Digital Health Consolidation

A merging of the minds with Ben Lee and Megh Gupta to talk about merging of healthcare companies

Sometime early last month, Thirty Madison merged with Nurx, prompting some interesting back and forth discussion in the related Health Tech Nerds thread (if you’re not in this community, you’re missing out). Ben, Megh, and I continued that brainstorm and (after a bit of p̶r̶o̶c̶r̶a̶s̶t̶i̶n̶a̶t̶i̶o̶n̶ intense editing) put together those thoughts on the categorization, classification, and general upside/drawbacks of various types of mergers and acquisitions we’re seeing across the industry. We hope you enjoy it and look forward to any feedback or thoughts.

We may still be in the early innings of this budding era of healthcare innovation, but enough time has passed that we’re seeing the emergence of new trends. Of these, the trend of consolidation has been steadily gaining traction over the past year. Many newer health tech companies have reached a degree of technical and operational maturity on a national scale. Combine this with the unprecedented dry powder in the industry and expectations from large fundraising rounds, and it’s a recipe to drive big acquisitions.

Each merger and acquisition is fundamentally unique as you dive into the details, but given that’s no fun, this article attempts to build mental models to categorize, classify, and hastily draw circles around groups of consolidations.

M&A Strategy

For D2C organizations, these acquisitions have been predominantly driven by rising CACs, resulting in a search for improved unit economics and overall TAM. Thematically, these organizations will seek expansion in-depth/complexity of offering or supported verticals.

Vertical Integration: D2C players will look to expand patient LTV by vertical integration. So far, the focus here has been to connect the virtual experience to the physical, either through in-home care (Ro + Workpath / Kit) or physical presence (Kindbody + Vios; Babylon + Higi). This trend should continue, as virtual players hit the ceiling of what patient care can be via primarily digital modalities and need some in-person touchpoints to continue to expand the care of their patients.

Horizontal Expansion: Alternatively, these players can also launch/acquire new verticals, and in doing so increase cross-sell opportunities (LTV) and/or overall TAM. One could draw a parallel between the strategies of increasing margins of cross-selling new verticals to SaaS businesses targeting expansion revenue. The largest share of acquisitions of these type have been companies with tangential specialty conditions (ThirtyMadison + Nurx; Ro + Plenity / ModernFertility / Dadi), but there have also been instances of companies acquiring assets in an orthogonal vertical but with close product fit (K Health + Trusst). From another angle, the addition of new verticals creates a more holistic offering that is also compelling to employers, enabling these D2C companies to more easily activate a B2B channel. This type of expansion is reminiscent of the parallel consolidation we see in traditional healthcare markets, with large integrated delivery networks offering complete integrated care across many acquired specialties.

With the increasing competition across the healthcare ecosystem, companies have also begun to expand to more complex reimbursement markets, and this has been reflected in merger activity as well. In combinations between D2C and Employer-focused companies (Calm + Ripple; Ginger + Headspace), you’ll ideally see accelerated distribution across markets and the combination of assets for a more diversified offering. Meanwhile, employer-focused organizations move towards government-funded markets (One Medical + Iora) for not only increased TAM but also the high-reward potential of value-based contracts. This brings unique stressors as these organizations need to build organizational and technical muscle to actually execute on that vision - enterprise sales experience instead of consumer-oriented marketing, for instance, or tooling to monitor and provide care management proactively at the population level instead of simple encounter oriented experiences.

For a variety of reasons,value-based care (and tangential) organizations are the other domain of healthtech that has seen an increase in M&A volume in recent months. Here, organizations will target larger savings by increasing patient-side and/or provider-side efficiencies or extending their capabilities in care.

