptions here.

Make a Plan: Whatever your goal is, you’ll benefit from preparation. Look at the floor plan and understand where key vendors, stages, or locations are. Read the agenda to know what sessions (if any) you want to attend. Set up meetings in advance. I’ve worked pretty exclusively at B2B infrastructure companies (and now a services company), meaning that most conferences have a business development component to them. If you prepare properly and set up 15-20 meetings, you’re almost certainly a lock to hit your goals unless the conference is a wash or you’re in the wrong profession.

Roll the Dice: While I strongly believe that preparation allows you to squeeze the most juice out of the chaos of these monstrosities, serendipity is half of any conference. Serendipity is like lightning, though - it only strikes when you put yourself in the position to be struck. By wandering the floor, attending the cocktail hours, or sitting in the hotel lobby bar, you create opportunities for those chance encounters - running into an old colleague, seeing a cool exhibit, building a close connection to a client yelling karaoke. Don’t overindex and leave your whole conference schedule to chance, but the only advantage to in-person events is to be in person with people where the spontaneous can combust.

To that last point, despite constant complaints of the rising costs, diminishing returns, and indulgence of conferences, they aren’t going anywhere. We will keep attending them because they deliver value that can't be replicated virtually. Moreover, their value will only grow in a world where our work is increasingly remote and isolated, the internet is crowded with exponentially multiplying AI slop content, and our attention is more fragmented than ever, physical gatherings offer a rare opportunity for focused, meaningful human connection.

You have every right to skeptically question and push back here. Conferences are inherently artificial constructs. They compress an industry's networking, learning, and deal-making into a few exhausting days of artificial, choreographed interactions. The exhibition halls are filled with polished marketing that, at best, rarely reflects the messy reality of implementation and, at worst, represents outright vaporware, lies, and fraudulence. Speaker sessions often recycle the same talking points year after year with only superficial updates.

If so, I respect your opinion while disagreeing with it entirely. Perhaps it’s an outcome of my own working situation as a remote employee and my need for concentrated doses of collegial interaction. Perhaps it’s a function of my own identity - deeply understanding and immersing myself in the industry is fun to me. And there’s certainly an element of personality that makes conferences appealing - groups of tens or hundreds of thousands are hardly appealing to introverts at face value. Whatever the case, I hope you find success the next time you attend one (and I hope I see you there).

With that (longer-form-than-intended) intro out of the way, here is your monthly review. As a reminder, this is a regular round-up of various short(er) form content on social media (typically LinkedIn since Bluesky’s failure to launch and Twitter’s descent into irrelevance) is to surface things you may have missed.

Regulatory:

ASTP and CMS Rumor Bets: We sit in the liminal space of an administrative transition, where various elements of the conservative coalition race to imprint their priorities. Healthcare is high on the list, but much is still unclear. So we threw down some odds on the rumors and possibilities we’re hearing.

HIPAA Violations and EHI Export: Oregon Health & Science University will pay a $200,000 HHS OCR penalty for taking 16 months to fulfill a patient's medical records request. Instead of racking up these fines and staffing large HIM departments, healthcare organizations should push their EHR vendor so that their individual EHI export functionality (or other digital ROI solutions) work in production and make it available through patient portals, using IAL2 identity verification to address PHI leakage concerns.

Mistaking Tech for Policy in Bamboo’s Mifepristone Tracking: Louisiana's reclassification of misoprostol and mifepristone as "controlled substances" has raised concerns about Bamboo Health's involvement in tracking these medications. However, this is a function of Louisiana policy, not Bamboo's technology. Bamboo simply operates the prescription monitoring system, similar to how they track opioids and other controlled substances.

Court cases:

RTMS’s Big Win: A significant appeals win for Real Time Medical Systems in their case against PointClickCare. The court found RTMS is likely to succeed on its unfair competition claim, determining that PointClickCare's actions likely violated the 21st Century Cures Act's information-blocking provisions. None of PointClickCare's claimed exceptions (manner, performance, security) were supported by evidence. This establishes that violations of the Cures Act can support state law unfair competition claims despite the Act lacking a private right of action.