Increase patient-side efficiencies: By increasing a patient’s ability to engage and utilize care, organizations can better patient health and reduce more costly downstream utilization. More holistic organizations will acquire point solutions that enable this - often in care management/navigation (Babylon + DayToDay; Aledade + Iris; Accolade + 2nd.md). Also common are M&As between navigation platforms and virtual care/telehealth orgs (Doctor on Demand + Grand Rounds; Accolade + PlushCare)

Increase provider-side efficiencies: Risk-bearers also look for cost-controlling opportunities in the care delivery itself. Recent examples have been specialist consultations (OSH + Rubicon) for effective triage and decreasing downstream referrals or quality-focused provider networks (Transcarent + BridgeHealth).

Extend care capabilities: Acquisition has enabled players to go deeper into care for key verticals and demographics, ideally resulting in not only increased savings but cross-selling opportunities, much like the above D2C plays. As of late, the target areas have been deeper engagement for chronic conditions (Teladoc + Livongo) and vertically integrating physical presences/home health (Humana + Kindred), where chatter about adopting value-based care models is gaining steam.

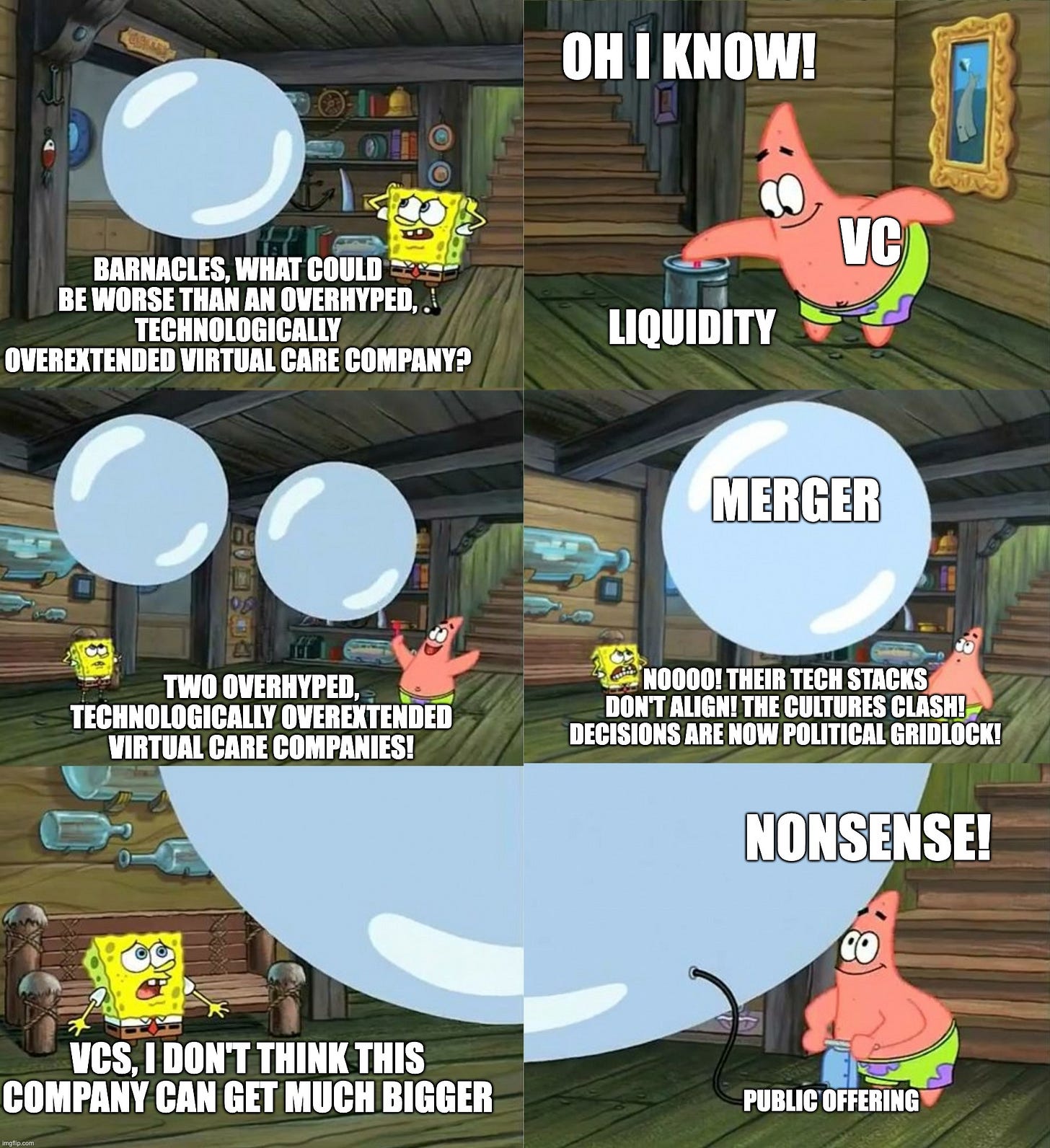

Lastly, we’ve also seen acquisitions geared primarily towards market share expansion (UniteUs + NowPow, LetsGetChecked + BioIQ, Cedar + OODA, Collective Medical + Audacious Inquiry). As the private markets start to follow the downturn of the public markets, landgrab-type acquisitions might pick up as directly competitive companies with similar assets look to shelter together for warmth as the sweet waning rays of our decade-long boom begin to wane. This represents the most traditional type of consolidation, removing competition by virtue of merger. In an era and administration of increased antitrust activity, though, market share expansion should be viewed more cautiously.

Post-Merger Integration

Once consolidation occurs, the key to longer-term viability will be navigating the challenges of integration, namely:

Organizational dynamics: How tightly integrated will the two organizations be? If the idea is to keep the two entities structurally independent, challenges here might be more side-stepped. However, if the goal is to consolidate to achieve a more comprehensive offering, putting thoughtful structure in place will be the differentiator in whether the merger is smooth or jarring for the new organization, especially for consolidation between companies with different GTM / reimbursement strategies.

Competitive dynamics: It can be the case that an acquired asset could result in odd internal competitive forces. A recent example here is the Ro + Workpath acquisition. Workpath, as a platform enabler of in-home health services, sells to virtual-first providers - some of whom might be directly competitive to Ro’s specialty condition business lines. Establishing the right set of incentive structures is critical to ensure alignment with the overall strategy and goals of the merged organization.

Merging clinical care stacks: When multiple Covered Entities consolidate, it’ll be the case that the organizations will possess stark differences in their clinical care stack. These will need to be resolved to ensure a consistent approach to providing patient care, billing, and organizational function. This is in addition to the more standard integration problems of merging tech stacks (see below).

Merging tech stacks: At the root of any consolidation between two product assets (as opposed to independent service lines) will be the challenge of technology integration: programming language, overall syntax, third-party vendors, etc. At worst, variations across the technology and stack used at these companies can turn mergers that on paper are pure winners into absolute Pyrrhic victories, leaving the product and engineering teams in full rebuild mode for months or years just to get back to parity. If the integration involves full incorporation of a new asset into a set of existing assets (eg.. K Health converting Trusst into K Therapy, Teladoc acquiring Livongo, Doctor on Demand merging with Included Health and Grand Rounds), it’ll be critical to be thoughtful in designing across the new workflows and to ensure smooth handoffs.

GTM strategy: In order to successfully streamline CAC and increase LTV, there will need to be a comprehensive GTM strategy in place to ensure that marketing channels, conversion mechanisms, and, if relevant, sales teams are all aligned. Consolidation can bring immense cross-selling and cost-saving opportunities if done right.

Looking forward

As the fallout from the public markets continues to drip into the private arena and well-capitalized startups look for alternative avenues for growth, we anticipate that industry consolidation will continue. The M&A strategies we outlined above are not exhaustive, and organizations will surely iterate to optimize for success. As to whether this wave of consolidation will yield tomorrow’s behemoths is yet to be seen, but regardless of whatever might happen, the middle innings of health tech are going to be truly interesting. Let us know your thoughts in the comments!