A Layer Deeper on Implications of RTMS v. PCC: The court's opinion reinforces several key points about information blocking: the burden of proof falls unequally on EHR vendors; once information blocking is proven (which is fairly trivial given the broad definition), the burden shifts to defendants to prove an exception applies; and exceptions like the manner exception will be difficult to use, requiring documented negotiation efforts rather than simply abandoning talks.

Particle v. Epic Discovery: Epic is attempting to pause discovery while the court considers their motion to dismiss the entire case. This procedural tactic is standard to save time and resources, but creates an interesting situation where Epic claims a stay was already granted orally by Judge Buchwald, while Particle argues no formal stay exists. Reading between the lines, Epic appears confident about dismissal but worried about discovery, while Particle wants desperately to get to discovery to obtain internal Epic communications and documents about their competitive strategies.

The Future of Information Blocking Litigation: Information blocking is better understood when it’s thought of in concrete roles interacting with one another, such as the patient with a provider, a business associate with a certified technology vendor, or between covered entities. The most obvious one this week is that courts are forcing EHR vendors to allow more access to patient data, either through APIs or by permitting screen scraping, but there are many others to untangle.

EHRs:

Epic, Oracle, and Wikipedia: Oracle published an aggressive corporate blog post targeting Wikipedia edits about Seema Verma and criticizing Epic. Both Epic and Cerner Reddit communities ridiculed the post, with some seeing it as a distress signal and clumsy appeal for help from the Trump administration. Oracle might better serve its interests by differentiating through better APIs and cross-organizational workflows rather than competitor criticism.

Oracle Regulatory Capture Conspiracy Theory: Oracle appears to be positioning itself to benefit from regulatory changes under the new administration. With Larry Ellison's stated goal of building a centralized database of Americans' healthcare records (through initiatives like Stargate), Epic stands as the main obstacle. Oracle's aggressive blog posts may be aimed not at industry insiders but at influencing the Trump administration and other power players.

Oracle Applies to be a QHIN: Oracle Health has filed a TEFCA QHIN

application, a positive development for the healthcare interoperability

ecosystem. This move represents a commitment to standards-based

exchange rather than proprietary approaches.

With the Patient at the Heart: Epic has renamed their "Health Grid"

product yet again from the short-lived "Save a Life Grid" to "With the

Patient at the Heart," emphasizing that their network-oriented products

aim to help patients. The frequent rebranding suggests Epic is still refining

its messaging for these network-focused offerings.

Epic Announces a Developer Conference: Epic is planning an

"Open@Epic" developer conference at their Verona campus on September

26th, 2025, signaling a continued push to engage with the developer

community.

Epic Announces an ERP and CTMS: As predicted in Epic Beyond the

Provider Empire, Epic continues to expand beyond provider-focused

systems by announcing a Clinical Trial Management System (CTMS) and

Enterprise Resource Planning (ERP) system, creating new systems of record

to sell to other healthcare entities.

Oracle Cybersecurity Incident: A cybersecurity incident was reported at

Oracle, though details remain limited. This was later reported as a

nationwide outage of Veteran’s Affairs sites live on Oracle.

Suing Epic Won’t Fix Your Product: Various applications mutter a lot

about suing Epic and may have legitimate antitrust concerns, but litigation

against Epic won't solve fundamental product-market challenges.

Enterprise sales are hard.

Tuva Health and Epic Intellectual Property: Tuva Health released an open

source connector that translates from Epic's Clarity reporting database

format to their data model. This is significant as Epic has historically

viewed their data model as intellectual property. The development raises

questions about whether Epic will funnel applications into Vendor Services

agreements, push them to Kit APIs, or potentially resist this open-source

mapping of their data model.

Interpreting Judy-ese: In a Modern Healthcare interview, Epic CEO Judy

Faulkner discussed how the definition of interoperability has evolved from

"information follows the patient" to broader use cases beyond treatment.

She acknowledged the demand for data by various stakeholders while

expressing concern about potential misuse. She also confirmed that APIs

developed in Workshop will be released to general Vendor Services, though

some Toolbox categories for Ambient aren't comprehensive of all APIs that

competitors are using.

Industry Analysis

Information Blocking and EHRs: Allowing Screenscraping: EHRs (even

major ones) may not be far from allowing RPA and screenscraping openly

as an integration technique. Information blocking cases point toward

certified health IT needing to allow some method of data access for all UI

elements. AI workflows are moving faster than available APIs and

standards can accommodate, and EHRs may find strategic value in

providing controlled paths for RPA rather than playing defense against it.

IAS, IAL2, and The Relentless March of Patient Identity: While TEFCA

IAS feels far off (although less and less so!), there are other digital identity

use cases that are happening now. Account activation and recovery for

patient portals have traditionally been cumbersome, requiring manual

activation codes, phone calls with HIM departments or error-prone credit

bureau verification. We’re now seeing slick IAL2 identity-proofing flows

for creating or claiming portal accounts, potentially improving the patient

experience of accessing their own health information.

Epic Announces CLEAR Toolbox: Epic's addition of CLEAR to their

Toolbox (rather than Workshop) signals a broader approach to partnerships

that’s not just limited to Workshop partners.

Information Blocking and Free Text APIs: As AI tools develop, one

alternative to EHRs allowing screen scraping is for vendors to expose "free

text” or agent-backed APIs. In this model, third-party applications would

authenticate normally and provide instructions that the EHR-maintained agent can interpret flexibly, maintaining control and auditing capabilities

while accommodating the need for flexible interactions.

Payer-Provider Exchange: Provider organizations should be sprinting

toward solutions that give them return or reciprocity for their clinical data.

Hospitals' business associate applications are restructuring contracts to

allow provision of clinical data to payers, and health information networks

are enabling secondary use, meaning provider data is flowing freely to

payers with or without strategic compensation. The opportunity to get

workflow improvements and operational benefits in exchange is rapidly

diminishing.

Cross-industry Comparisons:

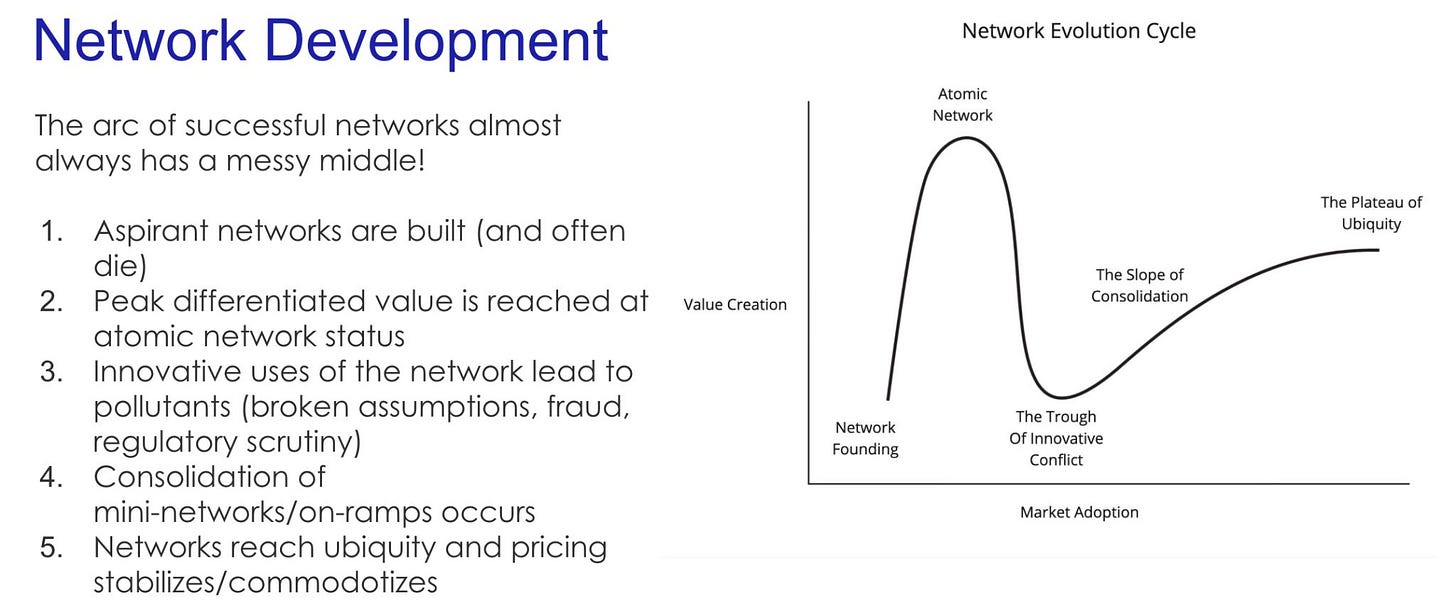

Ubiquity, Flexibility, and Cost: A post based on my HIMSS keynote.

Network effects are first and foremost judged on ubiquity. The reliability of

a ubiquitous solution beats the functional advantages of a technically

superior one. Analog networks like fax and phone are infinitely flexible to

unique payloads and edge workflows, albeit through human mediation. AI

is changing this dynamic by lowering the cost of existing ubiquitous

networks and enabling new digital networks with the flexibility of analog

ones.

Other News:

ViVE Reflections: The 2025 ViVE conference showed a complete exit of

tech-enabled care/delivery startups, partly due to post-ZIRP drawdown and

conscious choices by remaining companies. The event had a more

concentrated health system presence, with booths almost exclusively

focusing on B2B infrastructure, services, cybersecurity, and point solutions

for traditional health systems. Nashville proved superior to Las Vegas as a

conference location.

HIMSS Reflections: HIMSS was chaotic and disorganized but productive

and fun. Vegas is Vegas - we won’t stop going there for conferences, so we

must learn to survive. I just wish it had had a little more polish and less

nickle-and-diming.

PM Friend Looking for New Role: A colleague with a shorter but

impressive product management career in health tech is exploring new

opportunities, excelling at driving product strategy for new products (0 to 1

development), with a strong engineering foundation and deep

understanding of the health information landscape, particularly in de-

identified health data exchange.

External Media:

AI Rounds Episode 2: A fun second edition with Rik Renard debating

several key issues at the intersection of AI and healthcare, including the

unusual public dispute between Epic and Oracle, significant layoffs at HHS

affecting data and AI initiatives, emerging state legislation regulating AI in

insurance claims processing, and the Trump administration's call for input

on federal AI policy. We also got into Epic's evolving approach to third-

party developers (App Orchard, Vendor Services, Showroom, and Workshop

tiers) while also discussing the potential and limitations of AI chatbots for

therapy and clinical applications.

Fierce Healthcare Coverage of the RTMS v. PCC case: Solid reporting on

the court decision by Heather Landi.

Guest Lecturing at Stanford: Dr. Oliver Aalami (Director of Stanford’

sBiodesign for Digital Health and vascular surgeon) hosted me for a day down in South Bay, including presentations to their informatics fellows,

innovation fellows, policy fellows, and undergraduate engineers.

Guest Lecturing at John Hopkins: I was lucky enough to be invited to

present to Joe Mercado’s class at JHU on the topic of FHIR accelerators,

including stack ranking them by success so far, and answered a whirlwind

of questions from the class about intoperability, integration, and

connectivity.

Posts I Liked:

PointClickCare is Hiring: PointClickCare is recruiting for a Product

Manager Director role focused on Health Plan/ACO initiatives.

Volpara is Hiring: Volpara has multiple job opportunities available

spanning legal, HR, technical implementation, project management, and

clinical sales roles.

Patient Data Ownership vs Access (Sam Seymour): A discussion

questioning patient ownership and monetization of healthcare data, noting

the contrast between increasing fine print in consent forms versus the

potential for more transparent B2B transactions through emerging

marketplaces and brokerages for healthcare data exchange.